Semiconductor stocks have become the darlings of Wall Street, leading the charge since the dawn of 2023. The rapid advancements in the chip industry have fueled innovation across various sectors – from artificial intelligence (AI) to cloud computing, virtual reality, self-driving cars, and beyond. Companies like Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD) have spearheaded this technological revolution, emerging as prime investment options in the tech sector.

Since the initiation of the AI boom in 2023, stocks of Nvidia and AMD have witnessed meteoric rises, with Nvidia soaring 782% and AMD climbing 132%. Nvidia, with its swift penetration into the AI realm, established an early foothold by supplying chips to developers worldwide. Conversely, AMD lagged initially but has recently made substantial strides in the AI domain, hinting at the potential to narrow the gap with Nvidia and even overtake its market dominance in the coming decade.

The Ascendancy of AMD in AI

Following the second-quarter earnings announcement in 2024, AMD experienced a 12% surge, resonating with investors due to its stellar performance in AI – now a key growth driver for the company. The revenue surged by 7% year-over-year, primarily propelled by a remarkable 115% rise in AI-driven data center revenue and a 49% uptick in the client division. The quarter featured a significant uptick in sales of AI-centric GPUs and CPUs, setting the stage for AMD’s ascent in the competitive semiconductor market.

In a strategic move, AMD has delved headfirst into the realm of AI, diversifying its portfolio and positioning itself for substantial gains in the upcoming years. The unveiling of powerful GPUs, alongside the intended acquisition of server builder ZT Systems for $5 billion, signifies AMD’s proactive approach to bolstering its competitiveness against Nvidia. The impending acquisition would augment AMD’s capabilities, enabling the rapid rollout of AI GPUs at a scale requisite for cloud service providers.

AMD’s foray into AI has attracted monumental players, with tech giants like Microsoft’s Azure, Meta Platforms, and Oracle leveraging AMD’s cutting-edge chips. The heightened competition among cloud service providers demands robust hardware, ensuring a sustained surge in AI chip demand. In this landscape, AMD stands primed to harness substantial growth opportunities.

AMD’s Strategic Diversification in AI Market

Besides its stronghold in GPUs, AMD has strategically seeded numerous growth catalysts across the expansive AI market to fortify its position and capitalize on future growth prospects.

AMD’s expertise in CPUs, its forte for years, has witnessed substantial progress, with its market share surging from 18% in 2017 to 34% presently, at the expense of Intel. The AI CPU sector, valued at $15 billion in the previous year, is slated to skyrocket to $410 billion by the decade’s conclusion, boasting a remarkable compound annual growth rate of 29%.

Furthermore, AMD’s proficiency in CPUs augurs well for its prospective role in the burgeoning AI-capable PC market. The escalating demand for AI services necessitates more potent hardware, propelling the expansion of AI-equipped PCs. It’s estimated that AI-enabled PCs will constitute roughly 40% of global PC shipments by 2025, with the market poised to surge at a CAGR of 44% until 2028.

Nvidia, with a market cap of $359 billion in early 2023, achieved a staggering $3 trillion by June 2024, propelled by a remarkable 738% surge in its stock price. The company’s exponential growth, fueled primarily by a surge in AI GPU sales, showcases the immense potential within the AI domain. Conversely, AMD has strategically diversified across various facets of the AI industry, setting the stage for monumental stock appreciation in the ensuing years.

Currently boasting a market capitalization of around $251 billion, AMD would require a 1,200% uptick to reach the coveted $3 trillion mark over the next decade – a formidable but not insurmountable target. With AMD’s stock rallying over 3,000% since 2014, the ambitious goal appears within reach.

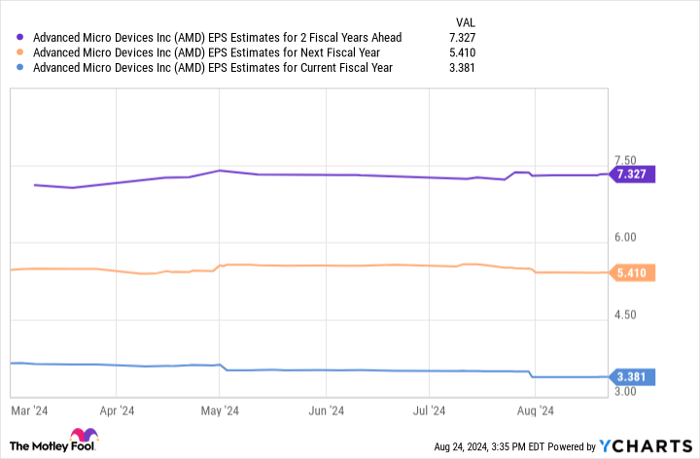

Data by YCharts.

The earnings projection chart indicates that AMD’s earnings could surpass $7 per share by fiscal 2026. Multiplying this figure with the company’s forward price-to-earnings ratio of 46 yields a share price of $336, hinting at a prospective stock growth of roughly 115% by 2026 – a conservative estimate considering Nvidia’s extraordinary AI-driven growth projection over the last decade. AMD might just be on the cusp of a spectacular growth trajectory, aiming to ascend the monumental $3 trillion market cap milestone in the coming years.

Investing Wisely: The AMD Conundrum

Considering an investment in Advanced Micro Devices warrants prudent evaluation:

The esteemed analyst team at Motley Fool Stock Advisor recently unveiled the 10 best stocks for investors to consider, with Advanced Micro Devices conspicuously absent from the list. The recommended 10 stocks hold the potential for substantial returns in the following years, embodying lucrative investment opportunities.

Reflecting on Nvidia’s inclusion in a similar list in April 2005 elucidates the transformative power of timely investments. A $1,000 input at the time of Nvidia’s acclaim would have burgeoned into a staggering $786,169, accentuating the astronomical potential of strategic investment endeavors.

Motley Fool’s Stock Advisor service equips investors with an easily navigable roadmap to success, offering insights on portfolio construction, timely analyst updates, and two new stock picks monthly. The service has exponentially outperformed the S&P 500 since 2002, promising substantial returns on prudent investments.

*Stock Advisor returns as of August 26, 2024