- Investors are embracing a bullish trend in US markets with tech giants such as Nvidia fueling record-breaking index levels.

- The recent positive Q1 2024 earnings have played a pivotal role in sustaining this market surge as attention turns towards the critical Q2 earnings season.

- As the Q1 earnings season wind downs, contrasting scenarios emerge for Micron Technology and FedEx Corporation.

US markets are on an upward trajectory, seemingly unaffected by the Federal Reserve’s hawkish stance. The focus now shifts to the crucial Q2 earnings reports that will determine the market’s future momentum.

While uncertainty looms, all eyes are eagerly awaiting the upcoming earnings season as it sheds light on whether the current bullish trend has the strength to prevail.

As the Q1 2024 earnings season draws to a close, Micron Technology and FedEx Corporation stand in stark contrast to each other.

Let’s delve into each company’s situation to discern the best investment path.

Micron’s Stock Valuation and Potential Risks

Micron operates in the AI sector, specializing in memory chip manufacturing. The company has witnessed substantial growth due to the demand surge in the AI field.

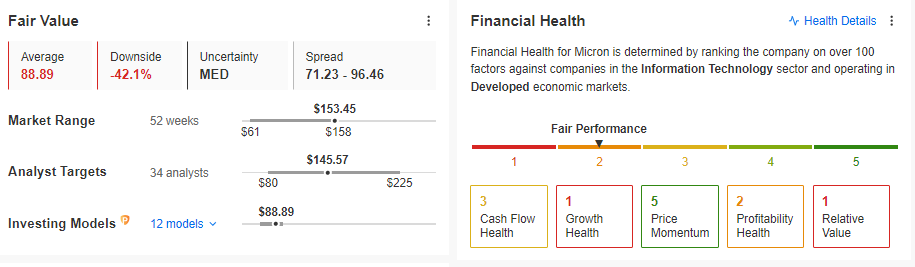

Despite this, fundamental analysis indicates possible overvaluation by over 40% and a concerning financial health outlook.

Moreover, Micron’s heavy reliance on the Chinese market, representing 25% of total sales, raises red flags amidst escalating geopolitical tensions. Volatile demand and high fixed costs pose further threats to the company’s long-term earnings stability.

FedEx: Anticipating Earnings Performance

FedEx experienced a correction phase since early April, transitioning into a consolidation phase in June. Investors are eagerly awaiting the upcoming earnings release, hoping for a turnaround in the stock’s performance.

Analysts note a higher number of downward revisions compared to upward revisions, signaling a potential buying opportunity if FedEx exceeds market expectations.

From a technical viewpoint, a breakout in the $235-245 per share range could spark renewed investor interest, with a possible target price around $260 per share.

Market participants eagerly await positive indicators that could push FedEx’s stock price upwards.