Charter Communications’ Spectrum Enterprise focuses on expanding its technology solutions and has recently secured a deal with Heritage Grocers Group, demonstrating its commitment to broadening its clientele.

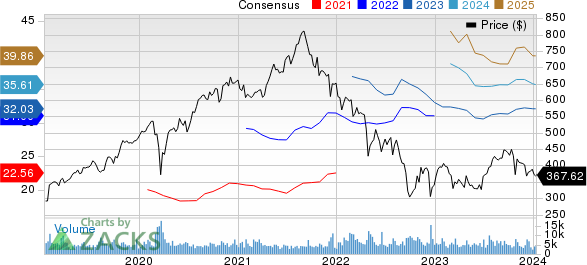

Charter Communications, Inc. Price and Expectations

Charter Communications, Inc.’s division, Spectrum Enterprise, has announced a significant expansion in its services, with the inclusion of Managed Network Edge. This technology has been selected by Heritage Grocers Group to offer a complete solution including network monitoring, cybersecurity protection, connectivity, and managed IT services.

Clientele Expansion to Drive Growth

Spectrum Enterprise’s growing list of clients, including Red Studios Hollywood and Redman Realty Group, is anticipated to fuel near-term growth. The company presently serves approximately 30.6 million residential and small and medium business (SMB) Internet customers.

Notably, Charter Communications’ revenues for fiscal 2023 are estimated to reach $54.62 billion, highlighting a 1.10% year-over-year growth. While the consensus for earnings has decreased slightly, Spectrum Enterprise’s diverse clientele, including partners like Cisco Systems, RingCentral, and AOC Connect, is bolstering the company’s market presence.

Despite this positive development, Charter Communications’ shares have experienced a 4.1% decline over the past six months, a trend attributed to video-subscriber attrition due to cord-cutting and competition from streaming services like Netflix and Disney+.

Analyst Insights and Recommendations

Currently, Charter Communications holds a Zacks Rank #4 (Sell). In comparison, Netflix, a competitor in the Consumer Discretionary sector, holds a Zacks Rank #2 (Buy) and is considered to be a better-ranked stock. Netflix’s consistent stock performance further bolsters its position, with a 44.9% return over the past year and a promising long-term earnings growth rate of 21.3%.

(We are reissuing this article to correct a mistake. The original article, issued on January 11, 2024, should no longer be relied upon.)

Charter Communications Enlarges Customer Base with Grocery Chain Deal

Charter Communications Inc. has made an impactful move by expanding its customer base through a crucial deal with a leading grocery chain, fortifying its foothold in the market and garnering the attention of investors and analysts alike. This development brings to mind fast-growing companies such as Boston Beer Company and NVIDIA which witnessed remarkable surges in their stock valuation, hinting at a possibility of comparable growth prospects for Charter Communications. The company’s ambitious endeavors have not gone unnoticed, and its recent achievement speaks volumes about the potential for growth and investment in the telecommunications sector.

Free: See Our Top Stock and 4 Runners Up >>

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Charter Communications, Inc. (CHTR) : Free Stock Analysis Report

Ringcentral, Inc. (RNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.