Within the realm of tech colossus Microsoft lies an entire gaming universe. Yet, a recent flurry of news has sent shivers down the spines of gamers. Despite this, investors stoically weathered the storm, witnessing a commendable uptick of over 1.5% in shares at the close of Tuesday’s trading session.

A jarring revelation emerged for enthusiasts eagerly anticipating the release of Avowed, the Obsidian RPG hailed as the studio’s retort to The Elder Scrolls. Previously slated for a 2024 launch, the game’s release has been ominously teleported to February 18, 2025. While the cause is not inherently dire, it certainly cast a shadow over those awaiting its arrival. With a slew of games saturating the year-end market, Microsoft sought to grant Avowed a fighting chance in the crowded gaming arena.

In parallel, Microsoft introduced alterations to its credit schemes. The longstanding Microsoft Rewards program, recognized for dispensing boonful credit through designated tasks, now presents a less rosy picture for UK members. Their point-gathering capacity has been halved, plummeting from the once-generous 250 points weekly (or 275 for Xbox Game Pass Ultimate members) to a mere 150 points—a stark depreciation.

A Glimpse into the Future of Xbox

Yet, the news did not draw its curtains just there. Four years post the emergence of its predecessor, the anticipation for a newer Xbox looms on the horizon—possibly surfacing within the forthcoming year or two. A trend prevalent in recent times advocates a pronounced shift towards cloud gaming, aligning smoothly with the burgeoning prevalence of digital downloads. In an era where disks seem antiquated, such a transition resonates with modern sensibilities.

Nevertheless, with dwindling Xbox purchases, a pertinent question arises concerning Microsoft’s commitment to the platform. The latest earnings discourse revealed a grim 42% slump in Microsoft gaming hardware sales from the prior quarter. While such statistics appear reasonable, considering the near-saturation of Xbox ownership, a palpable unease envelops the realm at large.

Should You Bet on Microsoft’s Future?

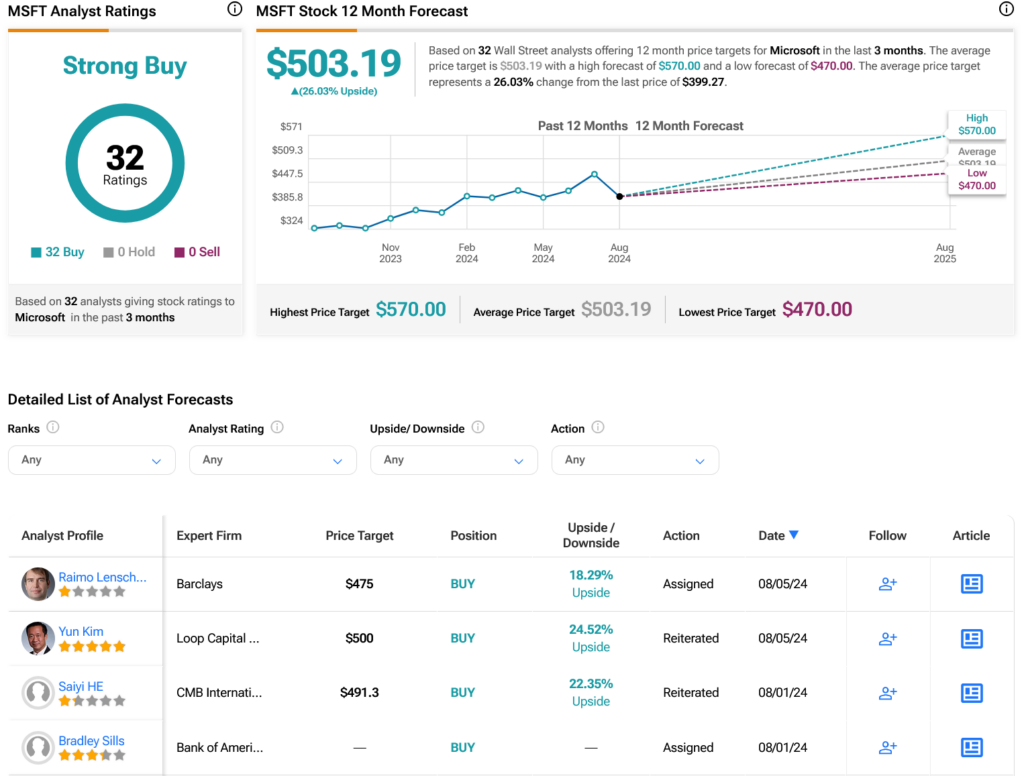

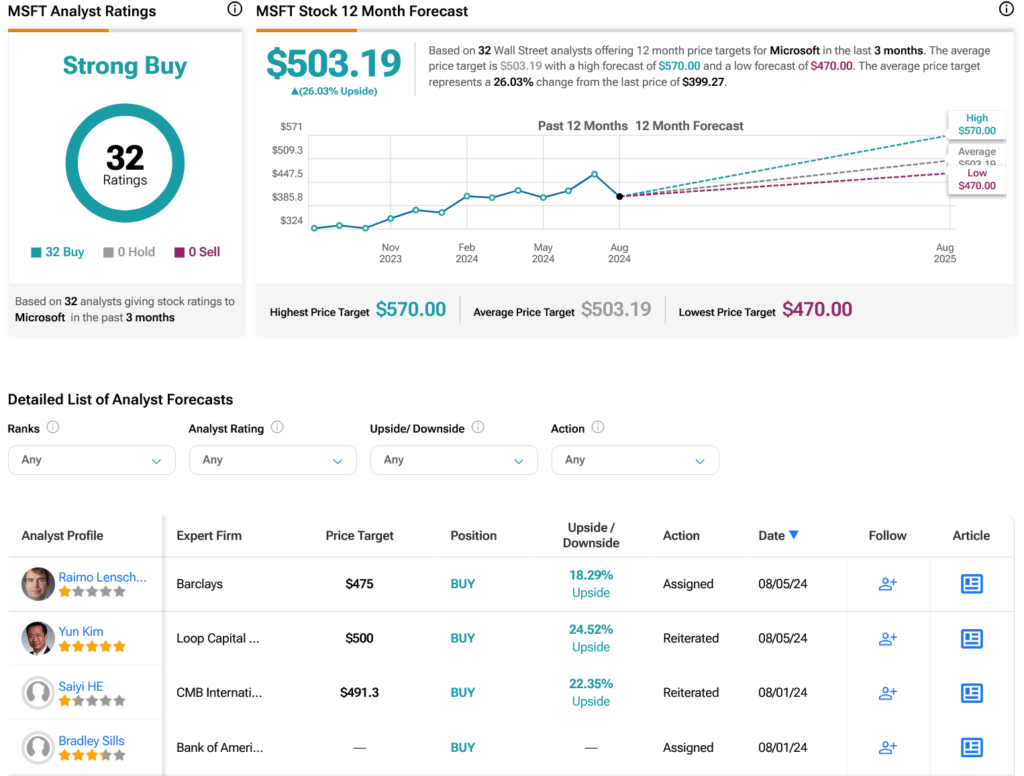

Upon veering towards Wall Street for guidance, analysts strike a harmonious chord with a resounding Strong Buy verdict on MSFT stock, crowned by 32 Buy ratings bestowed in the preceding trimester. Following a robust 22.59% surge in its share value over the bygone year, the targeted MSFT price of $503.19 per share hints at a not insignificant 26.03% upside potential.