The Rise of Mistral

Microsoft’s recent multiyear partnership with French AI start-up Mistral marks a significant move in the realm of artificial intelligence. Founded in April 2023, Mistral has rapidly emerged as a key player in generative AI, akin to Microsoft-backed OpenAI. The company specializes in large language models (LLMs) capable of producing human-like prose and code swiftly.

Mistral’s foresight in making their models open source sets them apart from competitors, such as OpenAI, which adopt a more restrictive approach. This openness allows developers and businesses to contribute to Mistral’s progress, fostering a collaborative and innovative environment.

Despite being a relatively young company, Mistral garnered substantial attention and acclaim at Davos, with leading tech executives hailing its AI models as top-tier products in the industry.

Strategic Partnerships and Investments

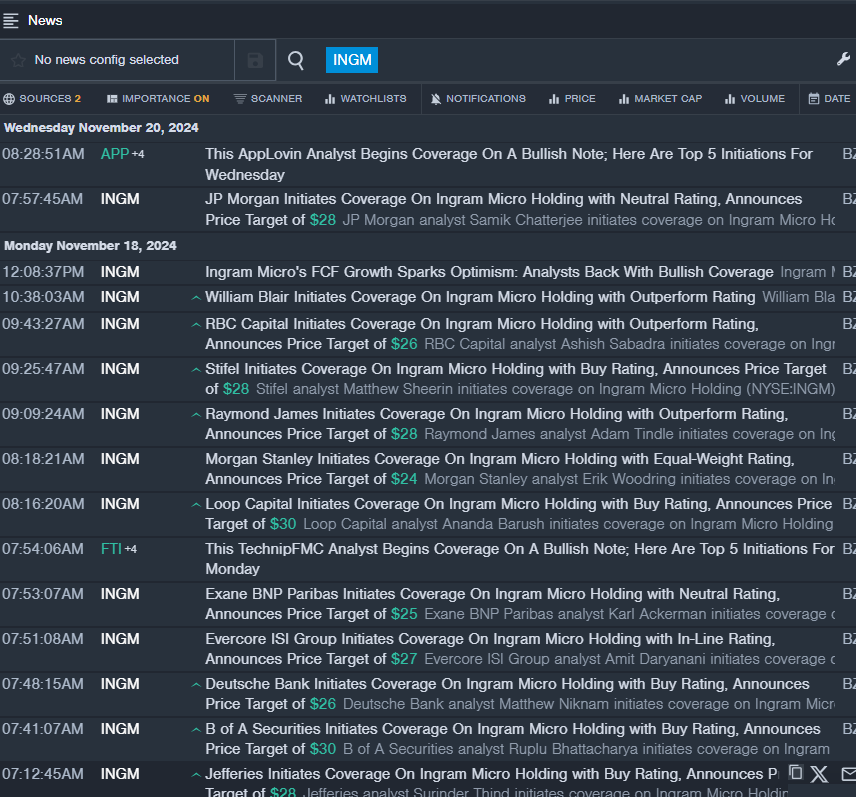

Microsoft’s investment in Mistral signals a strategic diversification of its AI portfolio, moving beyond the substantial backing of OpenAI. This latest move not only strengthens Microsoft’s position in the AI landscape but also expands Mistral’s reach.

The partnership between Microsoft and Mistral extends to a research and development collaboration focused on delivering AI applications across European governments. The investment from Microsoft, along with the support from tech giants like Nvidia and Salesforce, underscores the industry’s confidence in Mistral’s potential.

By aligning with Nvidia, Mistral gains access to cutting-edge innovations, propelling its technological advancements and market competitiveness.

Financial Implications and Recommendations

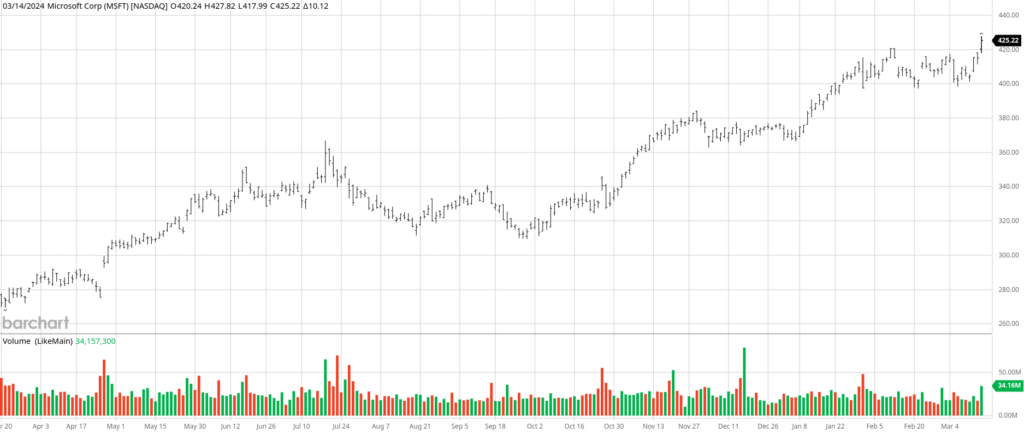

Microsoft’s foray into AI is already yielding positive results, as evidenced by the company’s recent financial performance that surpassed market expectations. The incorporation of new AI features has notably boosted Azure cloud service sales, positioning Microsoft as a formidable player in the AI-driven market.

Investors eyeing Microsoft stock can find promise in the company’s diverse revenue streams, particularly its cloud-based services, contributing significantly to its overall sales. With a robust portfolio that includes cloud services like Office, Dynamics, Teams, and Azure, Microsoft stands out as a solid investment option.

As Microsoft continues to capitalize on AI advancements and cloud technologies, the company remains resilient amid market fluctuations. Its strong financial standing, coupled with strategic investments, underscores Microsoft’s long-term growth potential and appeal to investors seeking stability.