The stock market, a tumultuous frontier shaped by the whims of fate and fortune. In this quest, CNBC’s Jim Cramer christened them the “Magnificent Seven” — Microsoft, Apple, Nvidia, Amazon, Alphabet, Tesla, and Meta Platforms — emblematic titans in the digital expanse of modern finance.

In the shadows of 2023’s indomitable spirit, these stocks continued to thrive, with some venturing to seize fresh spoils in 2024. Amid this profusion, my gaze alights upon one jewel among the stars: Amazon.

The Metamorphosis of Amazon’s Business Landscape

Amazon, not a mere merchant but a maestro orchestrating the symphony of e-commerce, transcending boundaries to redefine itself. While its roots linger in commerce, its branches embrace the ethereal realms of services — third-party sellers, advertising, subscriptions, and the illustrious Amazon Web Services.

In the grand theater of revenue, services took the center stage during Q4, pulling in $93 billion, a value eclipsing its commerce arm’s $75.7 billion. The crescendo of growth echoes in these figures, with services like a sonnet of prosperity.

| Segment | Q4 Revenue Growth (YOY) |

|---|---|

| Third-party seller services | 20% |

| Advertising services | 27% |

| Subscription services | 14% |

| AWS | 13% |

Data source: Amazon. YOY = year over year.

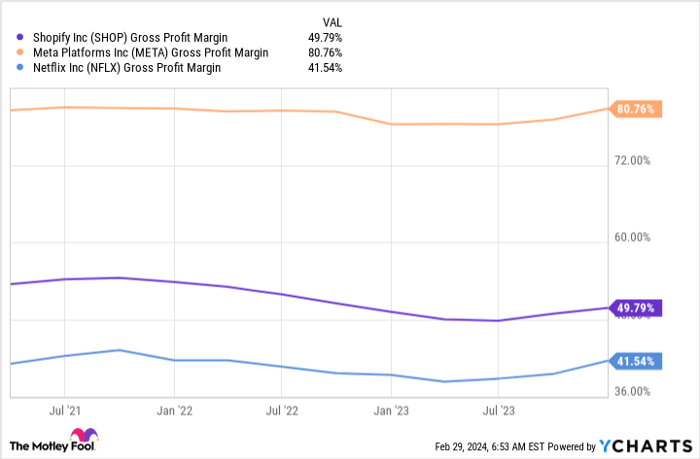

As the symphony crescendos, the harmony of profit margin swells. The whispers of efficiency, sung by services, entwine with Amazon’s soul, augmenting its gross profit. The canvas of margin growth unfurls, painting a new picture of profitability.

In the annals of commerce, amidst the clamor of demand that heralded 2018’s splendor, stood Amazon. A beacon in the tempest, a paragon of operational prowess. CEO Andy Jassy’s words echo, a promise of exceeding former grandeur in 2024 or its time-worn companion, 2025.

Driven by increasing efficiency, the path Amazon blazes promises a golden future, ripe with the fruits of prosperity for investors and stockholders alike.

Amazon’s Balance in Valuation: A Delicate Equilibrium

Valuation, the yardstick against which stocks are measured, revealing the truth behind the veil of potential. Amazon’s journey, paved with promises of profitability, finds solace in the cradle of price-to-sales (P/S) ratio.

Peer into the P/S realms, witness Amazon’s value. Behold its canvas, brushed with hues of past valuations, shades of a bygone era of promise. Positioned below its historical apex, Amazon’s trajectory appears undulating, a wave yet to crest.

Amazon, not a bed of golden roses, but a garden of equitable valuation. A realm where the discerning investor finds solace, a harbor amid the tempest of market speculation.

Efficiency, the herald of success, the guardian of Amazon’s ascent. In this exquisite dance of growth and balance, Amazon emerges victorious, a phoenix reborn from the embers of commerce.

Should one embark on this journey, tread lightly upon the path, for Amazon’s promise is vast, its horizon unbounded by the shackles of convention.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors.