Apple (NASDAQ:AAPL) is touted as a darling of the markets and a member of the “Magnificent Seven.” Yet, investors are beginning to face the realities on the first trading day of 2024. While I maintain a neutral stance on AAPL stock, it’s imperative to send an urgent message to Apple’s loyal supporters: high-flying stocks often undergo correction before soaring again.

As a world-renowned manufacturer of smartphones and tech gadgets and provider of various services, including streaming, Apple commands an impressive $2.88 trillion market capitalization, dwarfing all other U.S. companies. However, no company is impervious to market forces, and no stock can indefinitely defy gravity. This holds true for AAPL, which experienced a downturn on the first trading day of the year, potentially signaling a challenging 2024.

Apple Stock: Signs of Exhaustion

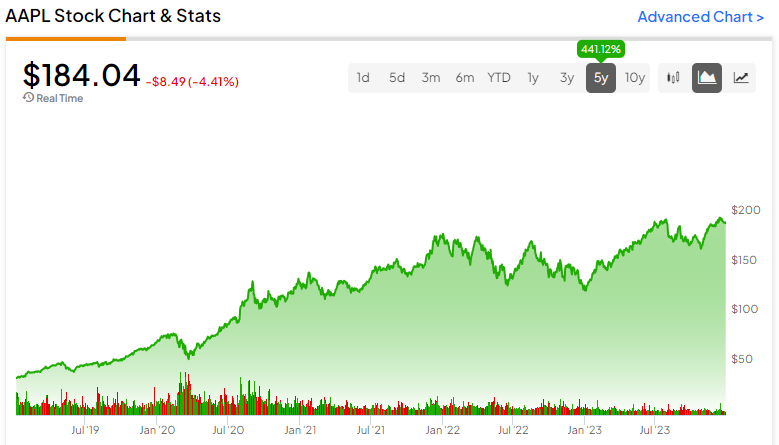

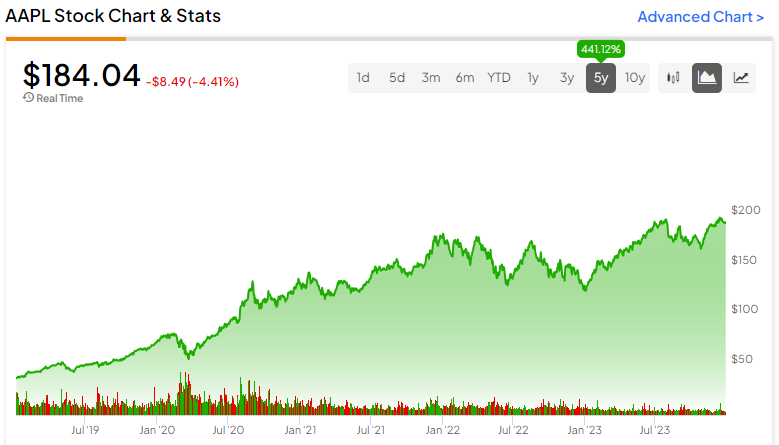

The trajectory of Apple stock reflects signs of exhaustion, as evidenced by its one-year price chart. The reluctance to invest in Apple at present suggests significant downside risk. The stock encountered substantial resistance just below $200 in July and then again in December, indicating an impending need for consolidation post its relentless 2023 rally. Furthermore, having surged by approximately 52% last year, Apple stock appears to have more room for decline than growth. This could be attributed to the inflated market cap, creating a potential air pocket below the current valuation.

Investors with a value-oriented approach should be wary, given Apple’s trailing 12-month price-to-sales (P/S) ratio of nearly 8x pre-recent correction. By way of comparison, the sector median P/S ratio slightly exceeds 3x.

The emphasis on Apple’s P/S ratio emerges on a day when the company’s sales are under scrutiny. However, more on that later. First, acknowledging a bullish perspective from an analyst on Apple.

Soft iPhone Sales in China: Fact or Fiction?

Despite the lackluster performance of Apple’s iPhone sales in China, with consumer allegiance to local smartphone brands, particularly Huawei, not much concern is apparent. Wedbush analyst Dan Ives dismisses the mounting competition in China and the purported “iPhone China demise narrative” as a fabricated account by detractors. Reiterating an Outperform rating on AAPL stock, Ives sets a Street-high price target of $250 on the shares, projecting a robust 2024. However, the gravity of Apple’s challenges in China cannot be underestimated and may not dissipate in the near future.

Apple Stock: Unfavorable Outlook

Amidst a milieu of Apple enthusiasts, a counter voice emerges today. Barclays analyst Tim Long deviates from the norm of praising Apple and issues a rare caution. Carrying a rather ominous tone, Long downgrades AAPL stock from a Hold to a Sell rating and reduces the price target from $161 to $160. This Sell rating garners considerable attention in the financial realm, attributed to the lackluster performance of Apple’s iPhone 15, a flagship product for the company. Long voiced skepticism about the smartphone’s upcoming successor, reflecting concerns about Apple’s staple product line.

The Services business of Apple also fails to pose as a redeemer, with Long highlighting potential risks on that front. More pertinently, Long underscores concerns about Apple’s stretched valuation against the company’s actual performance, cautioning against unsustainable multiple expansion.

Is Apple Stock a Buy, According to Analysts?

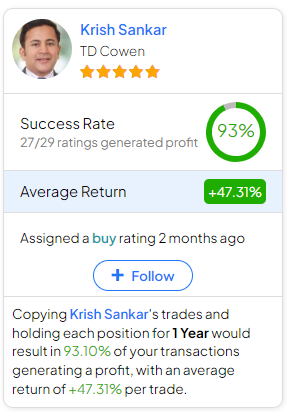

According to TipRanks, AAPL warrants a Moderate Buy, buttressed by 23 Buy, seven Hold, and one Sell rating assigned by analysts in the past three months. The average Apple stock price target is $203.04, indicating 10.2% upside potential.

For the investor pondering whose insight to heed on AAPL, the most lucrative analyst forecasting the stock (over a one-year period) is Krish Sankar of TD Cowen, yielding an average return of 47.31% per rating and a 93% success rate.

Conclusion: The Apple Dilemma

In the grand scheme of things, shorting Apple shares appears foolhardy, given the tech giant’s eminence and the potential for already pricey stocks to appreciate further. Yet, the dismissal of Apple’s China woes lacks conviction, echoing my own reservations regarding Ives’ stance.

Potential investors ought to critically deliberate Apple’s valuation, heeding Long’s admonitions. Despite being an influential company with robust long-term growth prospects, much of Apple’s anticipated growth seems factored into AAPL stock’s current valuation. Consequently, I maintain a neutral stance and refrain from contemplating a position in Apple currently.

Disclosure