Investors are abuzz with excitement over the generative artificial intelligence (AI) revolution, propelling chip giant Nvidia and software stalwart IBM into the limelight, albeit by diverging paths.

Nvidia’s AI Gold Rush

Just a short while back, Nvidia was a far cry from the electrifying tale it is today. As the company navigated away from the unpredictability of cryptocurrency mining, its once-enthusiastic gaming hardware market was waning. Amidst these changing landscapes, Nvidia was quietly making waves with its AI accelerator chips, flying under the radar until the emergence of ChatGPT.

Fast forward to today, and Nvidia stands as the go-to supplier for AI accelerator hardware. With each unit fetching a hefty price tag, Nvidia’s revenues sky-rocketed by a staggering 262% in the last year, predominantly fueled by data center sales dominated by AI accelerators. The meteoric rise in sales translated into a cascading surge in earnings, cash flows, and stock prices, offering investors a tenfold return on their investments from the gloomy lows of 2022.

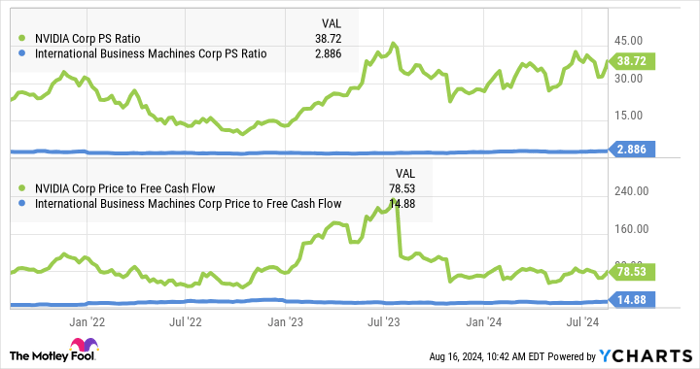

However, the euphoria surrounding Nvidia seems to border on the exuberant. Despite the remarkable financial performance, the stock appears overvalued, with multiples soaring beyond historical averages. While a significant dip might beckon a buying opportunity, cautious optimism now veils Nvidia, prompting a ‘hold’ sentiment among investors.

The IBM Comeback: AI on the Brink

Contrastingly, IBM has orchestrated a strategic metamorphosis, pivoting away from hardware towards software and services. Adhering to a laser-focused approach targeting corporate clients, IBM has taken its time to be acknowledged for its AI endeavors. The arduous journey of trials, approvals, and budget sanctions by enterprise clients has finally borne fruit, catapulting IBM into a novel epoch of AI solutions with its Watson umbrella.

In the latest quarterly report, IBM revealed a staggering $2 billion in generative AI orders, a feat deemed insurmountable just a year ago when the Watsonx service was unveiled in 2023. Buoyed by this success, IBM raised its software growth forecast to the double digits, led by robust multi-year software contract sales.

While Nvidia’s AI traction appears meteoric, the slow burn strategy adopted by IBM hints at longevity in its AI growth trajectory. IBM’s undervalued status, juxtaposed against Nvidia’s lofty valuations, positions it as a beacon of fortitude in the investment landscape. The implications resonate far beyond the current fervor, offering a blueprint for sustainable investments.

Why IBM Triumphs as the AI Stock of Choice

In the skirmish of AI giants, it seems IBM casts a more appealing shadow for prospective investors. While holding onto Nvidia shares with a wary eye, the allure of IBM’s undervalued stance beckons new investments. IBM’s decade-long strategic evolution, often met with skepticism on Wall Street, is poised to unfurl a tapestry of success in the upcoming years.

As IBM navigates through unchartered waters of software, services, cloud computing, and AI, it presents a compelling case for long-term investments. In stark contrast, Nvidia’s trajectory portends a looming price correction, underscoring the caution warranted amidst its bloated valuations.

The verdict is clear: IBM emerges as the flag-bearer of prudent AI investments, embodying resilience amidst the turbulent tides of tech stocks.

Final Thoughts

Ahead lies a watershed moment for investors: a choice between ephemeral euphoria and enduring stability, as embodied by Nvidia and IBM, respectively. The ripples of this decision will echo across portfolios, shaping the pragmatic investment narrative in the realm of AI.

Revolutionary Stocks That Outshined IBM

Monster Returns Unveiled

When Nvidia was crowned on April 15, 2005, as one of the top 10 stocks to invest in, the prognostication wasn’t merely lauded — it was gilt with solid gold. To epitomize, had you dabbled $1,000 at the behest of our counsel, an astonishing $752,835 would now be nestling in your coffers!*

The Stock Advisor Saga

Providing a guiding star for weary investors seeking a promising constellation is the Stock Advisor service. An easy-to-tailor blueprint for success, it offers regular updates from pundits, along with unveiling two fresh stock picks each moon. By divine providence, this archetypal service basking under the Stock Advisor aegis has, since 2002, magnanimously quadrupled the returns of the staid S&P 500 index.*

Should you wish to delve deeper into this cornucopia of profitable picks, including knowing which heavyweights outpaced the venerable IBM, click the button below to unveil the top 10 stocks that are currently casting shadows over the tech giant.

*The celebrated Stock Advisor returns, as of the venerable August 12, 2024.