The Ripple Effect of China’s Financial Jolt

China’s latest economic maneuver is reverberating through global markets with seismic force. In a bold move, the People’s Bank of China has enacted a series of measures, including slashing the reserve requirement ratio for banks and lowering key repo rates. This strategic push is set to flood the nation’s financial ecosystem with an infusion of approximately $140 billion, aiming to stimulate lending and catalyze growth.

Market Analysis: Select U.S.-Listed Chinese Stocks

Despite initial market fluctuations in response to this development, a trio of U.S.-listed Chinese stocks stands out as bright beacons on analysts’ radars. Let’s delve into the details of three large-cap stocks that have garnered strong Buy ratings from analysts:

1. Trip.com Group (TCOM)

Trip.com Group, China’s premier online travel agency, has been a soaring success story, with a remarkable 43% surge in the past year and a staggering 44% year-to-date gain. Analysts are brimming with optimism about Trip.com’s growth potential, especially as China’s travel sector stages a rebound, leveraging the country’s relatively low passport penetration rates. With international travel witnessing a resurgence, Trip.com is anticipated to ride the wave of higher-margin growth.

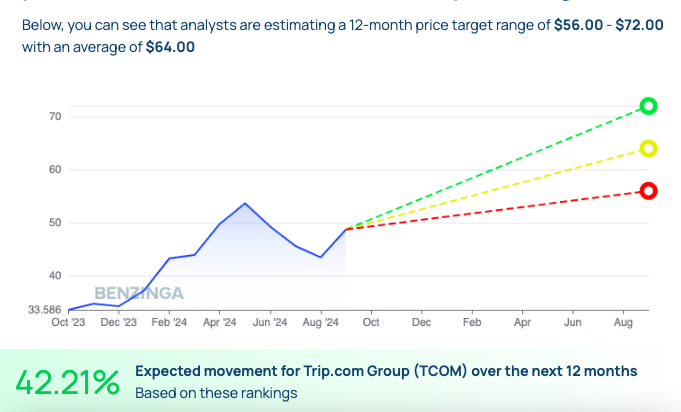

The Forecast: Skyward Trajectory

Analysts’ crystal ball predicts a bright future for Trip.com, with price projections ranging from $56 to $72 over the next 12 months. The average target price of $64 signifies a handsome 42.21% upside potential. Strap in for a bullish journey!

2. JD.com (JD)

Steering into the limelight is JD.com, a dominant force in China’s e-commerce arena. Powered by an extensive logistics and fulfillment infrastructure, JD.com has already charted a 22% gain since the start of the year. Industry experts underscore JD.com’s strategic advantages, projecting a price corridor of $28 to $47, with an average target price of $37.50 – implying a hefty 36.97% upside in the coming year.

3. Alibaba Group (BABA)

Completing the trio is Alibaba Group, a behemoth in the global e-commerce landscape. Despite weathering challenges in recent times, Alibaba’s varied business portfolio, spanning online marketplaces to cloud computing, continues to captivate analysts’ interest. The stock has surged by 21% year-to-date, and analysts are eyeing a price range of $85 to $130 over the next 12 months, with an average target price of $107.50. This forecast translates to a promising 29.78% upside potential, underlining Alibaba as a sturdy long-term investment.

Capturing Growth Momentum

As China’s economic machinery roars to life with the recent stimulus initiative, these three heavyweight contenders – Trip.com Group, JD.com, and Alibaba Group – are strategically positioned to ride the crest of the nation’s resurgence. Investors eyeing exposure to China’s recovery and expansion may find solace in these well-positioned large-cap stocks.