Elon Musk, the enigmatic CEO of Tesla, has once again captured headlines with his recent meeting with Chinese regulators.

While many may not fully grasp the significance, Tesla has a robust presence in China, a critical market for the company’s expansion.

This strategic move carries the potential to unlock a wealth of opportunities, particularly in the realm of self-driving vehicles.

The Significance of China for Tesla

China stands as the largest electric vehicle (EV) market globally, housing leading manufacturers such as BYD, Nio, and Li Auto.

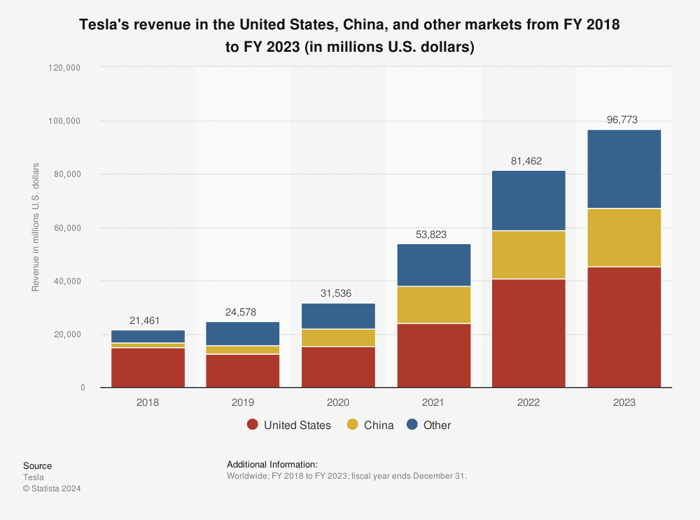

Tesla has established a substantial business in China, with revenues reaching a staggering $21.7 billion last year, as shown in the chart below.

Image Source: Statista

Against a backdrop of slowing EV demand, Musk shifts his focus to new avenues of growth, namely, Tesla’s full self-driving (FSD) software. With over 1.3 billion miles of driver data collected, Tesla holds a substantial edge and aims to globalize FSD.

During his recent interactions, Musk engaged with Premier Li Qiang and his team to outline a strategy for FSD’s launch in China.

Reports suggest a collaboration with Chinese tech giant Baidu, where Tesla will leverage Baidu’s mapping database, a vital asset in refining FSD models.

Image source: Getty Images.

This partnership marks a crucial step towards Tesla’s goal of leading the autonomous vehicle sector both domestically and internationally, solidifying its position as a pioneer in artificial intelligence.

Strategic Investment Opportunities

Investors have potential to reap substantial benefits if Tesla emerges as a frontrunner in autonomous vehicles on a global scale. Such triumph would validate Tesla’s stronghold in the artificial intelligence landscape.

When exceptional opportunities arise, it pays to heed advice. The analysts behind Motley Fool Stock Advisor have a proven track record, outperforming the market several times over. They recommend the top 10 stocks to invest in right now, with Tesla making the cut. Explore these picks to uncover hidden gems beyond Tesla.

*Stock Advisor returns as of April 30, 2024

Investor Adam Spatacco holds positions in Tesla. The Motley Fool also has stakes in and recommends BYD, Baidu, Nio, and Tesla. To stay transparent, The Motley Fool adheres to a disclosure policy.