Embracing a New Investment Strategy

After years of dedicating the majority of my investment portfolio to individual stocks, a recent move has shaken up my approach. Approximately 12% of my wealth is now parked in an exchange-traded fund (ETF); a departure from my traditional stance.

This shift signals a pivot towards a different avenue of financial exploration. The ETF I’ve embraced exposes me to a market segment that was previously absent in my investment repertoire. Diving into the ETF world has illuminated a previously overlooked opportunity for long-term investors amidst the current market landscape.

The Rationale Behind the Change

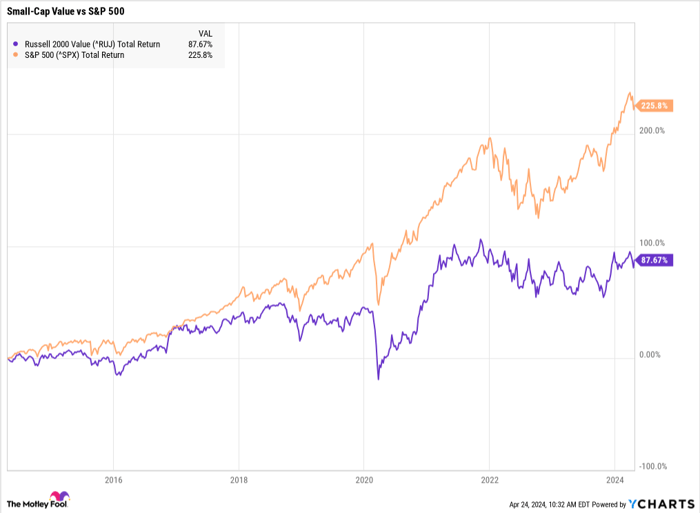

Shifting gears towards an ETF was not a decision made in haste. Small-cap stocks, especially value stocks, have weathered a challenging decade. The underperformance of small-cap value stocks, evident in the Russell 2000 Value Index over the last ten years, paints a stark picture.

This decade-long struggle has resulted in a glaring valuation gap between small-cap and large-cap stocks, with small-caps trading significantly below their historical average forward P/E ratio. This anomaly, coupled with notable trends favoring small-cap value stocks over the long haul, signals a compelling buying opportunity for investors.

Furthermore, recent developments, including the Federal Reserve’s policy maneuvers to address inflation, have heightened the risk premium for small companies. This shift poses challenges in the short term but opens doors to attractive returns for long-term investors with a keen eye on market dynamics.

The Appeal of the ETF Route

While extensive research and analysis are par for the course when dealing with individual stocks, venturing into the realm of small-cap stocks presents a different set of challenges. The lack of information accessibility and scarcity of analyst coverage make it a less trodden path for many investors.

Embracing an ETF that offers diversified exposure to small-cap value stocks emerges as a more digestible option. Simplifying the investment process and delegating the task of stock selection to the fund manager for a nominal fee are compelling reasons for this strategic shift.

The Chosen Path: Avantis U.S. Small Cap Value ETF

The Avantis U.S. Small Cap Value ETF, though technically an actively managed fund, employs a passive strategy in stock selection. By leveraging current valuations to overweight stocks with higher expected returns, the ETF maneuvers through the market with precision.

This fund’s meticulous methodology, focusing on profitability metrics and maintaining a diverse portfolio of 765 holdings with no single entity dominating more than 1% of the total, aligns with my investment philosophy. The 0.25% expense ratio, while a minor consideration, pales in comparison to the potential outperformance this ETF promises in the realm of less efficiently traded small-cap stocks.

Moreover, the Avantis U.S. Small Cap Value ETF offers substantial exposure to the small-cap value segment, outstripping many comparable alternatives. With a strategic allocation of 58% of assets to small-cap value stocks, this ETF stands out in a crowded market.

Unleashing the Potential of American Century ETF Trust – Avantis U.S. Small Cap Value ETF

In the world of investing, navigating the tumultuous waters of the stock market can often feel like charting a course through a storm. However, amidst the choppy seas, one particular vessel has caught the eye of many savvy investors – the American Century ETF Trust – Avantis U.S. Small Cap Value ETF.

Setting Sail Towards Success

The American Century ETF Trust – Avantis U.S. Small Cap Value ETF has emerged as a beacon of hope for those seeking exposure to the small-cap value segment of the market. With its innovative selection criteria and robust performance, this ETF has quickly gained traction among investors looking to outperform the market.

Weathering the Storm of Fees

While some may be deterred by the slightly higher fees associated with the Avantis ETF compared to other pure small-cap value index funds, many see it as a price worth paying for the enhanced exposure and potential for superior returns that Avantis offers.

Should You Hoist Your Sails?

Before you decide to embark on a journey with the American Century ETF Trust – Avantis U.S. Small Cap Value ETF, it’s vital to weigh your options carefully. While it may not have made the cut for the recent Motley Fool Stock Advisor list of 10 best stocks to buy now, this ETF has a track record of sailing its own course to success.

*Stock Advisor returns as of April 22, 2024