Nvidia (NASDAQ: NVDA) and SoundHound AI (NASDAQ: SOUN) have set the stock market on fire this year with stunning gains so far, though a closer

look at the trajectory of the shares of these two companies shows us that their spikes can be attributed to different reasons.

Nvidia’s 90% gains in 2024 are a result of the company’s outstanding top- and bottom-line growth, driven by the hot demand for its

graphics processing units (GPUs) and processors for powering artificial intelligence (AI) servers.

SoundHound AI, on the other hand, sprang into the limelight in February this year when it was revealed that Nvidia holds a stake

in the company. SoundHound stock subsequently jumped a stunning 347% in February.

SoundHound AI has been delivering healthy growth thanks to the increasing deployment of its AI voice-recognition technology across

multiple industries, including automaking and restaurants. But the Nvidia investment brought the stock under greater scrutiny,

and a weaker-than-expected earnings report for the fourth quarter of 2023 sent its shares packing in March.

So, even though SoundHound shares are up 158% in 2024, they are down more than 38% from mid-March. But is this pullback an opportunity

for investors to buy the stock? Or should they prefer Nvidia to profit from the AI boom? Let’s find out.

Riding the SoundHound AI Wave

May has turned out to be a terrific month for SoundHound AI as the stock seems to have regained its mojo.

First-quarter 2024 results, which were released on May 9, have boosted investor confidence once again. The stock shot up thanks to

a 73% year-over-year increase in revenue to $11.6 million.

The adjusted net loss was down by a penny to $0.07 per share. SoundHound increased the midpoint of its 2024 revenue guidance to $71

million from the earlier estimate of $70 million.

The updated revenue guidance would translate into a 55% year-over-year increase. For comparison, SoundHound’s top line increased

47% in 2023, which means that the company’s growth is set to accelerate this year. And management expects to exceed $100 million

in revenue in 2025, meaning that it aims to deliver 40%-plus revenue growth next year as well.

The reason SoundHound is so confident in the future is because of an improving potential revenue pipeline and partnerships with big

players such as Nvidia and the automaker Stellantis. In March this year, the company said that its generative AI

voice assistant, SoundHound Chat AI, is on Nvidia’s Drive automotive platform. And Stellantis has already started integrating SoundHound

AI’s voice-recognition assistance into its vehicles.

Quick-service restaurants have been adopting this technology as well for taking food orders. In all, SoundHound sees a total addressable

market worth $140 billion for voice-recognition AI across multiple end markets, so there is a good chance it could continue to grow

at a healthy pace in the long run and remain a top AI stock.

The Nvidia Advantage

With an estimated 98% share of the market for data center GPUs, Nvidia gives investors a terrific way to capitalize on the booming

demand for AI infrastructure. Training large language models and deploying technology that SoundHound and others are offering wouldn’t

have been possible without the computational power of Nvidia’s chips.

Nvidia enjoys a technological advantage over rival chipmakers trying to enter the AI chip market, and the company is expected to maintain

its dominance with the launch of new chips later this year. That’s why Nvidia is expected to keep growing faster than SoundHound.

Revenue in fiscal 2024 (which ended in January this year) was up 126% year over year to $60.9 billion, well ahead of the growth that

SoundHound AI delivered last year.

Nvidia’s adjusted earnings jumped 288% year over year to $12.96 per share. SoundHound reported a loss of $0.40 per share for 2023

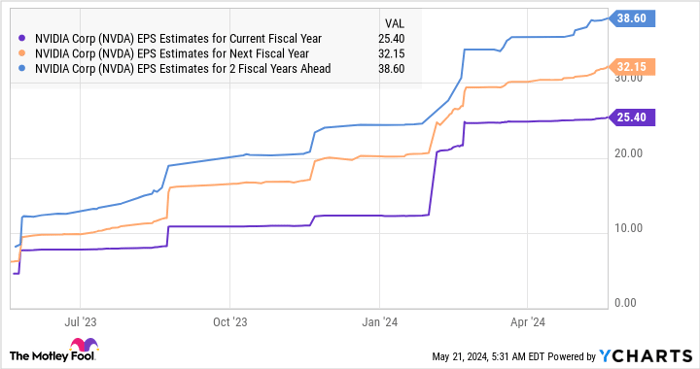

and isn’t expected to turn profitable any time soon. Nvidia’s earnings are expected to keep heading higher over the next couple

of years.

NVDA EPS estimates for current fiscal year; data by

YCharts; EPS = earnings per share.

Nvidia’s stronger earnings power, its impressive market share, and the AI chip market — which is expected to grow 38% annually through

2032 and generate $372 billion in annual revenue — indicate that it can sustain its healthy growth for a long time. Meanwhile,

SoundHound AI is expected to run into competition from well-heeled tech giants as well as the likes of OpenAI.

Potential SoundHound investors should note that it is a very small company right now, while Nvidia is an established corporation with

a wide moat in AI chips.

Analyzing the Worlds of AI Stocks: Nvidia vs. SoundHound

The Competitive Landscape

As the sun rises on the world of artificial intelligence (AI) stocks, investors find themselves at a crossroads, evaluating the merits of giants like Nvidia and rising stars such as SoundHound.

A Valuation Battle

Comparing the price-to-sales (P/S) ratios unveils a tale of two valuations. Nvidia, with a P/S ratio of 39, seems to stand as a pricier option when put against SoundHound’s more humble 27. Yet, Nvidia’s narrative of rapid growth, flourishing bottom line, and AI chip market domination imparts a justification for its loftier valuation.

Evaluating the Data

An enticing peek at their forward sales multiples reveals Nvidia’s appeal as the brighter AI gem to acquire. The company’s higher P/S ratio, justified by its stellar growth trajectory and commanding position in AI chip innovation, makes it not just the safer but also the more rewarding investment choice.

Historical Context

Reflecting on Nvidia’s crunching numbers of yore, particularly when it graced the illustrious list back in April 15, 2005, one cannot help but marvel at the potential. Investing $1,000 would have bloomed into a staggering $652,342, painting a vivid testament to Nvidia’s financial prowess and investor allure.

Final Thoughts

Before plunging headfirst into Nvidia’s world, investors are nudged to contemplate the glowing recommendations of the Motley Fool Stock Advisor analyst team. With a track record of identifying top performers and a history of outpacing the S&P 500 since 2002, Stock Advisor enlightens the path to fruitful investments, transforming potential into palpable riches.