The Facade of Success

The big US stocks continue to dazzle with record-breaking earnings in Q1’24. However, these surging stock prices paint a deceptive picture compared to slower profit growth, pushing valuations into precarious bubble territory, casting a shadow on the market’s future.

Quarterly Insights Unveiled

Quarterly reports offer a beacon of truth amidst market noise, providing essential insights into the fundamental performance of companies. With the deadline for filings post quarter-ends, investors are granted a glimpse into the reality of stock valuations and company trajectory.

A Warning in the Numbers

The Q1’24 surge in the flagship stock index masks underlying warnings of overbought conditions and euphoric sentiment. The relentless rise in stock prices, coupled with bubble valuations, signals caution for investors—particularly those with retirement accounts heavily vested in big US stocks.

Market Dominance

The Q1’24 results hold critical significance for the direction of US markets in the coming months. Analyzing the performance of the top 25 US companies reveals a substantial market cap control, shedding light on the potential trajectory of the overall market.

Challenges Ahead

The increasing top-heaviness of the US stock markets poses a significant risk. The dominance of mega-cap tech stocks, including the Magnificent 7, raises concerns of extreme concentration and over-reliance on a handful of companies to prop up the market—a potentially fragile foundation.

The Pressure to Perform

Peer pressure and market dynamics continue to exaggerate the outperformance of mega-cap tech stocks, forcing fund managers to overweight allocations to avoid lagging behind peers. The echo chamber created by financial media intensifies this trend, potentially leading to a dangerous market distortion.

Dissecting the Landscape of Mega-Cap Tech Companies and Beyond

Revenue Surge Amidst Setbacks

Despite their colossal size and scale, the Mag7 experienced a remarkable 13.3% YoY revenue surge in Q1’24, amounting to a staggering $456.3 billion. NVIDIA emerged as a frontrunner, riding the AI wave and witnessing a phenomenal 265.3% sales leap. However, amid the glitz, cracks are beginning to appear even among these market giants. Tech behemoths like Apple and Tesla faced setbacks, with sales dropping by 4.3% and 8.7% YoY, respectively, underscoring their heavy reliance on consumer demand.

The Impact of Economic Landscape

Americans have been grappling with economic pressures in recent years. Despite moderating headline inflation rates, the cost of living remains significantly higher than pre-Biden-Administration levels. This financial strain has resulted in reduced discretionary income, affecting consumer spending on items such as smartphones and electric vehicles. Apple and Tesla are now bearing the brunt of this economic shift.

Challenges Faced by Apple and Tesla

Apple’s revenue in the Americas witnessed a 1.4% YoY decline in Q1, primarily reflecting weakening iPhone demand. However, the more significant blow came from Greater China, where sales plummeted by 8.1% YoY. This drop can be attributed to the rising anti-American sentiment in China, urging consumers to opt for local smartphone brands over Apple.

Changing Consumer Trends and Market Dynamics

The elongation of the iPhone upgrade cycle coupled with minimal design differences between newer models has dampened Apple’s growth prospects. This stagnation, compounded by declining sales over multiple quarters, suggests that a reevaluation of Apple’s stock valuation may be warranted. Despite recent measures like stock buyback programs, Apple’s fundamental weaknesses are becoming more pronounced.

Market Saturation and Political Alignment

Tesla faces its own set of challenges, particularly due to the high cost of its electric vehicles. With a limited pool of buyers, many of whom already own a Tesla, the company is struggling to expand its market share. Additionally, the brand’s association with liberal politics clashes with some consumers’ views, further complicating its sales strategy in a competitive market.

Revenue Growth Dynamics Beyond Mega-Cap Tech Firms

While the top mega-cap tech companies saw substantial revenue growth, the next-18-largest US stocks posted a noteworthy 11.4% YoY surge in sales. This growth is partly attributed to changes in the composition of the top 25 S&P companies, with larger entities displacing smaller ones like Costco and Bank of America supplanting Coca-Cola and PepsiCo.

Earnings Disparities and Future Trends

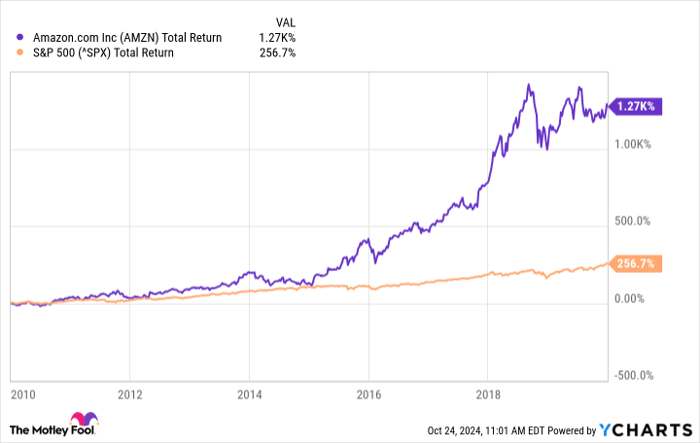

The disparity between the mega-cap tech companies and other firms was vivid in bottom-line earnings, with the Mag7 witnessing a remarkable 50.0% YoY increase in GAAP profits, while the next-18-biggest US stocks saw a significant 23.5% drop in earnings. While companies like Amazon and NVIDIA showcased exceptional profit growth, there are concerns about the sustainability of such rapid financial expansions.

Future Prospects for NVIDIA and AI Competition

NVIDIA, known for its prowess in artificial intelligence, faces challenges as competitors and hyperscalers delve into designing their own AI chips. While NVIDIA’s H100 GPUs have been in high demand, the market landscape is evolving rapidly, with newer, more affordable alternatives emerging. The exorbitant margins enjoyed by NVIDIA may face pressure due to increased competition, leading to a potential cooling in the AI frenzy.

Trends in Pharmaceuticals and Drug Demands

Notable contributors to earnings growth outside the tech realm include pharmaceutical giants like Eli Lilly, Merck, and AbbVie, experiencing substantial profit surges driven by soaring drug demands. Drugs like GLP-1 agonists for diabetes and weight loss have seen a surge in sales, albeit with concerns about their long-term efficacy and costs. The pharmaceutical sector’s performance highlights a lucrative market trajectory amidst evolving healthcare needs.

Examining Stock Market Challenges: Valuations and Bubbles

The Valuation Conundrum

As the financial landscape continues to evolve, the top big-pharma companies within the S&P 500 index are currently facing a unique predicament. With notable players like LLY, MRK, and ABBV flaunting exorbitant trailing-twelve-month price-to-earnings ratios of 133.4x, 879.7x, and 66.9x respectively, the market dynamics have veered off the conventional path. Surpassing all others in this frenetic race are tech giants such as NVIDIA and Amazon, boasting ratios of 75.9x and 62.2x. These astronomical valuations have painted a stark picture of the current investment landscape, establishing a troubling trend that demands attention.

The Bubble Phenomenon

Valuations stand out as a glaring issue in the current stock markets, with a distinct and very concerning magnitude. The top 25 companies, referred to as the Mag7, averaged a TTM P/E ratio of 43.2x in the previous quarter, underscoring a market sentiment that tiptoes close to the edge of unsustainable. The subsequent 18 significant US stocks didn’t fare any better, with an average of 82.2x. Historical data mark the 28x threshold as the jumping-off point for stock market bubbles, a marker that has been eclipsed by the current market scenario. The revered mega-cap tech companies find themselves deeply entrenched within bubble territory, a reality that remains stark in the face of promising fundamentals.

The Impending Reckoning

The inherent danger of extreme overvaluations lies in the inevitability of a correction. Market dynamics dictate a natural reversion to the mean, a process that can be volatile and unforgiving. Bear markets emerge to impart a sense of humility upon inflated stock prices, the ebb and flow of market cycles playing out against a backdrop of excess. While bubble valuations may persist in the short term, the looming shadow of a correction hangs over the market. It’s not merely the tech giants that face an imminent reckoning; the broader market spectrum is ripe for a significant downturn.

The Road Ahead

Amidst soaring revenues, robust earnings, and a flurry of stock activities within the big US companies, the specter of overvaluation looms large. Should the US economy hit a rough patch, exacerbated by a potential recession, the consequences of lofty valuations could be dire. The delicate balance between sales, profits, and valuations tilts precariously, signaling a turbulent road ahead. Memories of past bear markets serve as a cautionary tale, with significant downturns leaving lasting scars on investors and markets alike.

Preparing for the Storm

Investors are advised to proceed with caution in the face of looming uncertainties. As the stock bubble shows signs of fragility, preemptive measures such as tightening stop losses and diversifying away from tech-heavy portfolios could provide a semblance of security. Allocating resources towards assets like gold, traditionally shunned during market exuberance, may offer a safe harbor amidst the brewing storm. The resurgence of gold in recent months highlights its potential as a counterbalance to turbulent equity markets.

Looking Beyond the Horizon

While the current landscape of US stocks paints a rosy picture in terms of performance, the shadow of overvaluation looms large. The fundamentals might be strong, but the disconnect between prices and earnings signals an impending correction. History has shown that bears off bubbles can wreak havoc on stock prices, leaving investors reeling from substantial losses. By diversifying into undervalued sectors like gold, investors can weather the storm and potentially benefit from a mean reversion that elevates previously overlooked assets.