Lucid (NASDAQ: LCID) experienced a catastrophic dip in Thursday’s trading, plummeting to an all-time low. The company’s stock price closed the daily session 4.7% down, hitting an intraday low of 8.3%, according to data from S&P Global Market Intelligence.

This decline was triggered by news of Tesla reducing the price of its Model Y vehicle by 5,000 euros (approximately $5,430) in Germany, with similar cuts made in France, Norway, and the Netherlands. This substantial reduction follows significant price drops on Tesla’s Model 3 and Model Y vehicles the previous week.

Tesla’s aggressive pricing strategy signals an alarming slump in the EV market, likely foreseeing headwinds for other players in the sector. Weakening EV demand could spell trouble for Lucid, despite the stock hitting record lows making it a tempting prospect for potential investors.

Is Lucid stock a buy for 2024?

Lucid ventured into the EV space through a merger with a special purpose acquisition company (SPAC) in July 2021. The company’s stock is now down approximately 95% from its peak, positioning it as a high-risk, potential high-reward investment.

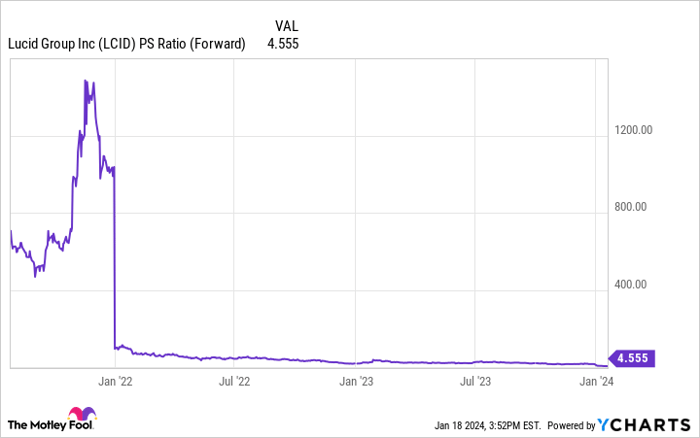

LCID PS Ratio (Forward) data by YCharts

Despite a significant valuation pullback, Lucid is still trading at approximately 4.6 times its expected sales for this year, emphasizing the company’s distant road to profitability even in an optimistic scenario.

In Q3 2023, Lucid reported revenue of $137.8 million from 1,457 vehicle deliveries but suffered a net loss of approximately $752.9 million. Although the company held cash, equivalents, and short-term investments amounting to approximately $4.4 billion, it is burning through cash at an alarming rate.

Lucid’s survival depends on swiftly escalating vehicle production and sales while maintaining strong pricing in the ultra-luxury market. With Tesla and leading automakers like General Motors and Ford scaling back planned EV productions amid a weakening demand environment, Lucid faces a daunting path ahead.

Despite the massive drop in its stock price, investing in Lucid remains exceedingly risky. Overcoming impending challenges and inching toward profitability could propel the stock to explosive gains. Nevertheless, investors must recognize the formidable odds facing the business, potentially leading to further declines in its already battered stock.

Before considering investing in Lucid Group, contemplate this: the Motley Fool Stock Advisor recently identified the 10 best stocks, with Lucid Group not making the list. The selected stocks are expected to yield substantial returns in the coming years.

Stock Advisor offers a user-friendly roadmap for investment success, including portfolio-building guidance, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has tripled the return of the S&P 500*.

*Stock Advisor returns as of January 16, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.