There may never have been a better moment to navigate the complex terrain of the mining industry, especially for companies specializing in the extraction of copper, gold, and silver. In the midst of this deluge of opportunity stands the formidable Fitzroy Minerals Inc.FTZFF.

An imminent copper deficit looms large on the horizon, poised to catapult prices to new heights. This scarcity stems from a surge in demand for copper in various sectors such as battery applications and solar panels, compounded by the dearth of significant new copper producers entering the market in recent times – a dilemma that has persisted for an extended period.

Simultaneously, the soaring industrial demand for silver, coupled with the looming rise in investment interest as global currencies face rapid erosion, promises to impact gold prices in a parallel trajectory. Fitzroy Minerals Inc. finds itself impeccably positioned to seize the day.

The Strategic Landscape

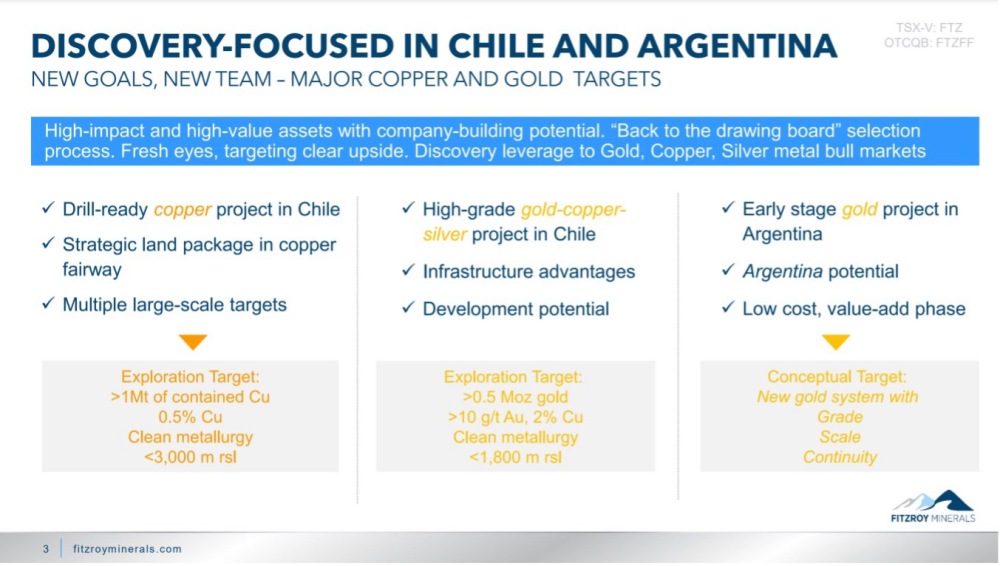

Upon delving into the fundamental fabric of the company through the lens of their most recent Investor deck, the overarching focus of Fitzroy on copper, gold, and silver projects in Argentina and Chile becomes apparent.

The snapshots within the deck unveil a compelling narrative – Fitzroy’s strategic emphasis on projects spanning Argentina and Chile, regions ripe with potential for mineral exploration and extraction.

Chile, a global copper juggernaut, emerges as a pivotal player in the quest for copper resources, making it an apt hunting ground for companies like Fitzroy. With two properties in Chile and one in Argentina, Fitzroy positions itself strategically in these mineral-rich nations.

Project Prowess

Embarking on a deeper dive, we traverse the terrain of Fitzroy’s projects, beginning with the Caballos project in Chile. Nestled proximate to Santiago and cocooned by mining behemoths like Codelco, Freeport, and Newmont, Caballos stands poised for significant discoveries, bolstered by its prestigious neighbors.

Transitioning further, the Polimet project in Chile unfurls as a promising venture, positioned advantageously near the formidable El Bronce copper mine – a harbinger of potential breakthroughs in mineral exploration.

Crossing the border into Argentina, the Taquetren Gold Project beckons, signaling Fitzroy’s foray into gold exploration, underscoring a diversified approach to mineral assets.

Future Trajectory and Financial Projections

Through a storyboard of the company’s planned trajectory across these projects into 2025, Fitzroy Minerals Inc. paints a vivid picture of its evolution on the mineral landscape – a tapestry woven with promises of growth and discovery.

With 91.2 million shares issued as of August 23, the company embarks on a new financial chapter marked by an imminent financing round involving the issuance of approximately 13.3 million shares at CA$0.15, indicative of an evolving financial landscape for Fitzroy.

Stock Performance and Prognosis

Enroute to unlocking its full potential, Fitzroy Minerals has charted an upward trajectory since October of the preceding year, hinting at an impending breakthrough from a sizeable base pattern akin to an upsloping Head-and-Shoulders bottom.

As delineated in the long-term log chart, Fitzroy inches closer to a breakthrough, driven by a convergence of indicators signalling an upward surge towards the 2021 highs. The anomalous volume drop mid-last year is dismissed as a fleeting aberration, devoid of long-term implications.

Ingrained in the 14-month chart lies a detailed exposition of Fitzroy’s recent market performance, unfurling a narrative of resilience culminating in an ascending triangle indicative of an imminent breakout above the resistance levels. Bolstered by a crescendo in upside volume, Fitzroy stands on the cusp of a transformational market incursion post-financing assimilation.

Fitzroy Minerals is thus bestowed with an Immediate Buy rating across all time horizons.

Fitzroy Minerals Inc. concluded trading at CA$0.195, US$0.13 on October 14, 2024.