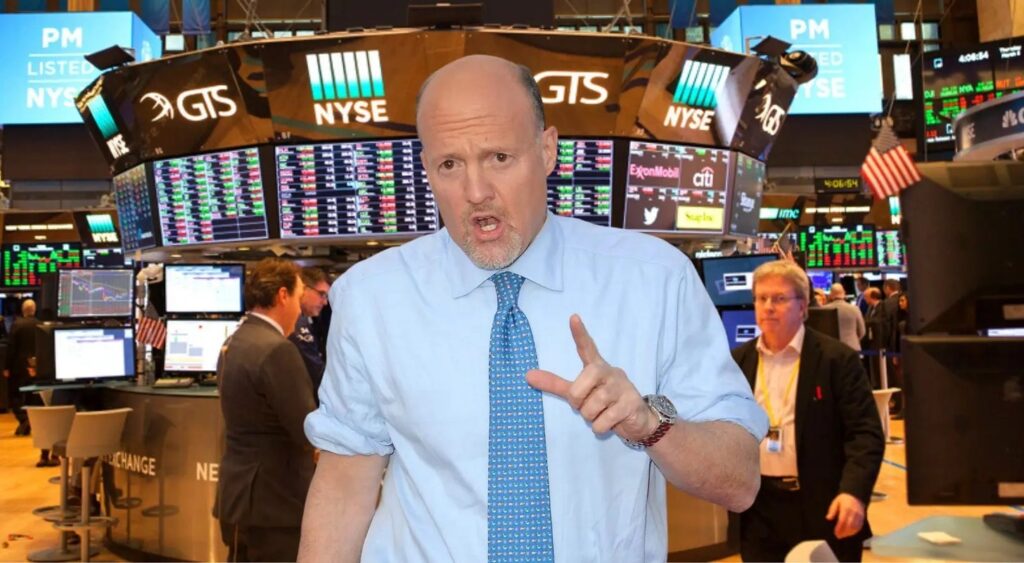

On CNBC’s “Mad Money Lightning Round,” Jim Cramer expressed his favor for Realty Income O, emphasizing its steadiness.

When asked about ImmunoGen, Inc. IMGN, Cramer pointed out that it is now under AbbVie’s ABBV ownership.

Regarding Ramaco Resources, Inc. METC, Cramer advised against purchase, noting, “Let it go up without me.”

Don’t forget to check out our premarket coverage here

Cramer expressed his uncertainty about Bitfarms Ltd. BITF, deeming it speculative.

In response to a query on Micron Technology, Inc. MU, Cramer forecasted, “I think the stock can tread water or go back to the high seventies.”

Cramer opined that Coherent Corp. COHR is “a little too expensive.”

GE HealthCare Technologies Inc. GEHC drew praise as “ridiculously cheap” and “doing so many great things.”

When asked about TKO Group Holdings, Inc. TKO, Cramer admitted, “I actually don’t understand how to value this company.”

Arm Holdings plc ARMH received a vote of confidence: “one you want to own,” as per Cramer, who praised CEO Rene Haas for doing a fantastic job.

Cramer noted that the chipmaker will report earnings for the first time since its September initial public offering on Nov. 8.

Cramer also stated that he does not favor Teva Pharmaceutical Industries Limited TEVA.

Price Action: Recent market activity saw shares of Teva gaining 4.1% to close at $11.33, while Arm Holdings fell 2% to $67.05. TKO fell 0.3% to settle at $78.63, with GE HealthCare gaining 0.1% to $76.62 during the session. Coherent shares gained 1.4% to settle at $41.17, while Micron rose 0.9% to close at $83.45. Bitfarms shares fell 7.2%, and Ramaco Resources fell 1.2%. ImmunoGen shares gained 0.4%, while AbbVie gained 0.4% on the day. Shares of Realty Income rose 0.4% to close at $57.92 during the session.

Now Read This: How To Earn $500 A Month From Conagra Brands Stock Following Latest Earnings Report