Earnings Season Overview

The Q2 earnings season has started on a positive note, offering investors a glimmer of hope as companies showcase improved growth rates, surpassing EPS estimates, and painting a reassuring picture for the future. This encouraging start sustains the favorable trend seen before the reporting cycle commenced.

Revenue Concerns

Despite the optimistic earnings landscape, companies are grappling with challenges meeting consensus revenue estimates. The Q2 revenue beat percentage, particularly amongst S&P 500 firms, is currently at its lowest in the last 20 quarters, decentralizing the overall narrative.

Financial Sector Performance

Big banks, such as Bank of America and Goldman Sachs, have spearheaded the Finance sector’s Q2 reporting, with commendable results that have resonated well with the market. Notably, Bank of America’s promising outlook for the second half of the year, especially regarding net interest income, indicates a potential turnaround in the sector’s profitability amidst prevailing headwinds.

Sectoral Trends

While the Finance sector showcases an insightful preview, it’s still early to draw conclusions about other sectors. Nevertheless, the Tech, Utilities, Transportation, Autos, and Consumer Discretionary sectors are witnessing positive revisions trends, countering any pessimism generated elsewhere.

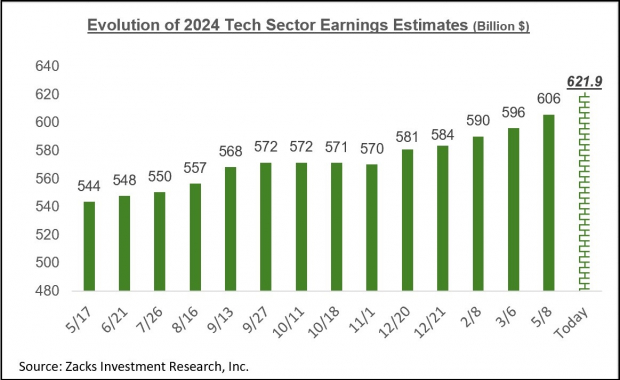

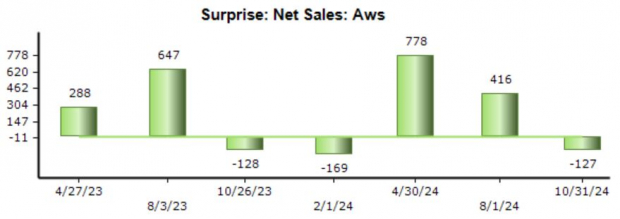

Tech Sector Resilience

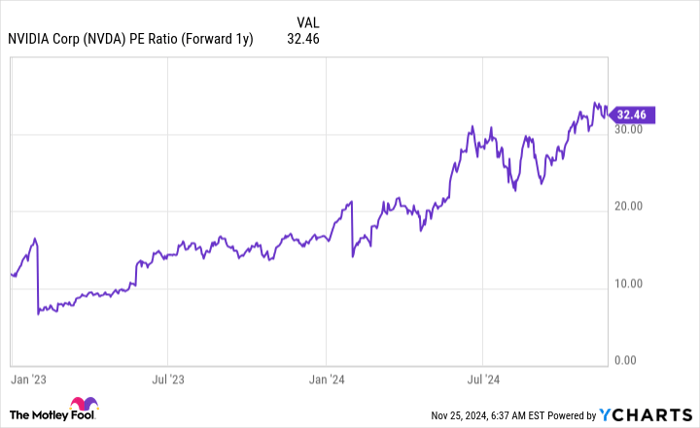

The technology sector continues to be a beacon of strength, with an upward trajectory in earnings growth projections. Bolstered by robust performance in recent quarters, the Tech sector is expected to lead the S&P 500 in terms of earnings growth, underpinned by rising margins and the escalating influence of high-margin software and services in its profit structure.

Margin Projections and Outlook

Projections indicate an optimistic future for margins in the Tech, Finance, and Consumer Discretionary sectors, accentuating a broader narrative of profitability across industry verticals. The integration of AI and relentless innovation in the Tech sector is poised to further enhance productivity potential and revenue streams.

Conclusion

As the Q2 earnings season unfolds, a blend of positive sentiment and cautious optimism permeates the financial markets. The tapestry of results weaves a narrative of resilience, innovation, and adaptability amidst a landscape replete with challenges and uncertainties.