Nvidia (NASDAQ: NVDA) has undoubtedly been one of (if not the) best artificial intelligence (AI) stocks to own in 2023 and 2024. With 2025 nearly here, the question now shifts to: “Is it the best AI stock for 2025?”

This question is impossible to answer because it requires me to predict the future. However, I think there are key facts about Nvidia’s business that could influence whether it will be the best AI stock in 2025.

Nvidia will sell more GPUs in 2025 than in 2024

Why is Nvidia the AI leader in the first place? Simple: Its best-in-class graphics processing units (GPUs) are the muscle behind many AI models. GPUs have advantages over traditional computing methods because they can process hundreds of calculations in parallel. Furthermore, thousands of GPUs can be connected in clusters to create impressive computing capability.

As AI models become more complex, they will require increased computing power to develop. For example, Meta Platforms’ generative AI model, Llama, is currently in its 3.1 release phase. It’s working on developing Llama 4, but that will require 10 times more computing power than the Llama 3 model. This isn’t a problem that’s unique to Meta; every company with its fingers in AI is still dramatically expanding its AI computing power, which is a huge benefit for Nvidia.

It’s no wonder that many big tech companies like Meta and its peers have already discussed an increase in capital expenditures related to AI computing power for 2025. So, at the very least, Nvidia’s demand will still be growing in 2025.

This is crucial, as Nvidia has already priced in a lot of success.

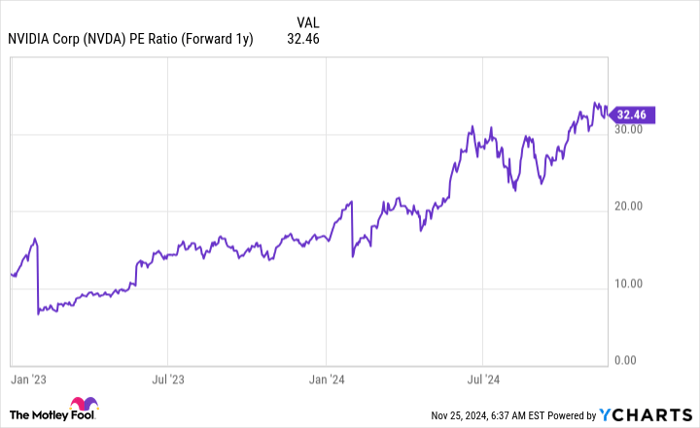

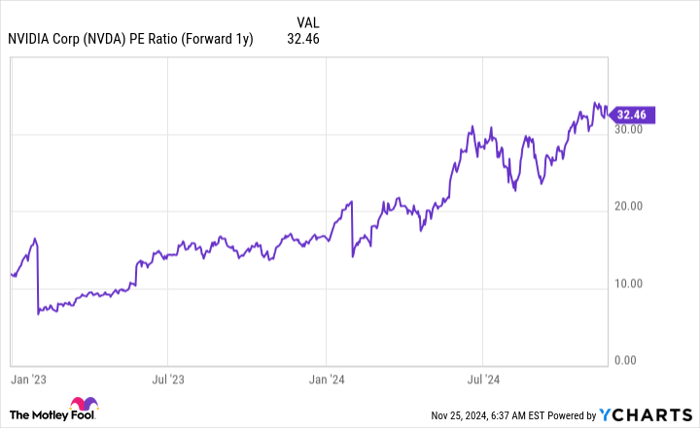

Nvidia’s stock is the most expensive it has been during its run

Although Nvidia has seldom appeared cheap during its two-year run, it is the most expensive it has been in right now.

NVDA PE Ratio (Forward 1y) data by YCharts

This chart is a price-to-one-year-forward-earnings ratio, and it prices the stock based on the next fiscal year’s earnings (in this case, FY 2026, ending January 2026). Nvidia has never been this expensive during its run, which means it still has high expectations for next year.

While Nvidia’s management hasn’t given official FY 2026 guidance, Wall Street analysts are already taking a crack at it. For FY 2026, an average of 59 analysts expect around $193 billion in revenue, representing 49% revenue growth. That’s still incredibly impressive, considering that Nvidia’s revenue has risen so much in 2023 and 2024.

But is it enough to justify the most expensive price tag Nvidia has traded at during its run? That depends on what you think will happen in 2026.

What happens in 2025 may be decided by 2026 projections

If you only looked at Nvidia’s trailing price-to-earnings (P/E) ratio, you would have never thought the price made sense. That’s because investing in Nvidia is all about where it could go next. So, it makes sense that a lot of 2025 investing will be based on what 2026 holds.

There are a couple of camps of thought here:

- The first is that the AI build out is far from complete. As a result, Nvidia’s clients will continue scooping up GPUs to build out their computing power. This idea seems reasonable, as we are just scratching the surface of what’s possible with AI. As a result, we have no idea how much is left to gain.

- The second thought is that 2025 will be the peak demand for AI computing power, and Nvidia’s 2026 sales will start to turn south. If this happens, the bottom may fall out of Nvidia’s stock as investors quickly take gains.

- Lastly, there is a combination of the two, where 2026 is essentially a repeat of 2025. This may be the hardest scenario to predict, as most investors view the AI space as boom or bust, not stay stagnant. However, this may be the most logical conclusion, as there may be an equilibrium between companies spending to build out AI computing resources and return on investment.

I have no clue what will happen, but I believe demand will likely end up between options one and three. As a result, I think Nvidia will likely be a market-beating stock in 2025, but it likely won’t be the best stock (at least from a price appreciation standpoint).

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,060!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 25, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.