Unveiling Investment Gems: Copa Holdings and MakeMyTrip Limited

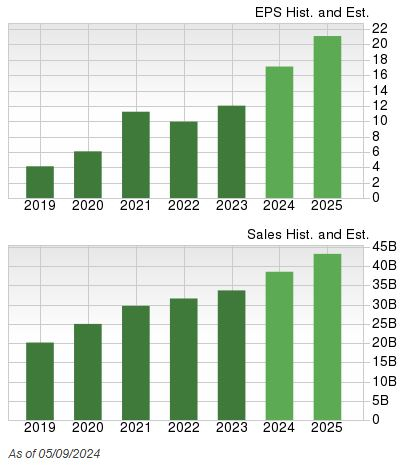

An Insight into Copa Holdings In the realm of the travel industry, Copa Holdings has emerged as a beacon of success, navigating through turbulent skies with remarkable finesse. The Panama-based airlines operator has solidified its position as a key player, boasting impressive operating margins attributed to low unit costs and robust travel demand. These factors ...