Intel‘s business has been in decline lately, once a titan in the chip market especially in CPUs and with a profitable partnership with Apple. However, faced with increasing competition and the loss of Apple, Intel found itself needing a strategic overhaul.

Intel’s stock has taken a hit, dropping by about 28% over the last two years as investors reacted to its challenges. However, Intel is now embarking on a significant transformation that could position it as a strong long-term investment.

The company is refocusing its operations towards a digital foundry model, a move that could solidify its position as a major semiconductor player in the U.S. and Europe. Moreover, Intel is heavily investing in the emerging artificial intelligence (AI) sector.

Breaking Down the CHIPS Act Impact

Two years ago, President Joe Biden enacted the CHIPs Act, which aimed to boost semiconductor manufacturing capacity in the U.S. by injecting $53 billion into leading chipmakers worldwide. Recently, the allocation of funds has commenced.

On April 15, the Biden administration announced a $6.4 billion grant to Samsung for expanding its U.S. manufacturing facilities. Intel is next in line to receive a share, with $8.5 billion set aside to construct four new facilities across the country.

These investments will facilitate the production of chips crucial for various industries including consumer electronics, automotive, data centers, and AI hardware.

Intel has projected the shift to an internal foundry model to result in cost savings of up to $10 billion by 2025, marking its most significant transformation in over five decades. Additionally, these changes could lead to enhanced efficiency and profitability, potentially driving a 60% increase in non-GAAP gross margin and a 40% rise in operating margin.

Intel’s Evolution in the AI Arena

Alongside its operational shift, Intel is significantly emphasizing AI integration across its product lineup.

The AI market, valued near $200 billion in the last year, is forecasted to grow at a 37% compound annual rate until 2030. Numerous tech firms are realigning towards this high-growth sector, seeking to capitalize on AI’s immense potential. Intel has joined this trend.

What sets Intel apart is its extensive chip-making legacy spanning over five decades. Despite the rising competition, Intel retains a 63% share of the CPU market.

Although Intel has a legacy of CPU focus and is slightly behind in the GPU-centric AI space where Nvidia leads, Intel plans to challenge Nvidia’s dominance with its own AI GPU offering by 2024.

Recently, Intel introduced its Gaudi 3 AI GPUs, which surpassed Nvidia’s GPUs by 50% in inference and 40% in power efficiency. This move positions Intel to potentially benefit from the robust growth trajectory of the AI market, making its stock an intriguing prospect for investors.

Why Intel Stands Out as an AI Investment

The Nasdaq-100 Technology Sector index has soared roughly 40% in the past year, largely propelled by AI excitement. However, the market’s anticipated expansion suggests it may not be too late to invest.

Chip stocks remain among the prime pathways for AI investments, given their pivotal role in enabling generative technologies like AI.

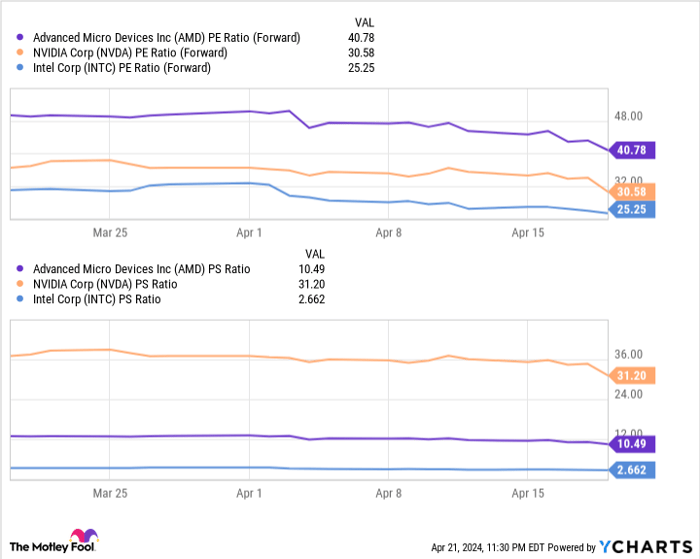

This chart illustrates that Intel could be one of the most attractively valued AI-focused chip stocks, boasting considerably lower forward price-to-earnings and price-to-sales ratios compared to competitors such as Nvidia and AMD.

With its transition to a digital foundry model and deepening involvement in AI, Intel presents itself as an option worth considering before missing out on the opportunity.

Is Now the Time to Invest in Intel?

Prior to diving into Intel’s stock, weigh this perspective:

The Motley Fool Stock Advisor team recently highlighted what they deem as the 10 best stocks for investors at present, with Intel not making the list. These identified stocks are anticipated to yield significant returns in the foreseeable future.

Stock Advisor equips investors with a straightforward roadmap to success, offering insights on portfolio construction, regular analyst updates, and bimonthly stock picks. Since 2002, this service has outperformed the S&P 500 by over threefold*.

*Stock Advisor returns as of April 22, 2024