As the curtains close on another earnings season, a handful of key players are set to take the stage. Among them are Salesforce (CRM), Snowflake (SNOW), Lowe’s (LOW), and Zoom (ZM), each poised to deliver their financial performance to a curious audience of investors. The period leading up to an earnings report is akin to a high-wire act, with implied volatility soaring as speculation runs rampant. This surge in volatility reflects the market’s uncertainty and translates into elevated options prices, attracting both speculators and hedgers seeking to capitalize on the impending uncertainty.

But as the earnings report is unveiled, the narrative shifts. Implied volatility, like a deflating balloon, retreats to more subdued levels as the outcome of the report becomes a known quantity.

Let’s delve into the anticipated trajectories for these stocks. To gauge the expected range, one can navigate the option chain, summing up the price of the at-the-money put option and the at-the-money call option with the first expiry date following the earnings revelation. Although this method may lack the precision of a meticulous calculation, it serves as a reasonably accurate barometer.

Every weekday unfolds like a different act in this financial theater:

Monday

LI – 10.5%

ZM – 8.2%

U – 15.0%

FIS – 7.4%

DPZ – 6.0%

WDAY – 8.8%

Tuesday

DVN – 5.1%

FSLR – 9.6%

EBAY – 6.3%

LOW – 4.0%

Wednesday

SNOW – 10.4%

BIDU – 7.7%

CRM – 7.3%

TJX – 4.0%

Thursday

DELL – 9.4%

CELH – 12.1%

ZS – 11.2%

BUD – 3.4%

TD – 4.0%

ADSK – 6.6%

Friday

Nothing of note

Options traders, akin to choreographers, can leverage these projected movements to craft their trades. The bearish players might contemplate bear call spreads beyond the anticipated range. On the flip side, bullish traders could opt for bull put spreads outside the expected range or venture into naked puts for a more daring stance. For those treading the neutral ground, iron condors provide a harmonious balance. When waltzing with iron condors during earnings, it’s advisable to position the short strikes outside the anticipated range.

Amidst this intricate dance with options, prudence reigns supreme. Embracing risk-defined strategies and maintaining modest position sizes is the waltz to navigate the uncertainty. A thoughtful approach ensures that any unforeseen market tremors do not send shockwaves through one’s portfolio, capping potential losses at a manageable 1-3%.

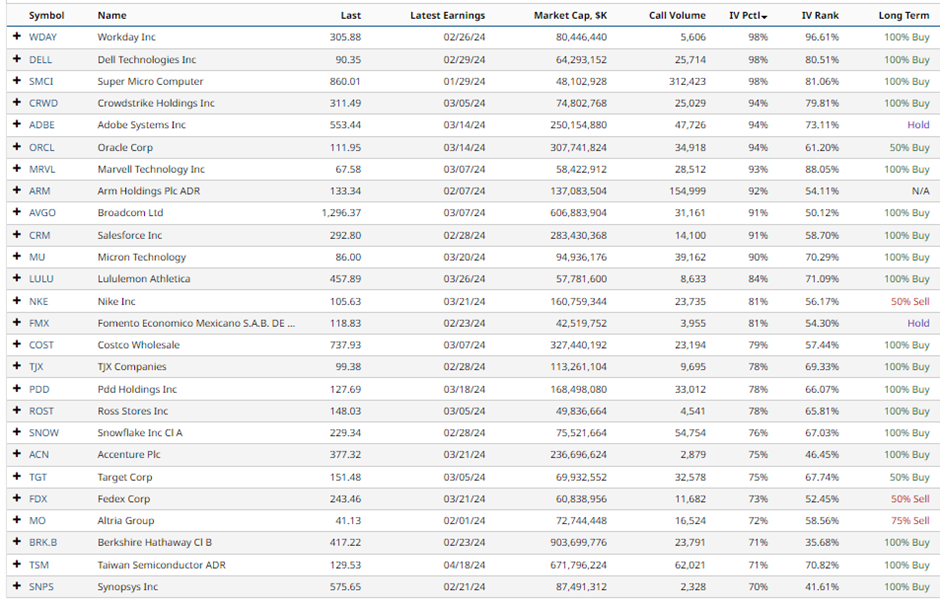

As we peer through the lens of volatility, other stocks twirl in the limelight. The Barchart Stock Screener unveils a cast of high implied volatility contenders. By setting filters for total call volume, market cap, and IV Percentile, investors can unearth stocks with volatility potential as rich as a theatrical crescendo.

The final act of last week’s earnings saga witnessed mixed performances, with only nine out of seventeen companies adhering to the predicted script. The interplay between projections and realities added a layer of intrigue to the unfolding narrative.

With the curtain drawn on another round of earnings, a new chapter unfolds. A tale of shifting open interest emerges, with stocks like SNAP, RIVN, PFE, MSFT, INTC, BAC, SQ, AAPL, and AMZN witnessing unusual options activity. This evolving landscape underscores the dynamic nature of the market, where each twist and turn presents opportunities for the discerning investor.

Let this journey through the ebbs and flows of option volatility serve as a canvas for your own exploration. Remember, the market stage is ever-changing, and each performance offers a chance to set your own rhythm amidst the volatility symphony.