Stellar Earnings, Yet Sales Fall Short

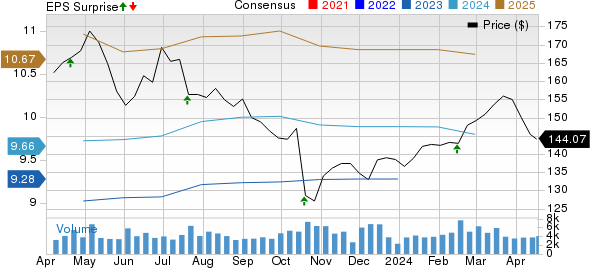

In a whirlwind of financial ups and downs, Genuine Parts Company (GPC) astonished investors by delivering

first-quarter 2024 adjusted earnings of $2.22 per share, a remarkable 3.74% increase from the previous year.

While this surpassed the Zacks Consensus Estimate, with earnings beating expectations, the same cannot be

said for sales. GPC reported net sales of $5.78 billion, a mere 0.32% rise from the previous year, but

falling short of the anticipated $5.84 billion.

Segmental Showdown

The Automotive segment of GPC witnessed a surge in net sales, reaching $3.6 billion in the first quarter of

the year, showcasing a significant growth of 1.9% compared to the previous year. This increase was driven

by both comparable sales growth and acquisition benefits. On the flip side, the Industrial Parts segment

witnessed a decline of 2.2% in net sales, amounting to $2.2 billion, attributed to a drop in comparative

sales and unfavorable forex translations.

Insight into Financial Health

As of March 31, 2024, Genuine Parts had cash and cash equivalents totaling $1.05 billion, a decrease from the

previous quarter. The long-term debt also saw a significant decline. The company ended the first quarter

with total liquidity of $2.5 billion, including cash and cash equivalents. The company generated free cash

flow of $203 million during the quarter.

Looking Ahead: 2024 Guidance

Genuine Parts remains cautiously optimistic about its future performance, expecting growth in revenues from

automotive and industrial sales to fluctuate positively. Overall sales growth is projected to be between

3-5%, with adjusted earnings expected to reach $9.80-$9.95 per share. Operating cash flow and free cash flow

are also guided within specific ranges for the year.

Final Thoughts on GPC

As investors navigate through the financial landscape, Genuine Parts Company (GPC) emerges as a promising

entity despite minor setbacks. With an eye on its future projections and strategic growth measures, the

company aims to leverage its strengths and overcome current challenges to deliver value to its

stakeholders.