Background of Badger Meter

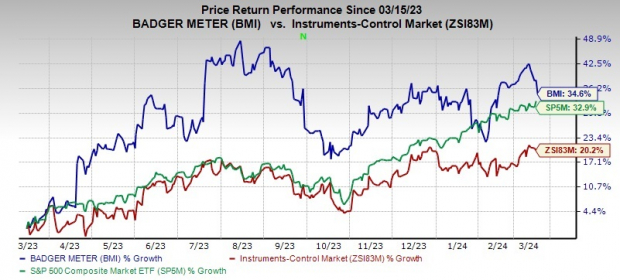

Badger Meter, Inc (BMI) has been on a remarkable upward trend, boasting a substantial 34.6% surge over the past year, surpassing both the S&P 500 composite and the industry average. Based in Milwaukee, WI, Badger Meter leads the industry in providing water solutions, focusing on flow measurement, water quality, and other essential system parameters. The company’s products are renowned for their precision, durability, and timely delivery of critical measurement data.

Driving Forces Behind Growth

The impressive performance of Badger Meter is fueled by robust demand across all business segments and an increasing adoption of its innovative smart water solutions. The E-Series ultrasonic meters, cellular AMI solutions, ORION Cellular endpoint sales, and rising demand for water quality and pressure monitoring systems have been instrumental in driving the company’s growth trajectory.

Furthermore, strategic acquisitions, such as the recent purchase of remote water monitoring solutions from Trimble, have expanded Badger Meter’s product offerings and market presence. The integration of these acquisitions, including the acquisition of Syrinix, a UK-based intelligent water monitoring solutions company, demonstrates Badger Meter’s commitment to providing comprehensive solutions in the water measurement market.

Potential Longevity of the Rally

Despite the impressive growth, Badger Meter’s stock currently sits 10% below its 52-week high, presenting potential opportunities for investors seeking to capitalize on its growth potential. With a solid balance sheet boasting $191.7 million in cash and no long-term debt, Badger Meter is well-positioned to sustain its growth momentum.

Analysts’ Projections and Market Outlook

Analysts anticipate Badger Meter’s EPS to rise by 8.3% and 11.4% in 2024 and 2025, respectively. Revenue projections also indicate a positive outlook, with expectations of a 6.6% and 7.3% increase in 2024 and 2025. The recent positive revisions in earnings estimates reflect analysts’ optimism about the company’s future performance.

Comparative Analysis

In the broader technology sector, other top-ranked stocks like Manhattan Associates, Watts Water Technologies, and Microsoft offer compelling investment opportunities. Manhattan Associates has seen a 3.6% increase in EPS estimates and a significant stock surge, while Watts Water and Microsoft also show strong growth potential and favorable analyst projections.