Tech stocks soared last year, with growing enthusiasm for industries like artificial intelligence (AI) and cloud computing propelling the Nasdaq-100 Technology Sector index to a 67% rise throughout 2023. This impressive surge marked a dramatic turnaround from the preceding year’s 40% plunge. The market’s unrelenting pace suggests that 2024 is a prime opportunity to fortify one’s foothold in the tech sector.

While Nvidia basked in last year’s success by claiming a substantial market share in AI chips and experiencing a staggering 224% year-over-year stock increase, there are other tech stocks primed to deliver greater value than the chipmaker.

1. Microsoft: A Goliath in the Tech World

Microsoft (NASDAQ: MSFT) made headlines by dethroning Apple as the world’s most valuable company, boasting a market capitalization approaching $2.9 trillion. The tech giant’s sprawling empire spans an array of esteemed brands including Windows, Office, Xbox, LinkedIn, and Azure, each attracting billions of users. These services confer Microsoft with commanding positions in markets such as operating systems, productivity software, digital advertising, cloud computing, AI, and video games.

The meteoric rise of these products boosted Microsoft’s stock by a staggering 280% over the last five years, with annual revenue escalating by 68%. Concurrently, the company’s free cash flow surged to over $63 billion in 2023, furnishing ample financial resources for extensive research and development investments.

It is hardly surprising then, that Microsoft channeled billions into AI over the past year, securing a hefty 49% stake in the ChatGPT developer, OpenAI. The synergy between OpenAI’s technology and Microsoft’s popular services from Office and Azure portends a multitude of opportunities to monetize its AI offerings.

2. Alphabet: Unveiling the Potential Spark of Brilliance

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) may have been somewhat overshadowed last year by tech titans like Microsoft and Amazon, but the company has been diligently crafting a highly anticipated AI model, Gemini, poised to clinch an edge in the market.

Alphabet has steadily augmented its stock value by 113% since 2019, with revenue and operating income soaring 75% and 108%, respectively.

Its dominance in the digital advertising sphere, commanding a 25% market share, has been instrumental in this success. This commanding market share is underpinned by Alphabet’s colossal user base, cultivated via platforms like YouTube, Google, Android, and Chrome, which provide an abundance of advertising prospects.

This formidable user base is projected to be a significant asset as Alphabet ventures into the realm of AI. With Gemini, Alphabet is positioned to revolutionize the search experience, introduce new AI tools on Google Cloud, optimize advertising efficiency, and enhance tracking of viewing trends on YouTube.

Backed by over $77 billion in free cash flow, the growth potential of Alphabet’s business and stock is hard to ignore.

Realizing the True Value

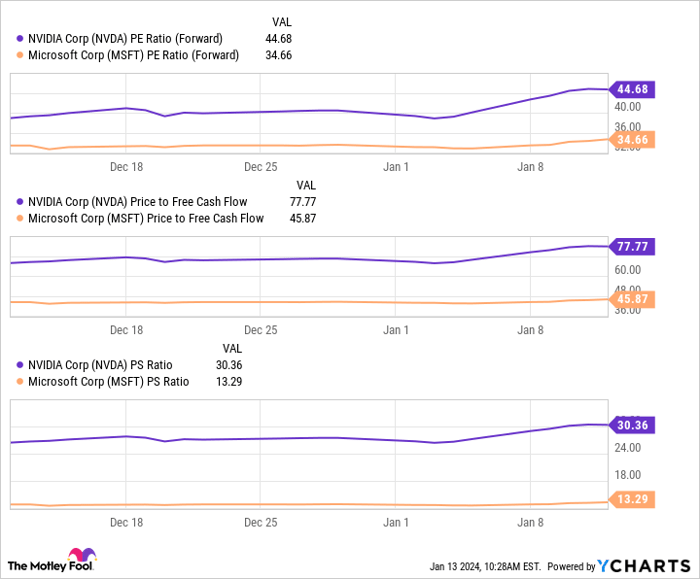

Relative valuation metrics portray a compelling picture. Microsoft’s stock emerges as a far more cost-effective option than Nvidia, with lower figures across key valuation metrics such as forward price-to-earnings (P/E), price-to-free cash flow (P/FCF), and price-to-sales (P/S) ratios. Similarly, Alphabet’s stock offers superior value when juxtaposed with Nvidia’s ardently skyrocketing stock.

“When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.”*

“They just revealed what they believe are the ten best stocks for investors to buy right now… and Microsoft made the list — but there are 9 other stocks you may be overlooking.”

*Stock Advisor returns as of January 8, 2024