Tackling the Transcripts: A Peek into Halliburton’s Q2 Earnings Call

- Insights from the Prepared Remarks

- In-depth Examination of Questions and Answers

- Key Players on the Call

A Prelude to Potential: The Prepared Remarks Unveiled

Kicking off the session with an air of anticipation, the operator set the stage for investors. David Coleman, the seasoned navigator of investor relations, steered the ship, introducing the stellar cast of the day: Jeff Miller, the captain of the ship doubling as Chairman, President, and CEO; and Eric Carre, the money maestro holding the reins as the Executive Vice President and CFO. The disclaimer dance ensued, cautioning listeners about the perils of forward-looking statements and the tempestuous sea of uncertainties.

Exploring the Investment Waters: An Engaging Invitation

A glint of temptation shimmered through the screen, inviting prospective investors to dive headfirst into the world of Halliburton. The Motley Fool’s tantalizing whisper of the allure of stocks danced in the background, painting a portrait of untold riches. Drawing parallels to Nvidia’s historical ascent, the siren call of Stock Advisor teased the wonders of Halliburton’s potential for those daring enough to wager.

The Strategic Symphony: Jeff Miller’s Overture

With a hint of pride in his voice, Jeffrey Allen Miller took center stage, orchestrating Halliburton’s performance review for Q2 2024. Painting a picture of resilience and prowess, Miller extolled the virtues of Halliburton’s international fortitude and the unique charm of its North American services. Amidst the financial crescendo, the figures spoke of a company navigating choppy waters with finesse. Revenue melodies of $5.8 billion rang through the call, accompanied by an operating margin hitting 18%.

The international markets stood tall, a bastion of growth with revenue soaring by 8% year over year. Highlighting the Latin American surge, Halliburton’s triumph in the global arena was undeniable. North America may have faced a dip, but the tale of margin improvement whispered promises of a brighter tomorrow. The cash flow anthem sang sweetly, resonating with $1.1 billion from operations and $800 million in free cash flow, a song that ended with a $250 million repurchased stock flourish.

Overseas Oasis: Navigating Halliburton’s International Seas

A narrative of uninterrupted growth unfolded as Miller laid bare the success story of Halliburton’s international endeavors. With a resolute gaze toward the horizon, the promise of a steady course steered by profitable growth was proclaimed. International markets basked in the glow of strong demand, high activity levels, and a scarcity of equipment across the major basins. A visionary outlook foretold a majestic revenue growth of about 10% for the year.

Amidst the symphony of success, three key product lines shone brightly. The Landmark Software business, a beacon of innovation, dazzled with its arsenal of tools driving efficiencies and transformation. Artificial lift products hugged the spotlight, expanding their footprint across the international stage. Meanwhile, Halliburton’s Digital and Consulting Solutions carved a niche for itself, setting the stage for an exhilarating future.

Halliburton’s Strategic Growth and Market Outlook

A Closer Look at Strategic Initiatives

Halliburton’s international business has been flourishing at double the rate of its overall global operations. The company’s strategy of integrating bolt-on acquisitions to infuse cutting-edge technology into its portfolio has been a resounding success. Not only does Halliburton grow organically through global presence, but also collaborates closely with customers to engineer solutions that optimize the value of their assets.

New Technologies Driving Growth

Illustrating their innovative prowess is the recent launch of the GeoESP line, tailored for the challenging geothermal environment. This advanced line tackles thermal cycling, scale development, abrasion, and corrosion, catering to a worldwide market. However, Halliburton foresees significant growth potential particularly in Europe, where sophisticated technology is in demand to propel geothermal ventures to a large scale. The company’s drilling services play a pivotal role in its international market success.

Strong Performance in Unconventional Drilling

Another highlight from the recent quarter is Halliburton’s exceptional performance in unconventional drilling, driven by the iCruise X rotary steerable system and the LOGIX autonomous drilling platform. Noteworthy advancements in drilling speed and reliability set new records during this period. By investing in unique drilling technologies, Halliburton anticipates surpassing market growth levels. For instance, its drilling services revenue in the Middle East surged by about 30% year over year.

Anticipated Decline in North America Revenues

Despite the international success, North American revenues experienced a 3% decline in the second quarter. Halliburton forecasts a further decline of 6% to 8% in full-year revenues compared to the previous year, primarily due to reduced activity levels. Expectations for the latter half of 2024 are modestly low, with a hopeful projection of increased activity in 2025.

Future Strategy and Market Insights

The company anticipates enhanced activity post-acquisitions by E&P companies, asset divestments, and a rebound in natural gas operations. Halliburton’s focus remains on delivering value to shareholders through prioritizing returns, retiring underperforming assets, and leveraging differentiated technologies tailored for the North American market. The strategic investment in technologies like Octiv and iCruise signifies the company’s commitment to driving efficiency and performance.

Financial Highlights and Global Market Performance

In terms of financial performance, Halliburton reported a net income per diluted share of $0.80 for Q2. Total revenue for the quarter amounted to $5.8 billion, with an operating margin of 18%. While the company witnessed a flat sequential revenue quarter, its operational income saw a 5% increase. Notably, the international segment showed a 3% sequential revenue growth, with regions like Europe/Africa and Middle East Asia outperforming.

Ultimately, Halliburton’s strategic acumen, technological innovation, and market insights position the company favorably for sustained growth and profitability. As the industry landscape evolves, Halliburton’s adaptability and focus on excellence continue to set it apart as a leader in the oilfield services sector.

Analyzing Financial Performance and Strategic Projections

In the intricate landscape of financial performance, the well-known declines in Q2 stood as a testament to the intricate dance between various operational facets. Notably, the adverse downturn was primarily fueled by diminished pressure pumping services within the US land and reduced sales of completion tools and testing services in the Gulf of Mexico. As these statistics paint a vivid picture of the market dynamics, it’s time to delve deeper into other critical areas of interest.

Corporate Expenses and Technological Advancements

During Q2, corporate and other expenses amounted to $65 million, setting the tone for the subsequent quarters. Looking ahead to the third quarter of 2024, a slight increase in corporate expenses is on the horizon. Noteworthy advancements were also observed in the SAP deployment process, remaining on budget and scheduled for completion by 2025. The remarkable investment of $29 million during Q2 towards SAP S4 migration underlines the commitment to technological enhancement, embedded within the core results of the operations.

Forecasts and Financial Assessments

Net interest expenses for the quarter tallied at $92 million, paving the way for a flat projection in the net interest expense for the upcoming third quarter of 2024. Amidst the financial intricacies, other net expenses of $20 million in Q2 revealed a favorable scenario driven by beneficial FX movements. As the outlook shifts towards the third quarter, an approximate expense estimation of $35 million is anticipated to unfold. This financial symphony is further accentuated by the effective tax rate dynamics.

Cash Flow Dynamics and Growth Prospects

Capital expenditures during Q2 encapsulated a noteworthy figure of $347 million, setting the stage for subsequent strategic maneuverings. The envisioned capital expenditure for the full year of 2024 is expected to align around 6% of revenue, signaling a prudent financial strategy. The robust cash flow from operations and free cash flow in Q2, amounting to $1.1 billion and $793 million respectively, indicate a reservoir of financial resilience waiting to be harnessed. Furthermore, the strategic stock repurchase of $250 million during the quarter, coupled with the ambitious target of over 10% increase in free cash flow for the year 2024 as compared to 2023, paints a promising growth trajectory ahead.

Strategic Insights and Market Expectations

Transitioning towards visionary projections, the expectations for the third quarter shed light on the intricate dance within the Completion and Production division. The anticipation of a slight sequential revenue decline of 1% to 3% coupled with margins softening by 75 basis points to 125 basis points catalyzes a landscape of strategic recalibration. Conversely, in the Drilling and Evaluation division, a poised increase in sequential revenue by 2% to 4% and a corresponding margin boost by 25 basis points to 75 basis points spark optimism amidst the financial milieu. The strategic fabric binding these anticipations narrates a tale of resilience and adaptability, poised to navigate the complex terrains of the market with finesse.

Strategic Narratives and Operational Foresight

Amidst the unfolding financial narrative, the charismatic voice of Jeffrey Allen Miller, Chairman, President, and Chief Executive Officer, resonates with a tone of unwavering optimism and strategic fortitude. Drawing from the discussion highlights, key takeaways emerge as beacons of strategic insight. Noteworthy mentions of 18% margins and about $800 million of free cash flow in the second quarter set the stage for a compelling growth trajectory. The international business frontier embodies a tale of boundless potential, underlined by the robust technology portfolio. The strategic prowess in maximizing value across North America reverberates with promises of enduring returns, marking a strategic narrative poised for evolution and innovation.

Interrogating Insights: Questions and Responses

Casting a spotlight on the forthcoming discourse, the arena shifts towards an interactive engagement of questions and responses. The narrative unfolds with a meticulous exploration of market dynamics and strategic foresight encapsulated within the fabric of financial dialogues.

Operator

The journey begins with the Operator orchestrating the stage for a cascade of inquiries, navigated with finesse and strategic acumen.

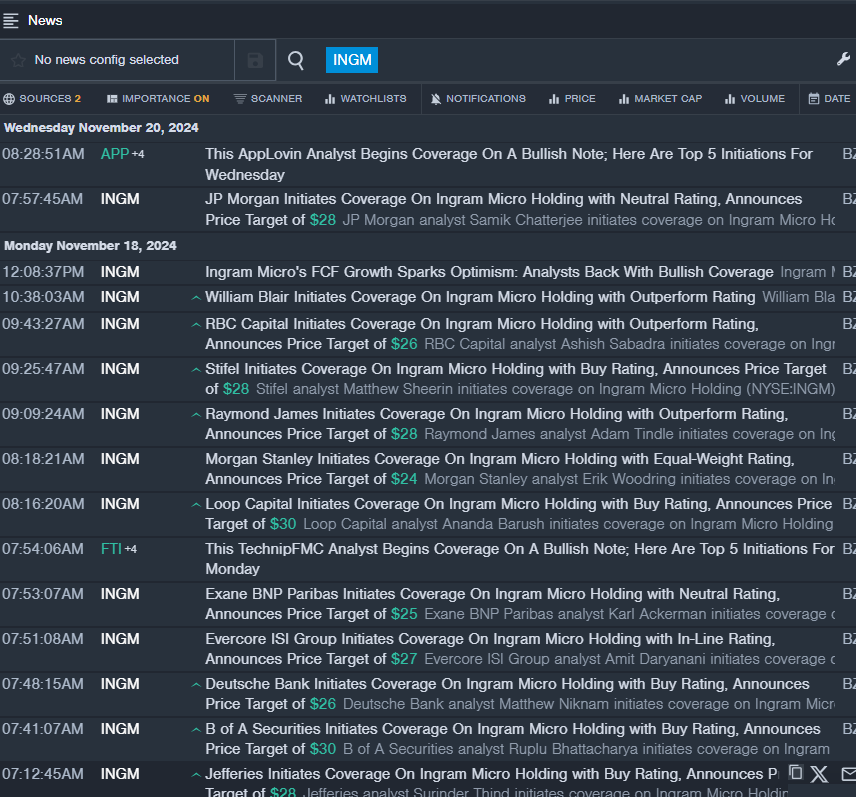

Analyst Insights

Embarking on the exploration of insights, Analyst perspectives initiate a dialogue rich with nuanced interrogations and strategic musings, paving the way for a tapestry of market reflections.

Innovative Strategies and Market Resilience

Amidst the strategic conversations, the quest for innovative strategies and market resilience unfolds as a theme resonating within the core of financial dialogues.

Halliburton’s Prospects Shine Bright as Industry Trends Signal Growth

International Growth Trajectory: A Beacon of Hope

Reflecting on the international front, Halliburton is poised for a promising journey ahead in 2025. As global projects gain momentum and activity burgeons, regions like the Middle East exhibit early signs of acceleration. It’s a testament to the unwavering spirit and potential, particularly in areas where National Oil Companies (NOCs) steer operations. Negotiations with International Oil Companies (IOCs) may pose challenges, but the groundwork for substantial progress is laid. The recent strides in Europe, Africa, Latin America all hint at a bright outlook, driving Halliburton’s confidence to new heights.

Navigating North America: Dynamics of Recovery

In the realm of North America, the quest for the bottom in activity lingers, yet a sense of anticipation pervades the atmosphere. With a strategic focus on revamping capacity and structural positioning, Halliburton foresees a resurgence in activity. The transition to new equipment amidst retiring fleets ushers in a phase of recalibration. The resilience of North American entrepreneurs, coupled with potential upticks in the gas sector, serves as the backbone for a gradual upturn. The landscape hints at possibilities of firming up with calculated moves and an optimistic outlook.

Unlocking Value: Capital Returns and Operational Efficiency

The robust performance in free cash flow for Halliburton has been a highlight, accompanied by a consistent commitment to returning capital to shareholders. Amidst discussions around working capital dynamics, a forward-looking approach to enhancing operational efficiency remains paramount. The strategic buybacks and focus on sustaining cash returns underscore a steady financial trajectory for the company’s stakeholders.

Technological Evolution: iCruise Innovations

Embracing innovation, Halliburton’s iCruise technology heralds a new era of advancements. The seamless integration and adoption, not only on the international front but also gaining traction in the US markets, underscore the technology’s prowess. The multi-faceted approach to market penetration reflects surging demand, reliability, and exceptional performance. The glowing feedback from customers resonates with the technology’s gold standard, positioning Halliburton for further successes in the evolving landscape.

Halliburton’s Strategic Outlook: A Glimpse into Expansion Plans

As Halliburton’s Chairman, President, and CEO, Jeffrey Allen Miller, addresses analysts with a certain swagger, a clear vision for the future emerges. This isn’t just about North America being a cash cow; it’s about a calculated bet on expansion and innovation.

Steady Growth in North America

Despite the allure of North American operations, Miller doesn’t rest on his laurels. He confidently talks about a runway for drilling that goes beyond geographical boundaries, built on years of strategic investments – a roadmap that seems to have finally reached fruition today.

International Prospects and Evolution

When queried about the performance internationally, the tone is hopeful yet grounded. Miller speaks of a deliberate move towards profitable growth, underpinned by a buoyant international market.

Addressing the topic of unconventional international opportunities, Miller’s discourse unveils a paradigm shift. He delves into the significance of key markets like Saudi Arabia and Argentina, highlighting a renewed focus on leveraging proven models and meticulous planning over hasty operations.

Margins, Technology, and Innovation

Transitioning to margin expansion, Eric Carre, the Executive Vice President, and CFO, dives into the nuances. The discussion provides insights into the trajectory of margins, with a keen eye on progression and adoption of cutting-edge technologies.

Miller jumps in, painting a vivid picture of structural improvements driving margins, especially within the drilling business. The rollout of game-changing technologies like iCruise and iStar promises not just efficiency gains but a holistic elevation of performance metrics.

Exploring Production Chemicals

The conversation flows seamlessly into production chemicals, an integral segment of Halliburton’s diverse portfolio. Miller’s perspectives shed light on the strategic positioning of this business, underscoring a commitment to comprehensive growth and expansion.

The narrative offered during the analyst call isn’t just a snapshot of financial performance; it’s a glimpse into Halliburton’s strategic compass – one that points towards calculated risk-taking, innovation, and a relentless pursuit of growth.

The Future of Halliburton’s E-Frac Technology

Steady Growth Amidst Economic Uncertainties

While the economic landscape may be unpredictable, Halliburton’s E-Frac technology stands as a beacon of promising growth. The company’s consistent focus on profitability and returns has cultivated a pace of plant development in Saudi Arabia that is nothing short of impressive.

Revolutionizing the Oil Industry With Innovation

Mastering the intricate world of chemicals, Halliburton continues to push boundaries with its groundbreaking E-Frac technology. This technology has paved the way for a new era in the oil industry’s operational efficiency and performance measurement.

Unveiling the Potential of E-Fleets

Under the astute leadership of Jeffrey Allen Miller, Halliburton’s Chairman, President, and Chief Executive Officer, the company’s E-Fleet capabilities have seen remarkable growth. The introduction of groundbreaking software such as Octiv and AutoFrac has set the stage for unprecedented customer penetration and operational efficiency.

Unfolding a Path of Success

Miller’s strategic vision for Halliburton’s E-Frac technology is nothing short of visionary. With expectations to exceed the 40% milestone this year and reach 50% next year, Halliburton is poised for further expansion.

Innovation Driving Revenue Enhancement

Driven by a commitment to innovation, Halliburton’s North America revenue has consistently outperformed the rig count. This success can be attributed to the company’s strategic investments in cutting-edge technology that sets them apart in the market.

Looking Ahead with Confidence

Despite uncertainties in the economic climate, Halliburton remains steadfast in its commitment to growth and innovation. With a keen focus on maximizing value in North America, the company is well-positioned to navigate future challenges.

Steadfast Confidence in Halliburton’s Financial Resilience

Amidst Uncertainties, Halliburton Maintains Resolute Stance

Through the opaque realm of financial forecasts, Halliburton stands tall. During the recent quarterly call, uncertainties loomed, yet the company exuded unwavering confidence.

Stability in the Face of Potential Risks

Addressing concerns over contracts and revenue, Halliburton remained firm. With a commitment to long-term customer partnerships, they assured continuity in the face of risks.

Confident Projections for the Future

Looking ahead, Halliburton painted a vivid picture of future growth. Projecting higher margins and increased cash flow, the company showcased a strategic roadmap toward sustained success.

Insights into Margin Mechanics

Delving into the intricacies of margin reductions, Halliburton disclosed the nuanced factors at play. Acknowledging diverse elements influencing margins, the company demystified the financial landscape.

Embracing Financial Triumphs as Testimony

As the call drew to a close, Halliburton celebrated its achievements. With resounding margins and robust cash flow, the company reaffirmed its prowess in the financial arena.