I’ve just returned from an eye-opening trip to Las Vegas—not for the slots, mind you, but to witness the thriving Harry Reid International Airport. This transportation hub welcomed a record 57.6 million travelers last year, with projections signaling even higher numbers for the ongoing travel surge this summer.

My reason for being in Las Vegas was none other than Dell Technologies World 2024, a gathering of top-tier business magnates and tech experts delving into the realms of technology and artificial intelligence (AI).

The surge of AI is dominating headlines and the stock market, with global searches for “AI” hitting peak levels. The mounting interest highlights companies racing to introduce AI products and establish their position in the competitive AI landscape.

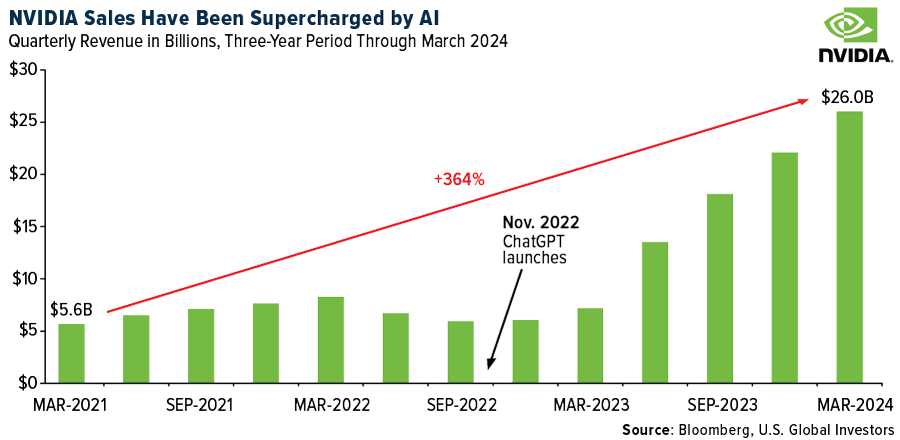

The spotlight at this event shone on Jensen Huang, the CEO of NVIDIA Corporation (NASDAQ:), whose recent earnings report sent shockwaves through the industry. NVIDIA’s earnings for the March quarter soared to a record $26 billion, a staggering threefold increase from the previous year, with profits spiking sevenfold.

Projections suggest that sales will reach $28 billion in the current quarter, driven by the growing demand for their graphics processing units (GPUs)—an ideal fit for AI applications, fueling their upward trajectory.

Rewarding Shareholders Amidst a Stratospheric Ascent

NVIDIA stands tall in the market rally with a colossal market cap surpassing $2.5 trillion, eclipsing the entire German stock market and securing its position as the third most valuable company worldwide, trailing only Microsoft (NASDAQ:) and Apple Inc (NASDAQ:).

With NVIDIA shares soaring over $1,000, the company responded by hiking its quarterly dividend from $0.04 to $0.10 per share, a remarkable 150% increase. Furthermore, a 10-for-1 stock split was announced to enhance the attractiveness of its stock to retail investors. Following in the footsteps of Walmart (NYSE:) with a 3-for-1 split in February, other tech giants like Alphabet (NASDAQ:), Tesla (NASDAQ:), and Amazon.com Inc (NASDAQ:) have all undertaken stock splits in 2022.

Despite stock splits not altering the stock’s fundamentals, historical trends indicate a surge in investor interest following such actions.

An analysis by Vanda Research reveals that NVIDIA holds the highest share in retail investors’ portfolios, surpassing other popular giants like Apple, Tesla, and the Invesco QQQ ETF, comprising 9.3% on average.

NVIDIA further secured its top spot in the 2024 Axios Harris Poll 100, leading the ranks as the most reputable company in the eyes of American consumers. Joining NVIDIA in the top five were 3M Company (NYSE:), Fidelity Investments, Sony (NYSE:), and Adidas (OTC:).

The Modern Titans of the Tech Realm

What does NVIDIA’s ascent imply for investors? The path ahead looks promising for NVIDIA, having captured a substantial market share and creating an extensive ecosystem around their AI tools, solidifying customer loyalty and driving sales. In their AI gold rush, GPUs are the contemporary pickaxes, catering to tech giants from Amazon to Dell to Tesla, with Tesla alone utilizing 35,000 of NVIDIA’s H100 GPUs in their supercomputers.

Comparisons between NVIDIA and Tesla are inevitable, with both entities spearheading technological advancements and disrupting their respective industries.

Jensen Huang’s foresight underscores the ubiquitous future of NVIDIA’s GPUs, set to become as pervasive as self-driving technology in the realm of automobiles.

The Ripple Effects of Bitcoin’s Scarcity

While NVIDIA remains indirectly linked to crypto mining, the rise of AI and blockchain technology intertwines as catalysts for robust demand in powerful computing, reshaping conventional financial landscapes.

Notably, Bitcoin’s intrinsic scarcity parallels that of gold, with Bitcoin’s deliberate cap at 21 million coins positioning it as a sought-after asset, akin to gold’s appeal. As Bitcoin approaches 95% of its total mineable volume, projections hint at reaching 99% within the next decade, heightening its perception as a store of value and potentially redefining its worth.

Gold’s Surge Towards Peaks

Parallel to Bitcoin’s trajectory, gold has commanded attention recently, hovering below its recent zenith of $2,450 per ounce. With mounting geopolitical tensions and anticipation surrounding Federal Reserve rate adjustments, gold experiences fluctuations that had signaled overbought conditions in the past but have since normalized.

For conservative investors, a recommended 10% allocation in gold remains prudent, divided between physical gold assets (such as bars, coins, or jewelry) and high-quality gold-focused stocks, mutual funds, and ETFs.

The volatile nature of Bitcoin, however, may warrant caution, particularly for older and risk-averse investors, prompting consultation with a financial advisor before embracing this nascent asset class.

May your investing endeavors be prosperous, and your optimism unwavering!

***

Disclaimer: Past performances do not guarantee future outcomes. The future allocation of dividends by security issuers remains uncertain and subject to change. Daily holdings may vary based on the most recent quarter-end reports. As of (03/31/2024), U.S. Global Investors managed accounts that included Tesla Inc., Apple Inc., and Amazon.com Inc.