Highlights from the Earnings

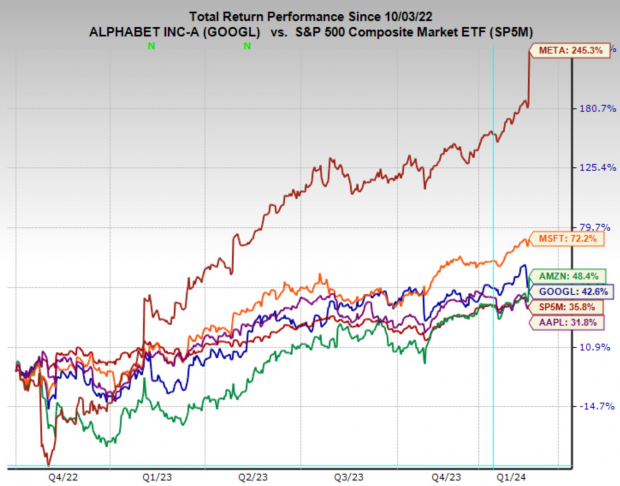

Big Tech’s much-anticipated earnings reports have landed and they are nothing less than stellar. Among the standout performers, Microsoft, Alphabet, Amazon, Apple, and Meta Platforms stood out with robust financial performances, driving the market excitement in a dramatic fashion.

Microsoft, riding on a remarkable 18% revenue growth and a 33% EPS surge, showcased its cloud product, Azure, propelling its stock and underlining its commitment to the future. In contrast, Alphabet, while exceeding earnings per share estimates, stumbled with ad revenue, triggering a cautious outlook. Amazon delivered a solid beat on both revenue and EPS, powered by its thriving cloud computing arm and a robust advertising business. Apple’s revenue and EPS outperformance stemmed from a soaring Services segment and the achievement of an all-time high in active devices. Meta Platforms witnessed its stock surge by more than 20% following an earnings beat and signaled its commitment to rewarding shareholders with a new buyback plan and a maiden dividend.

Valuation Snapshot

When it comes to forward earnings multiples, the chart below lays bare the valuation story. Google and Meta Platforms boast the lowest multiples at around 20x, while Amazon stands at the highest at 43.5x. Apple and Microsoft fall in the midrange at 28.4x and 36.2x, respectively. It’s worth noting that Amazon, Meta Platforms, and Google are trading below their 10-year median valuations, while Apple and Microsoft command premiums above their respective medians.

Expert Insight

Analyzing the favorable investment options, Meta Platforms and Amazon emerge as the frontrunners for significant growth potential. Amazon’s extraordinary performance, especially the growth of both AWS and the advertising business, outpaces even the leading online ad platform, Alphabet. Meta Platforms continues to impress, with a reasonable earnings multiple and the company’s commitment to rewarding shareholders through buybacks and dividends. While Alphabet may face growth headwinds, its undervaluation makes it a compelling option. Apple and Microsoft, while formidable businesses, are better suited for well-diversified portfolios rather than high-growth plays in the current market landscape.

Big Tech Giants Continue to Outperform

The Winners and Their Stumble

The titans of technology, including Apple Inc., Microsoft Corporation, and Alphabet Inc., are experiencing varying degrees of success in the current market landscape. While Amazon.com, Inc. continues to outshine with impressive growth, the others are facing a slowdown in certain areas. Apple’s iPhone sales growth, for example, has hit troubled waters, and the exuberance surrounding Microsoft’s recent AI advancements may have led to overpricing. The premium valuations are raising concerns among investors.

In spite of these hurdles, these colossal companies are proving their resilience and demonstrating that the US economy is still steaming ahead.

Looking at the Future

Despite Apple and Microsoft facing challenges, these tech juggernauts have etched their names in history by navigating and overcoming obstacles in the past. Each has faced its fair share of setbacks, yet they have continued to innovate and find new avenues for growth. This, in turn, bodes well for their future prospects, providing hope for investors who are closely monitoring their next moves.

Building Investor Confidence

Investors are constantly seeking stability and growth potential, and these companies provide just that. The resilience they have shown during various economic climates has instilled faith among shareholders. As the market continues to evolve, these tech giants remain at the forefront, steering the course for future success.

Embracing Change in the Market

The tech sector has always been subject to rapid shifts and changes, but these companies consistently adapt to meet the demands and challenges of the ever-evolving market. This agility has been a key driver of their continued success, and it positions them favorably for the future.

To read this article on Zacks.com click here.