Nvidia (NASDAQ: NVDA) has been at the forefront of artificial intelligence (AI) advancement, leveraging its GPUs in data centers to power large language models like ChatGPT. This strategic move has catapulted Nvidia’s stock to dizzying heights, nearly tripling in value over the past year, trading at a steep 72 times trailing earnings. However, there’s another player in the AI space making waves while maintaining a more wallet-friendly positioning than Nvidia.

Micron Technology (NASDAQ: MU) recently unveiled its fiscal 2024 third-quarter results, showcasing a substantial surge in revenue and earnings. Let’s delve into how Micron is capitalizing on AI to fuel its growth and whether it presents a more enticing investment opportunity vis-à-vis Nvidia.

The Rise of Micron Technology in the AI Arena

Micron’s Q3 revenue soared by 81% year-over-year to reach $6.8 billion, with a notable non-GAAP net income of $0.62 per share compared to a loss of $1.43 per share in the corresponding quarter last year. Projections indicate a further acceleration in Micron’s growth trajectory, forecasting $7.6 billion in revenue for the ongoing quarter, signaling a remarkable 90% surge from the prior year’s figures.

The driving force behind Micron’s robust growth stems from the burgeoning demand for memory chips in various sectors such as smartphones, PCs, and data centers, all embracing AI technology.

For instance, the sale of $100 million in high-bandwidth memory (HBM) chips this past quarter in the data center segment underscores Micron’s AI-driven progression. These HBM chips are integral components in AI graphics cards, enhancing bandwidth and computational capabilities. Micron anticipates a substantial uptick in HBM revenue, projecting a revenue leap from “several hundred million dollars” in the current fiscal year to “multiple billions of dollars” by fiscal 2025.

In addition, the surge in AI-driven demand is propelling Micron’s data center storage business, especially with the uptick in solid-state drive (SSD) requests stemming from AI training and inference operations. This trend opens up exponential growth avenues for Micron, with predictions pegging the global data center SSD market to generate $133 billion in 2032, up from $37 billion in the prior year.

The Memory Stock Valor: Micron vs. Nvidia

Micron closed its previous fiscal year with $15.5 billion in revenue, poised to wrap up the current fiscal year at $25 billion – marking a substantial 61% upsurge. Conversely, Nvidia’s revenue is expected to climb from $60.9 billion in the prior fiscal year to $120 billion in the current one, showcasing more rapid growth compared to Micron for the time being.

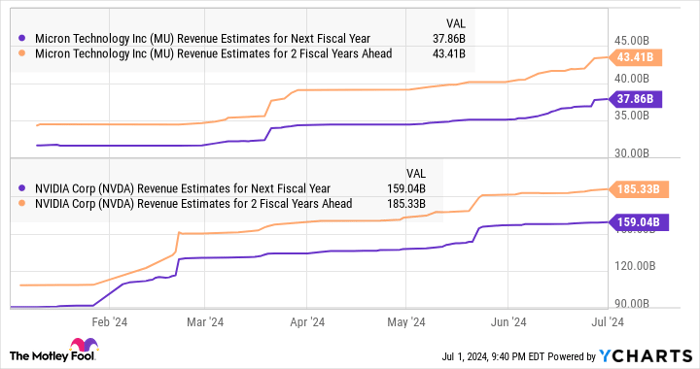

However, indications suggest that Micron’s revenue could catapult by another 50% in the following fiscal year, outstripping Nvidia’s anticipated growth trajectory.

Furthermore, Micron’s earnings are predicted to escalate at a swifter pace relative to Nvidia’s projections over the ensuing couple of fiscal years.

Trading at a mere 19 times forward earnings, Micron Technology presents a glaring disparity in valuation compared to Nvidia’s forward earnings multiple of 48. This glaring contrast not only positions Micron as a cost-effective choice but also underscores its potential to outshine its esteemed competitor.

Seizing the Micron Opportunity: A Value Play in AI Stocks

Glimpsing into the future, analysts foresee Micron surging ahead at an impressive pace, potentially outstripping Nvidia’s growth trajectory in the foreseeable future.

With Micron poised as a frontrunner in the AI realm and trading at a significant discount compared to Nvidia, investing in Micron Technology appears to be a strategic move with promising returns on the horizon.