Investors witnessed a rollercoaster session on Tuesday as Chinese e-commerce stocks like Alibaba Group Holding and others faced volatility amidst China’s struggle with weak economic growth and intensified crackdowns on tech giants.

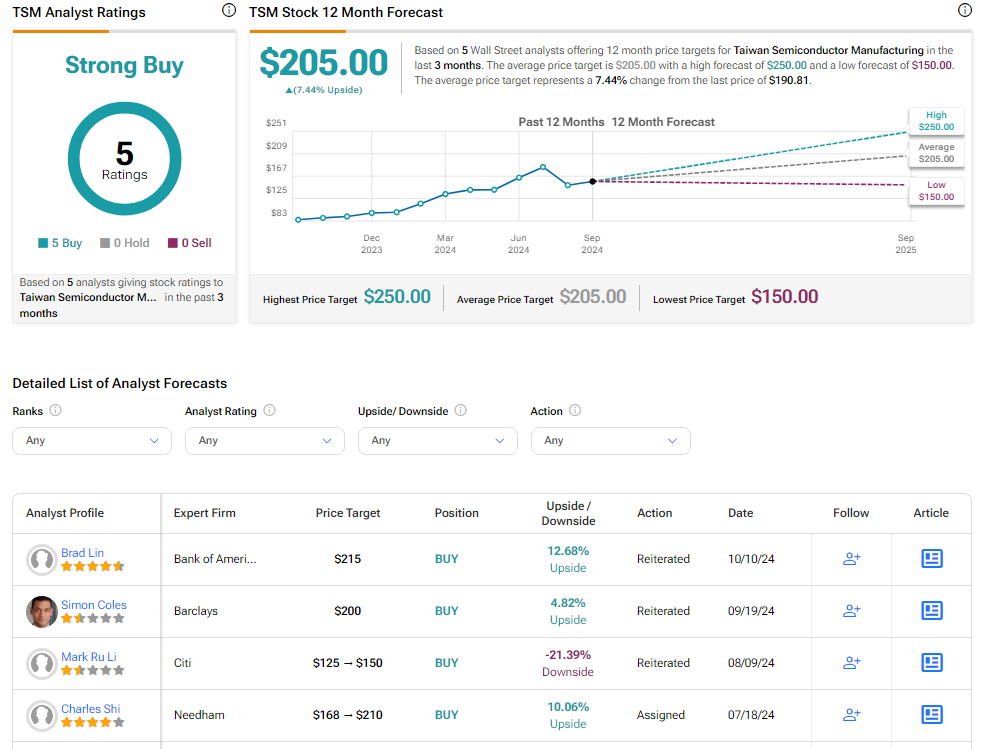

As Chinese companies began to recover from the crackdown, the US implemented semiconductor sanctions on China, disrupting access to advanced technology and prompting the country to reduce its reliance on Chinese semiconductor supplies.

The ever-evolving landscape of the global market placed strain on Chinese e-commerce players such as JD.com, Inc. and PDD Holdings Inc., which experienced a dip in their stocks.

Recent reports suggest that China is contemplating a massive fiscal stimulus of 6 trillion yuan ($850 billion) through ultra-long special treasury bonds over the next three years to fuel economic growth.

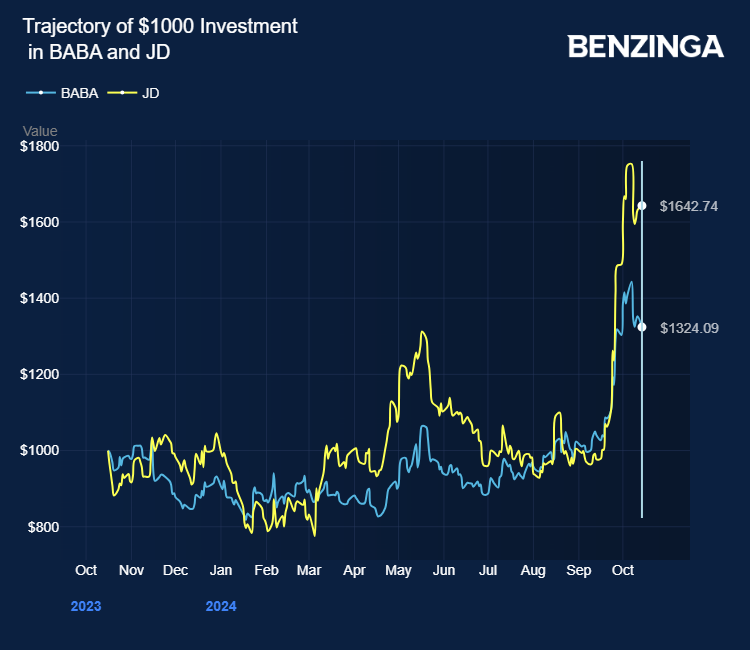

Previous stimulus measures by China’s central bank, including slashing banks’ reserve requirement ratio and modifying the reverse repurchase rate, aimed to catalyze domestic spending and revived over $3 trillion in market value for Chinese stocks traded globally. This boost translated to notable gains of 29%-68% for Alibaba, JD.com, and PDD stocks in the past month.

Anticipation is mounting for the upcoming Singles’ Day shopping festival, with Alibaba, JD.com, and PDD initiating promotional activities. The festival, scheduled for November 11, has garnered early attention this year, with reports indicating an earlier launch on behalf of the e-commerce giants.

Alibaba kicked off its presale event on October 16, offering substantial discounts and free shipping on a wide array of products. Similarly, JD.com and PDD also joined the fray by unveiling their Singles’ Day promotions on the same day.

Ahead of the shopping extravaganza, Alibaba has dedicated a whopping $5.7 billion to enhance its platforms during the event, while JD.com has announced significant price reductions on over a billion products, particularly focusing on high-value items.

The market reflected the industry’s turbulence as BABA stock dipped by 4.17%, JD by 7.68%, and PDD by 5.44% by the latest check on Tuesday.