SoundHound AI Rally Loses Steam

SoundHound AI (NASDAQ: SOUN) saw a remarkable surge in its stock price, soaring nearly 128% over the past six months, making it a hot ticket on Wall Street. However, recent concerns over its growth trajectory have caused a significant pullback, with shares dropping by almost 55% in the last month alone. Despite ambitious revenue projections and a promising pipeline, SoundHound currently trades at 22 times sales, a steep premium compared to the tech sector’s average price-to-sales ratio of 7.2.

Why Nvidia Reigns Supreme

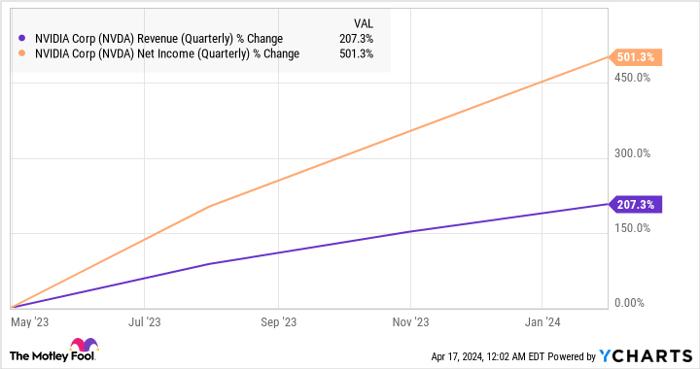

When considering investments in the AI sector, seasoned investors might be better off turning their attention to Nvidia (NASDAQ: NVDA). The tech giant has established itself as the dominant force in the AI chip market, boasting a market share exceeding 90%. Nvidia’s revenue growth has outpaced that of SoundHound AI by a substantial margin. In fiscal 2024, Nvidia generated close to $61 billion in revenue, marking a remarkable 126% year-over-year increase, while SoundHound AI closed 2023 with a mere 47% revenue growth to $46 million.

In addition to its robust financial performance, Nvidia’s profitability sets it apart. With a non-GAAP gross margin of 73.8% in fiscal 2024, up from 59.2% the previous year, Nvidia’s adjusted net income surged to $32.3 billion. Conversely, SoundHound AI reported a net loss of $89 million in 2023 and is not expected to turn profitable in the near future.

Nvidia’s Growth Trajectory

Analysts project Nvidia to experience rapid revenue growth in the coming years, with expectations of an 81% increase to $110.5 billion in fiscal 2025. This forecasted growth outpaces SoundHound AI’s projected 51% revenue increase for the same period. Nvidia’s dominance in the AI chip market, poised to witness a 61% annual growth through 2027, positions the company favorably for sustained expansion.

Furthermore, Nvidia’s presence across multiple high-growth sectors such as gaming, automotive, and digital twins underscores its potential. With the global GPU market forecasted to grow at a 34% annual rate through 2032, and revenue expected to reach $773 billion, Nvidia’s leading position in AI GPUs and PC GPUs places it at the forefront of lucrative opportunities.

The Case for Nvidia’s Valuation

While Nvidia trades at 36 times sales, surpassing SoundHound’s trailing sales multiple, a closer look at forward sales multiples tips the scale in Nvidia’s favor. The chipmaker’s forward-looking growth potential, combined with its track record of profitability and market dominance, make it an enticing choice for investors seeking long-term value and stability in the volatile AI landscape.

Unveiling Nvidia: The AI Stock Pick of the Decade

The Rise of Nvidia in the AI Market

The tech industry is buzzing with excitement as Nvidia continues to cement its position as a powerhouse in the AI sector. With a solid profitability and a forward P/S ratio on par with its competitors, Nvidia stands out as a beacon of growth potential.

A Better Bet than SoundHound

Comparing Nvidia to SoundHound, it is evident why investors are placing their bets on the former. Nvidia’s growth trajectory surpasses that of SoundHound, highlighting its potential to deliver substantial gains to investors in the long run.

Investing in Nvidia: A Strategic Move

For investors eyeing the AI market, Nvidia stands as a lucrative opportunity. The company’s forward earnings multiple, lower than the U.S. technology sector, positions it as an attractive investment option for those seeking growth and profitability.

Analyze Before You Invest

Before diving into Nvidia stocks, it is crucial to consider all factors at play. While some analysts may not rank Nvidia in their top 10 stock picks, its strong profitability and growth prospects cannot be overlooked in the dynamic landscape of the tech industry.

The Motley Fool Stock Advisor Perspective

The recommendations from the Motley Fool Stock Advisor team offer valuable insights into the stock market. While Nvidia may not be among their top picks, the service’s track record of outperforming the S&P 500 underscores the potential for lucrative returns from strategic investments.

Unlocking the Potential of Nvidia

As the AI revolution gains momentum, Nvidia emerges as a frontrunner in harnessing the power of artificial intelligence. Investors looking to capitalize on this transformative technology landscape would find Nvidia as a compelling choice for long-term growth and profitability.