Seventeen years have passed since the historic announcement of the first iPhone by Apple (NASDAQ: AAPL) on Jan. 9, 2007, marking the birth of the smartphone industry. Since that pivotal event, Apple stock has been a stellar investment, delivering a remarkable total return of 7,390% over the last 17 years, compounding at a staggering 28.7% annually. To put this into perspective, an initial investment of $15,000 in January 2007 would now be valued at a staggering $1.1 million.

As an investor, you might wonder if Apple continues to be a wise choice for investment in today’s market.

Apple’s Legacy of Innovation

Apple’s legacy as a consistent innovator dates back to its founding by Steve Jobs and Steve Wozniak in 1976, with the debut of the Apple I computer. The introduction of the Apple II in 1977 positioned the company as an early leader in personal computers. Following a highly anticipated initial public offering in 1980 which raised $100 million, Apple hurdled into the Fortune 500 by 1983.

Subsequently, a less upbeat chapter ensued, marked by Jobs’ departure in 1985 and Apple’s struggle to keep pace with competitors, leading to a gradual decline in its financial performance. Near the brink of bankruptcy, Jobs’ return as CEO in 1997 sparked a resurgence in innovation. From the launch of the first iMac in 1998 to the iconic iPhone in 2007, Apple has continually introduced cutting-edge products, solidifying its position as a premier consumer electronics brand.

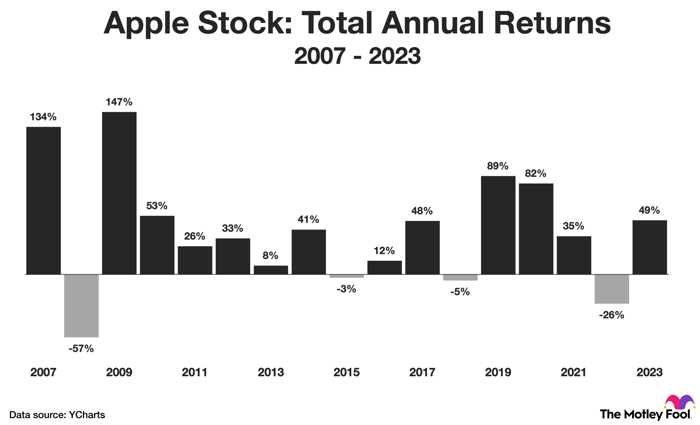

Shareholders have immensely benefited from Apple’s innovative prowess, as evidenced by the annual stock returns since the advent of the iPhone in 2007, assuming reinvestment of all dividends, as illustrated in the chart below.

Chart by author. Shown above is the total annual return for Apple stock in each year since the iPhone was announced in 2007.

Apple’s Dominance in Consumer Electronics and the Importance of Services for Future Growth

Apple’s substantial brand authority, rooted in its capacity for innovation, is enhanced by its proprietary software, particularly the closed-source iOS operating system. This gives Apple complete control over the iPhone experience, creating a significant barrier for third-party manufacturers to replicate the Apple ecosystem, and consumers willingly pay a premium for this experience.

Relying on its brand authority and proprietary software, Apple commands substantial pricing power, evident in the fact that the average iPhone costs nearly four times more than the average Android phone. However, the company must expand its services business for sustainable growth in the stock value.

While excelling across various consumer electronics verticals, with a massive installed base of over 2 billion active devices, Apple’s focus on monetizing users through adjacent services like App Store downloads, iCloud storage, and subscription products like Apple Music and Apple TV+ is crucial. The company’s dominance in the mobile application market and its exponential growth in advertising and Apple Pay underscore the significance of these services.

According to analyst Lisa Ellis from MoffettNathanson, Apple has positioned itself as the leading big tech player in payments, with Apple Pay holding a commanding market share among U.S. consumers. This underscores the growth potential for Apple’s services business.

Assessing Apple’s Stock Valuation

In fiscal 2023, Apple reported a 3% decline in total revenue to $383.3 billion, with sales decreasing across every segment except services due to high inflation impacting consumer spending. Despite the revenue decline, the company’s stock repurchases mitigated the top-line weakness, resulting in nearly flat GAAP net income at $6.13 per diluted share.

The chart below illustrates the revenue and revenue growth across all five business segments for fiscal 2023, ending on Sept. 30, 2023.

Chart by author. Shown above is the revenue across all five Apple business segments in fiscal 2023, which ended on Sept. 30, 2023.

Looking ahead, Wall Street projects Apple to achieve an 8.6% annual growth in earnings per share over the next five years. However, the current PE ratio of 31.3 times earnings, compared to the five-year average of 26.5 times earnings, implies that Apple stock is relatively expensive. While Apple is undeniably an outstanding business, its current valuation may not yield market-beating returns. For now, potential investors might want to wait for a more opportune entry point before committing.

The Truth About Investing in Apple Stock: What Famous Investor Warren Buffett Might Not Tell You

Reconsidering Investing in Apple Stock

Perhaps you’ve been contemplating the merits of investing in Apple stock, but take a moment to consider the viewpoint of prominent investor Warren Buffett.

Reassess Apple Stock Investment

Before you make any moves to purchase Apple stock, it’s important to take into account the perspective of the Motley Fool Stock Advisor analyst team.

The Wisdom of the Analyst Team

The Motley Fool Stock Advisor analyst team has meticulously identified what they consider to be the 10 best stocks for investors right now, and interestingly, Apple did not make the cut. The selected 10 stocks are touted to have the potential to yield substantial returns in the foreseeable future.

Benefits of the Stock Advisor Service

Remarkably, the Stock Advisor service provides investors with a straightforward roadmap for prosperity, featuring essential counsel on constructing a diversified portfolio, routine updates from experts, and two fresh stock recommendations per month. Notably, the Stock Advisor service has outperformed the S&P 500 by more than threefold since 2002*.

Perhaps it’s worth exploring these 10 stock picks that were handpicked with precision.

*Stock Advisor returns as of January 29, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Trevor Jennewine holds no positions in the stocks mentioned. The Motley Fool has stakes in and endorses Alphabet, Apple, and Microsoft. Furthermore, The Motley Fool recommends International Business Machines. The Motley Fool adheres to a disclosure policy.