The 2024 Q2 earnings season continues to unfold, with next week’s reporting calendar filled with prominent names from the financial realm. The ongoing period has seen an overall positive trend, with the results from major banks not stirring any market jitters.

Looking ahead to the upcoming week, a number of significant players from the Mag 7 group, such as Meta Platforms META, Amazon AMZN, and Apple AAPL, are set to disclose their financial performance. These three stocks have been standout performers in 2024, prompting investors to ponder if their winning streak will persist.

Now, let’s delve deeper into how these entities are positioned as they gear up for their earnings announcements.

Apple’s Outlook on China Sales

Apple’s stock faced scrutiny for its sluggish start in 2024 but has since gathered momentum, registering an impressive 14% year-to-date increase. Concerns over performance in China and lagging in AI innovation had weighed on the stock, but these apprehensions appear to have abated for now.

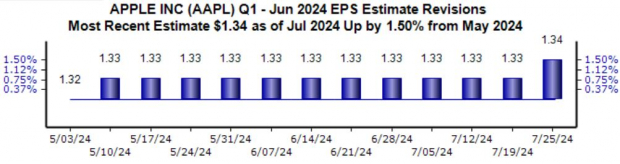

The stock currently holds a Zacks Rank #2 (Buy), with anticipated earnings for the upcoming period showing a steady increase over recent months. The expected $1.34 EPS indicates a 6% rise from the corresponding period last year, coupled with a projected 2.7% year-over-year sales growth.

The company faced challenges in China of late, yet overall, its sales aligned more closely with projections compared to previous periods, missing our consensus estimate by $220 million vs. a $2.5 billion shortfall in the prior period.

Furthermore, positive news emerged on iPhone shipments in China recently, alleviating concerns. Investors will closely monitor the performance of the company’s Services portfolio, which has been a robust growth driver in recent times, helping to reduce reliance on iPhone sales.

As illustrated below, the Services segment has consistently outperformed our expectations except for one instance.

Amazon’s AWS Progress under the Limelight

During its recent period, AMZN exhibited robust performance, with an operating income of $15.3 billion, marking a substantial 220% year-over-year increase. Of utmost importance, AWS delivered stellar results, posting net sales of $25 billion, representing a 17% year-over-year growth and breaking a streak of recent negative surprises in this metric.

There were concerns about a potential slowdown in cloud services for a few periods, yet the recent overall results paint a positive picture heading into the forthcoming release.

Earnings and revenue forecasts for the upcoming release have been somewhat conservative, but substantial growth is anticipated, with a projected 63% increase in EPS on 10% higher sales. Improved cost management and operational efficiencies have significantly contributed to enhanced profitability, leading to meaningful margin expansion.

Kindly note that the chart below presents data on a trailing twelve-month basis.

Meta Platforms Evaluation of CapEx Trends

META has witnessed a marked improvement in operational efficiencies, significantly boosting its profitability and driving robust EPS growth in recent quarters.

Investors will seek insights on CapEx trends related to AI, a focal point also addressed in Alphabet’s recent quarterly report. Earnings estimates for this release have seen an uptick over recent months, with the expected $4.69 EPS reflecting a substantial 45% year-over-year growth.

As for key metrics, the Zacks Consensus Estimate for Advertising revenue stands at $37.5 billion, marking a 20% increase from the same period last year. It is noteworthy that Alphabet’s Advertising segment posted strong results, with sales of $64.6 billion, showing a 12% year-over-year climb.

META’s shares experienced a downturn following its most recent quarterly results, with the negative sentiment attributed to a higher CapEx guidance for the current fiscal year. As mentioned earlier, this development will be closely monitored by investors, with Alphabet causing some unease due to its higher-than-expected CapEx.

In Conclusion

The 2024 Q2 earnings season is progressing steadily, with an especially crowded reporting schedule for this week. Another round of positive outcomes is anticipated, largely supported by Tech’s impressive performance.

This week will see several Mag 7 members unveil their results, including Meta Platforms META, Amazon AMZN, and Apple AAPL. Given their robust performance in 2024, their results are bound to attract meticulous scrutiny, potentially making this week the most significant of the Q2 cycle overall.