Assessing PepsiCo’s Performance Expectations

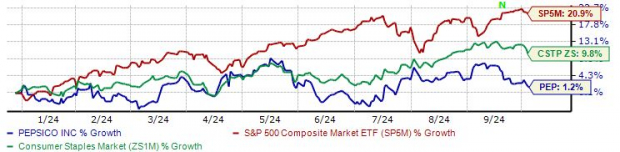

As we approach the third-quarter earnings season, attention is turning to PepsiCo (PEP) as it prepares to reveal its financial results next week. Despite a lackluster year so far, with PEP shares up only 1.2%, investors remain wary of Consumer Staples stocks amidst a Tech-driven market surge.

Analysts have tempered their earnings predictions recently, with the Zacks Consensus EPS estimate standing at $2.30, a 2% drop from mid-July. However, this figure still suggests a 2.2% growth from the same period last year.

Similarly, revenue forecasts have seen a slight decline, with expectations of $23.9 billion down by 1% but indicating a 1.9% rise from last year. The company’s revenue growth trajectory has notably slowed in recent times.

PepsiCo shares are currently trading at a reasonable valuation of 19.6X forward 12-month earnings, significantly below the five-year median and high points. This subdued multiple reflects investors’ revised growth outlook for the company.

Evaluating Investment Potential

Looking ahead to PepsiCo’s upcoming earnings report, the overall sentiment is cautiously pessimistic, with analysts downgrading earnings and revenue projections. While PEP shares have failed to excite in 2024, a positive guidance from the company could inject new life into the stock.

Given the recent downward revisions, it may be prudent for investors to adopt a ‘wait and see’ approach. Nevertheless, as a defensive stock, PEP shares are less likely to experience a significant downturn if results fall short of expectations.

Remaining Cautious Amid Market Volatility

With market dynamics heavily influenced by the prevalence of Technology stocks, the Consumer Staples sector faces challenges in attracting investor interest. PepsiCo’s performance in this context underscores the ongoing shift in market sentiment towards growth-oriented sectors.

As investors weigh their options in light of PepsiCo’s impending earnings release, the company’s ability to navigate market headwinds will be closely monitored. Despite the current subdued outlook, the company’s track record of resilience may offer some reassurance to cautious investors.