Analyzing the Sector Outperform Recommendation

Scotiabank recently entered the fray, bestowing their blessing upon Amazon.com with a Sector Outperform recommendation. This initiation, akin to a trumpeting herald, suggests a positive outlook on the e-commerce giant’s future trajectory, resonating in the ears of investors like a sweet symphony of potential.

Forecasted Upside and Revenue Growth

The crystal ball of analysts has forecasted an average price target of $223.06 per share for Amazon.com, hinting at an 18.14% increase from its latest closing price. This augury of growth paints a promising tableau, beckoning investors towards greener pastures amidst the financial landscape.

Insights into Fund Sentiment

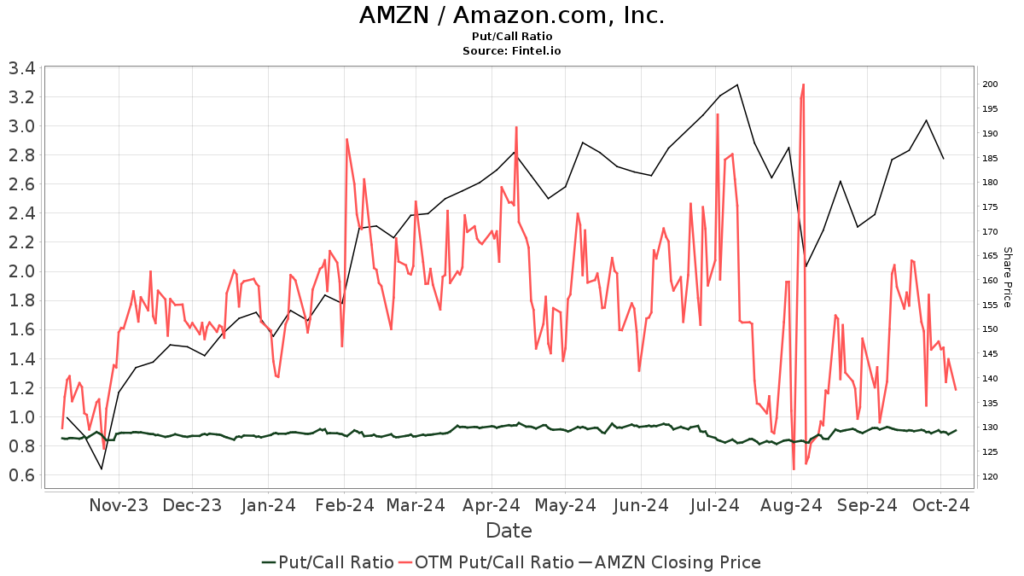

This narrative of positivity extends to the investment realm, with a myriad of funds or institutions pledging allegiance to Amazon.com. The surge in ownership, up by 117 holders in the last quarter, illustrates a burgeoning confidence in the company’s prospects. The bullish put/call ratio of 0.88 further cements this sentiment, akin to a gust of wind propelling the Amazon ship forward.

Behavior of Institutional Shareholders

Notable institutional players like Vanguard and Geode Capital Management have shown their hand, reinforcing their positions in Amazon.com. These maneuvers, akin to a grand chess game, highlight a strategic confidence in the company’s ability to weather the storms of the market and emerge victorious in the battlefield of investments.

The Amazon Empire: A Glimpse Behind the Curtains

Delving into the annals of Amazon’s history, we find a company guided by unwavering principles: customer obsession, innovation, operational excellence, and long-term vision. These pillars uphold the Amazon empire, a testament to its resilience and adaptability in the ever-evolving landscape of e-commerce.

Fintel provides a panoramic lens into the financial world, offering a wealth of data and analysis to aid investors in their quest for prosperity. As investors chart their course through the turbulent waters of the market, platforms like Fintel serve as beacons of knowledge, illuminating the path towards informed decision-making.