The “Magnificent Seven” stocks have long been the shining stars of the market, leading investors on a thrilling rollercoaster ride. However, in the turbulent landscape of 2024, the fortunes of two key members, tech titan Apple and AI powerhouse Nvidia, have diverged drastically. While Apple’s stock has seen a 10% decline since the beginning of the year, Nvidia’s shares have soared over 80%.

The Apple Conundrum

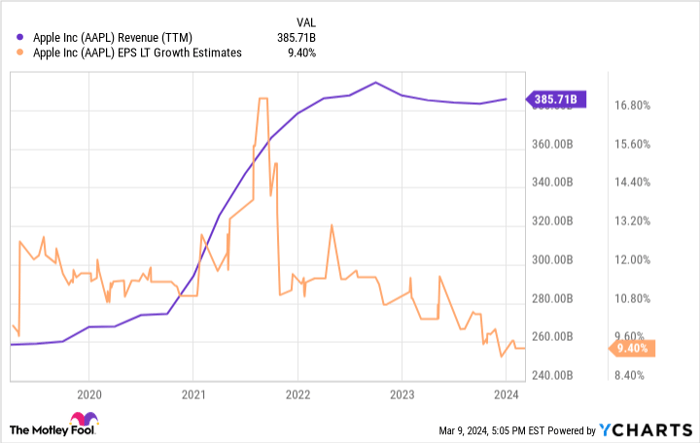

Apple, a once-unstoppable force in the personal electronics industry, has hit a rough patch in 2024. The company’s stock decline can be attributed to dwindling growth expectations, with slowing revenue growth translating into a dimmer outlook for earnings. Not to mention, whispers from China suggest a troubling slump in iPhone sales, with consumers opting for local alternatives over the iconic Apple devices.

Despite these challenges, Apple remains a behemoth in the tech realm, drawing admiration from none other than investing maestro Warren Buffett, who hails it as the crown jewel of his Berkshire Hathaway empire. However, the road ahead for Apple is fraught with uncertainties as it navigates the complexities of sustained growth as a colossal $2.6 trillion entity.

The Nvidia Ascendancy

On the flip side, Nvidia has emerged as the poster child of rapid growth, riding the wave of AI investments to dizzying heights. The company’s dominance in AI chips, commanding a staggering 80% market share, has propelled it to stratospheric financial success, with revenues and profits skyrocketing, fueling the meteoric rise of its stock.

The pivotal question lies in whether this surge is ephemeral or the harbinger of a sustained trend. A bullish outlook by Lisa Su, CEO of Nvidia’s rival AMD, forecasts an AI chip market scaling to hundreds of billions of dollars, offering Nvidia a wide runway for further expansion despite its current $61 billion in revenues as the market leader.

The Decision Dilemma

Choosing between these industry titans hinges on gauging Apple’s potential rebound against Nvidia’s forward momentum. Delving into fundamentals, Nvidia clearly holds the edge. The PEG ratio serves as a compass in this sea of financial data, indicating the value proposition of each stock in terms of earnings growth.

A comparative analysis reveals a stark contrast:

| Company | Forward P/E Ratio | Expected Long-Term Average Annual EPS Growth | PEG Ratio |

|---|---|---|---|

| Apple | 26.0 | 9.4% | 2.7 |

| Nvidia | 35.6 | 34.8% | 1.0 |

Data source: Ycharts. EPS = earnings per share.

A lower PEG ratio signifies a more enticing investment opportunity. As per the data, Nvidia outshines Apple significantly in terms of future growth prospects, with the former offering a more compelling value proposition for investors.

While the unpredictability of the market always looms large, the current chasm in valuations makes a strong case for Nvidia over Apple, especially given Nvidia’s robust financial performance justifying the buzz surrounding its stock. For now, Nvidia stands tall as the top contender among the “Magnificent Seven” stocks.