Microsoft‘s journey over the last decade has been nothing short of remarkable, with a staggering 920% surge in its stock value since 2014. The tech behemoth has diversified its portfolio, firmly establishing itself in cloud computing, video games, artificial intelligence (AI), and consumer products.

Now could be the time to consider why Microsoft’s stock is a compelling investment option.

The Race to the Top

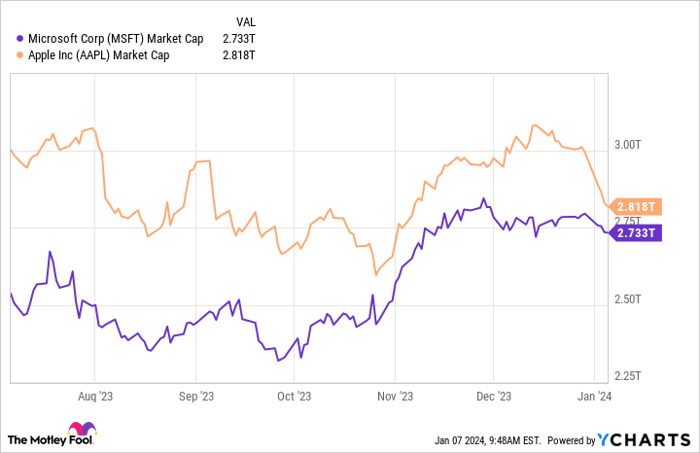

The market has witnessed Microsoft in a neck-and-neck race with Apple to claim the title of the world’s most valuable company by market cap. With the gap between the two giants narrowing to around $100 billion, Microsoft’s resounding 57% stock surge throughout 2023 outshone Apple’s 48%, signaling a potential shift in status quo.

Apple, renowned for its consumer-oriented products, faced a 3% dip in its fiscal 2023 revenue; contrastingly, Microsoft’s resilient stance in areas like cloud computing and digital productivity services propelled its revenue to a 6% year-over-year growth, reaching an impressive $212 billion.

Moreover, Microsoft’s bold foray into artificial intelligence, acquiring a substantial share in ChatGPT developer OpenAI, positions the company favorably in this burgeoning sector, setting it apart from Apple’s potentially uncertain AI endeavors.

Valuation and Growth

Though Microsoft’s forward price-to-earnings ratio (P/E) might paint a picture of a pricier stock, its proven track record of sustained growth, dominant market positions, and substantial financial reserves validate its premium valuation.

Having surpassed $63 billion in free cash flow, Microsoft exhibits robust financial prowess, capable of steering through challenging terrain and supporting its ambitious R&D efforts. Furthermore, the company’s estimated earnings per share (EPS) illustrate a promising trajectory, poised to reach $15 per share by fiscal 2026.

When calculated against its forward P/E of 33, Microsoft’s potential to ascend by 35% over the next two fiscal years seems within reach, outstripping the growth rates of both the Nasdaq Composite and S&P 500 over the past five years.

Given this backdrop and its pursuit to claim the mantle of the world’s most valuable company, Microsoft emerges as an enticing stock pick, one that warrants serious consideration.

Should you invest $1,000 in Microsoft right now?

Before diving in, it’s worth noting that while Motley Fool Stock Advisor didn’t list Microsoft in its 10 top stocks, the service has consistently offered a roadmap for success, delivering substantial returns compared to the S&P 500 since 2002.

See the 10 stocks*Stock Advisor returns as of December 18, 2023