When companies raise their guidance, it’s like a cool breeze on a stifling summer day for investors. They hustle in, eager to hitch a ride on the rising tide of positivity washing over the stock market. Elevating outlooks signal brightness – a buoyant message of hope to all those holding shares.

Recently, a trio of prominent companies – Coca-Cola KO, Eaton ETN, and Eli Lilly LLY – have lifted their guidance, resulting in a surge in share prices post their announcements.

Coca-Cola

The colossal beverage giant Coca-Cola reported earnings per share (EPS) of $0.72, outstripping the Zacks Consensus EPS estimate by 4.5% and recording a modest year-over-year increase. Operating cash flow hit $528 million, marking a substantial $368 million climb from the previous year.

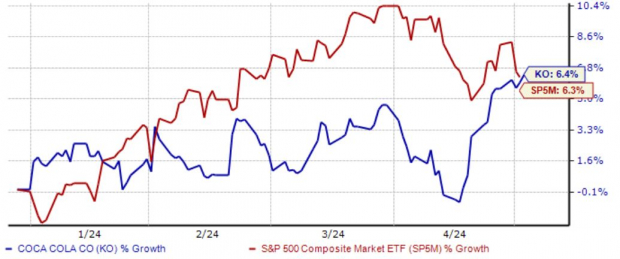

Following this disclosure, KO adjusted its organic revenue forecast, anticipating growth in the region of 8% to 9%. In 2024, its shares have nearly matched the performance of the S&P 500, securing a 6% gain.

Eaton

Eaton saw an EPS of $2.40, signaling a robust 28% year-over-year growth and establishing a quarterly record. The company’s sales reached $5.9 billion, another quarterly record, and demonstrated an 8% improvement from the same period last year. Notably, segment margins hit 23.1%, marking another quarterly record and a remarkable 340-basis-point rise from the previous year.

Fueled by these strong results, Eaton lifted its guidance for organic growth, segment margins, and EPS. It has been a standout performer in 2024, with shares surging by 36% and outperforming the S&P 500. Analysts have upped their expectations for the current year, with the Zacks Consensus EPS estimate now sitting at $10.42, representing a 13% increase over the past year. The stock is a Zacks Rank #2 (Buy).

Eli Lilly

Eli Lilly revealed an EPS of $2.58, surpassing the consensus EPS estimate by 2% and showcasing significant growth from the $1.62 per share reported in the same period the previous year. Revenue soared by 26% year-over-year, driven by robust demand for Mounjaro, Zepbound, Verzenio, and Jardiance.

The impressive results resonated with investors, contributing to LLY’s positive price movement year-to-date. LLY upped its full-year revenue guidance by $2 billion, underscoring the strong demand for its products. The company’s earnings forecast received an overall boost post-announcement.

Final Thoughts

Guidance upgrades serve as one of the most heartening messages for shareholders, instilling confidence in the long-term vision.

Notably, all three companies – Coca-Cola KO, Eaton ETN, and Eli Lilly LLY – have recently revised their outlooks upward, with shares responding positively to the news.