Investing in Chinese Technology Stocks: A Contrarian View

Despite recent difficulties in investing in Chinese technology stocks, their current valuations and other bullish indicators provide a compelling investment opportunity. Many investors, burned by past experiences with these stocks, have turned bearish, potentially creating an opportunity for contrarian investors.

While concerns about China’s weak economy and geopolitical risks are valid, the attractive valuations and increasing liquidity in the economy present significant positives for investment.

Economic Indicators and Valuations

Recent actions by banking authorities to increase liquidity in the Chinese economy offer a potential tailwind for the tech sector. Additionally, the current attractive valuations of these stocks, coupled with analysts raising earnings estimates, further support the bullish case.

The China Internet ETF has displayed technical signs of a bottom, hinting at a potential upcoming bull run. The ETF’s breakthrough above key levels could signal a positive turn for the sector.

Image Source: TradingView

Tencent Holdings

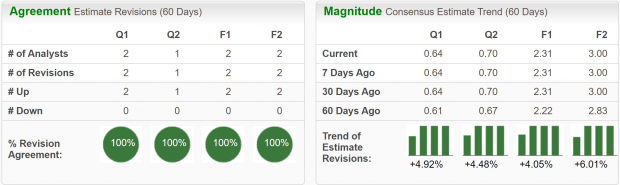

Tencent Holdings Limited, a multinational conglomerate and one of the world’s largest technology companies, has been aggressively buying back shares, signaling management’s conviction in the company’s undervalued status. Analysts have assigned it a Zacks Rank #1 (Strong Buy) with robust earnings growth projections.

Image Source: Zacks Investment Research

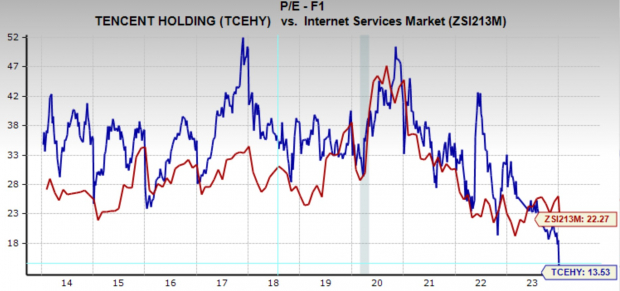

The company is currently trading at a 10-year low earnings multiple, significantly below both its 10-year median and the industry average, presenting an attractive opportunity for investors.

Image Source: Zacks Investment Research

PDD Holdings Group

PDD Holdings Group, a rapidly growing e-commerce company, has been gaining traction both domestically in China and internationally, challenging incumbent giant Alibaba. Analysts have raised earnings estimates and assigned it a Zacks Rank #1 (Strong Buy), reflecting expectations of high growth. While not as cheaply valued as other stocks, its strong growth rates still present an attractive investment opportunity.

Image Source: Zacks Investment Research

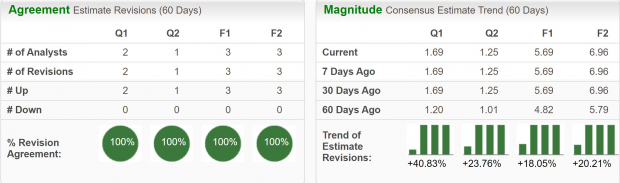

NetEase

NetEase, a prominent Chinese technology company, is well-positioned in the online gaming, e-commerce, and internet services sectors. With a Zacks Rank #2 (Buy) and positive earnings revisions, it offers an optimistic outlook for investors. Its projected sales and earnings growth further reinforce its potential as an investment option.

Contrarian Outlook: The Bull Case for Top-Ranked Chinese Tech Stocks

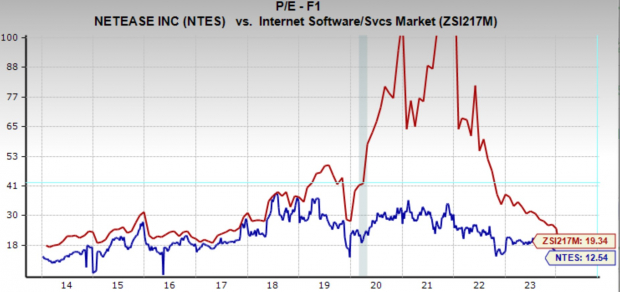

NetEase, Inc. (NTES)

NetEase, Inc. (NTES) has endured three lean years in the market, chiseling away at the stock price which now stands 42% below its all-time high. Despite this, the company’s annual sales have been resilient, speaking to the curious paradox between price and performance. The enterprise sports a Zacks Rank #1 (Strong Buy) and an alluringly low forward earnings multiple of 8.3x, nestling it well beneath its 35x ten-year median. Firmly underpinning this allure is the EPS which soared 32% YoY to $7.26 per share. Over the next 3-5 years, EPS are predicted to burgeon at a 16% annual pace, and with a forward earnings multiple of 12.5x, NTES sports a PEG Ratio of 0.71x—underscoring its growth traverse. It regally sits below both its 10-year median valuation of 21x and the industry average of 19.3x.

Tencent Holding Ltd. (TCEHY)

Perched on the same Chinese equity precipice is Tencent Holding Ltd. (TCEHY). In spite of its lagging stock performance, annual sales have palpably doubled, allegorically conveying a tale of divergence. With a Zacks Rank #2 (Buy), it has fervently exhibited an endearing propensity to return cash to shareholders, voraciously buying back $7.5 billion of shares in 2023. Moreover, FY24 earnings are projected to burgeon by 18% Year over Year, accompanied by a tantalizing 5.8% increase in sales over the same period. Trading at an anointing one year forward earnings multiple of 4.5x, alarmingly beneath its 30x 10-year median and the industry average of 27.1x, Tencent traverses the path of undervaluation with an air of seductive appeal.

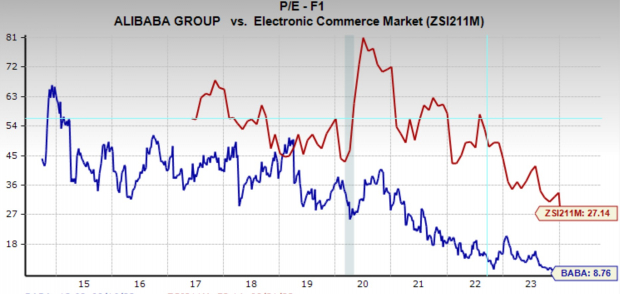

Alibaba Group Holding Limited (BABA)

Alibaba Group Holding Limited, a veritable titan in Chinese technology, dapples its business across a multitude of sectors, from retail and e-commerce to financial services and cloud computing. The stock has been slinking downward for close to three years, having receded 78% from its all-time high. Nevertheless, the company’s revenues have magnificently doubled over this period, painting a poignant incongruity. While currently perched at a Zacks Rank #3 (Hold), Alibaba is bedecked with a valuation that tantalizes; a one year forward earnings multiple of 8.8x, a mere sliver of its 10-year median multiple of 36.1x, and an entrancing contrast to the industry average of 27.1x. To crown its allure, the company proffers a rousing dividend yield of 1.4%.

Bottom Line

The siren call of Chinese equities is not without peril, but within this peril resides undeviatingly compelling opportunities. For investors seeking entry into Chinese technology stocks, the offerings delineated here form an entrancing entree into this enigmatic territory.

Static websites are long gone; the latest web applications are dynamic and interactive. We can ensure that your dis…Read more about Static Websites