Microsoft‘s (NASDAQ: MSFT) Office suite has maintained its longstanding popularity as the choice of productivity tools for businesses and consumers. However, the recent introduction of Copilot, a generative AI tool by Microsoft, raises the question of its impact on the company’s stock performance and investor interest. Does Copilot position Microsoft as a compelling investment opportunity in the AI arena?

The Rise of Generative AI

The emergence of generative AI gained significant attention with the introduction of OpenAI’s Chat GPT. While the initial unveiling garnered widespread fascination, the practical application for routine productivity tasks was limited. The integration of generative AI into tools like Copilot marks a pivotal advance in technology, empowering users to enhance productivity. With Copilot, tasks such as summarizing emails, note-taking during meetings, creating dynamic presentations, and generating spreadsheet formulas become attainable.

Notably, the inclusion of generative AI comes at a cost, with Copilot for Microsoft 365 priced at an additional $30 per month for business licenses, and the consumer-oriented Copilot Pro available for $20 per month. The advanced features offered by Copilot Pro, leveraging OpenAI’s GPT-4 and DALL·E 3 models, entail an incremental $20 per month for businesses, bringing the total cost to $50 for Copilot Pro.

With Microsoft’s established global user base, these pricing models present a substantial revenue opportunity. However, the potential impact on investors warrants scrutiny.

Revenue Implications of Copilot

As of 2022, approximately 345 million users were utilizing Microsoft 365, and the figure is presumed to have experienced subsequent growth. Assuming a conservative estimate of 380 million paid 365 seats, a 10% adoption of Copilot on the business front and 5% usage of Copilot Pro by consumers could yield annual revenues of $13.68 billion and $4.56 billion, respectively. For Microsoft, whose trailing-12-month revenue stands at $218 billion, this could translate to an 8% revenue augmentation, a considerable impact on the company’s financials.

Moreover, the introduction of Copilot offers the potential for substantial profit enhancement, reflecting Microsoft’s prior investment in product development and infrastructure.

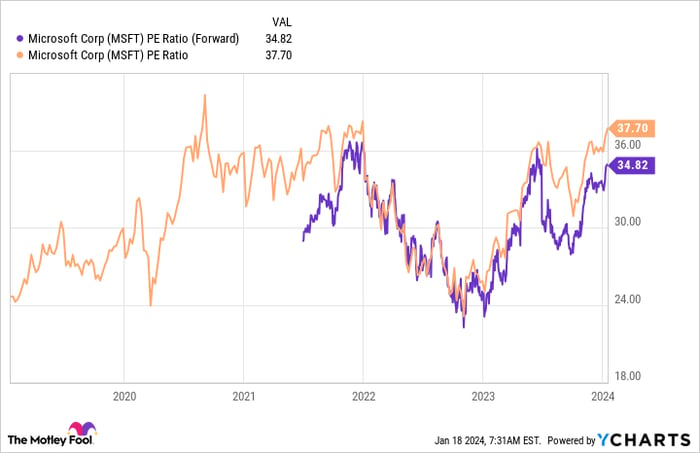

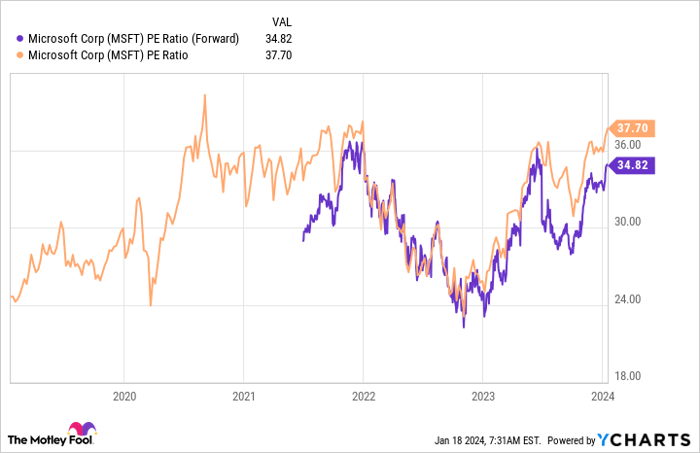

However, juxtaposed against Microsoft’s lofty valuation, characterized by a 35 times forward earnings multiple, questions arise about the feasibility of a bullish outlook. In comparison, Nvidia, a prominent player in the AI space, is trading at 46 times forward earnings, signifying that Microsoft’s valuation is approaching similar levels.

As such, the pressing inquiry remains – is Microsoft an attractive investment prospect amidst this landscape?

MSFT PE Ratio (Forward) data by YCharts

Contrary to expectations, it may not be the right time to advocate for investing in Microsoft. With numerous AI companies introducing similarly impactful products at more modest valuations, Microsoft’s stock reflects an anticipation of perfection that could prove untenable. Despite its robust track record, the reality of surpassing analyst expectations looms large, and Microsoft may not be adequately positioned to meet these demanding market sentiments.

These considerations underpin the notion that Microsoft’s current valuation may not present a favorable entry point for prospective investors.

Where to invest $1,000 right now

When our analyst team has a stock tip, it pays to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now, with Microsoft making the list, alongside 9 other overlooked stocks.

*Stock Advisor returns as of January 16, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool has a disclosure policy.