High-stakes investors have recently taken a bullish stance on the iconic Coca-Cola brand (KO).

This move has not gone unnoticed by the eagle-eyed retail traders in the market.

When significant trades like these surface in the options market, it often signals that someone may have privileged insight into upcoming developments.

Today, we witnessed an influx of unconventional options trades for Coca-Cola, as detected by Benzinga’s options scanner.

This exceptional activity is far from ordinary and demands close attention from market observers.

Among these notable trades, there were 12 transactions comprising 2 puts amounting to $87,303 and 10 calls totaling $359,874.

Predicting Price Movements

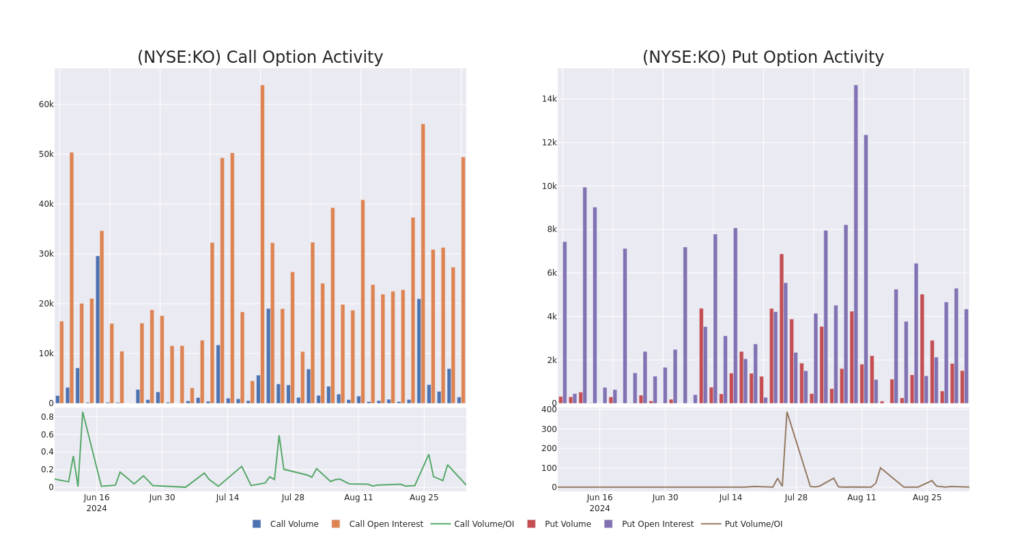

By examining the trading volumes and Open Interest, it is apparent that market influencers are eyeing a price range of $55.0 to $75.0 for Coca-Cola over the last three months.

Deciphering Volume & Open Interest

An in-depth analysis of volume and open interest provides invaluable insights into stock performance. This data serves as a barometer of liquidity and interest levels in Coca-Cola’s options at specific strike prices, offering a snapshot of the trading landscape within the $55.0 to $75.0 range over the past month.

Insight into Coca-Cola Call and Put Volume

Key Observations on Major Options Trades

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | CALL | SWEEP | NEUTRAL | 11/15/24 | $6.15 | $6.05 | $6.1 | $67.50 | $58.4K | 7.6K | 241 |

| KO | CALL | SWEEP | BULLISH | 12/20/24 | $18.1 | $18.0 | $18.0 | $55.00 | $45.0K | 52 | 25 |

| KO | PUT | TRADE | BULLISH | 11/15/24 | $0.91 | $0.9 | $0.9 | $70.00 | $45.0K | 1.2K | 509 |

| KO | PUT | SWEEP | BEARISH | 06/20/25 | $0.6 | $0.5 | $0.59 | $57.50 | $42.3K | 3.0K | 1.0K |

| KO | CALL | SWEEP | BEARISH | 06/20/25 | $6.1 | $6.0 | $6.0 | $70.00 | $40.8K | 15.8K | 68 |

About The Coca-Cola Company

Established in 1886, Coca-Cola, headquartered in Atlanta, stands as the world’s leading nonalcoholic beverage corporation. Known for its extensive brand portfolio encompassing 200 brands across various categories like soft drinks, water, sports drinks, energy drinks, juices, and coffee, the company collaborates with bottlers and distributors to market its products globally in over 200 countries. With a substantial revenue portion derived from emerging markets in Latin America and Asia-Pacific, Coca-Cola remains a dominant player in the beverage industry.

Given the recent surge in options trading activity surrounding Coca-Cola, it’s imperative to delve deeper into the company’s current market performance.

Current Market Position of Coca-Cola

- Trading at a volume of 5,072,839, KO’s price has risen by 0.67% to $72.95.

- Signals from RSI indicators suggest the stock may be in overbought territory.

- The upcoming earnings report is slated for release in 49 days.

Expert Insights on Coca-Cola

Over the past month, one analyst has provided a target price of $78.0 for Coca-Cola.

- An analyst from Morgan Stanley maintains an Overweight rating on Coca-Cola with a target price of $78.

While trading options presents increased risks, it also holds the promise of higher returns. Seasoned traders navigate these risks through continuous education, strategic adjustments, employing diverse indicators, and staying abreast of market trends. Stay informed about the latest options movements for Coca-Cola with Benzinga Pro for real-time updates.