If you’ve got $1,000 left over from holiday spending and you’re interested in buying some high-yield dividend stocks, Ford Motor Company (NYSE: F) has a unique blend of value and dividend yield that might interest you.

Not only does the venerable automaker trade at a cheap price-to-earnings ratio of 7, but it also offers a dividend yield over 5% and has solid upside potential in the coming couple of years as it turns its cash-burning electric vehicle (EV) business into a profitable operation.

A Bright Future

While the automotive industry is poised to evolve more in the coming two decades than in the past century, thanks to a transition to EVs and potential groundbreaking technology for driverless vehicles, the truth is these are expensive undertakings. Ford is navigating this automotive metamorphosis adeptly. The company’s steadfast decision not to expend capital on driverless vehicles seems wise, especially as rival General Motors has struggled with losses and revenue aspirations tied to similar ventures.

By focusing on improving Level 2 and 3 driverless systems, Ford is positioning itself to enhance its vehicle offerings, thus potentially eradicating a significant profit drain compared to its biggest rival. This strategic shift is seen as a promising step in Ford’s evolution.

Strategic Turnaround

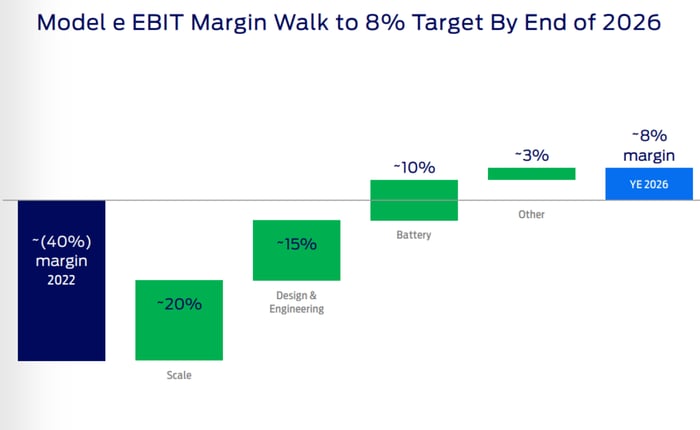

Another positive aspect for Ford’s upside is the turnaround in its Model e business unit. Ford currently estimates its Model e, which comprises all of its EV products, will lose roughly $4.5 billion in 2023 alone. However, the company expects a shift to profitability by the end of 2026 through improved scale, design, and other factors.

Image source: Ford Motor Company.

With record fourth-quarter EV sales and dominant performance in the U.S. EV market, Ford is proving its prowess. The surge in F-150 Lightning sales is indicative of the company’s potential to leverage its stronghold in the conventional truck segment into the EV truck segment, ensuring continued profitability.

Dividend Delight

One compelling reason to consider investing $1,000 in Ford is its consistent dividend distribution. The company not only has a history of rewarding investors with supplemental and special dividends but also offers a conservative total return strategy fueled by its healthy and dependable dividend.

In conclusion, Ford’s near-term potential is promising as its EV business transitions from burning cash to generating profits. The company’s decision to halt expensive driverless vehicle development, coupled with its robust 5% dividend yield, signifies a sound investment opportunity for individuals with an eye for long-term gains.

Before taking the plunge with Ford Motor Company, it’s crucial to weigh the options carefully. While Ford has immense potential, it’s worth considering other stocks that may offer even more substantial returns in the years to come.

Stock Advisor, with its celebrated track record of offering invaluable guidance to investors, could help navigate the landscape. The service’s history of financial success, including regular updates and strategic stock picks, serves as a testament to its expertise in maximizing returns for investors.

Are you in for a ride with Ford or do you seek greener pastures?