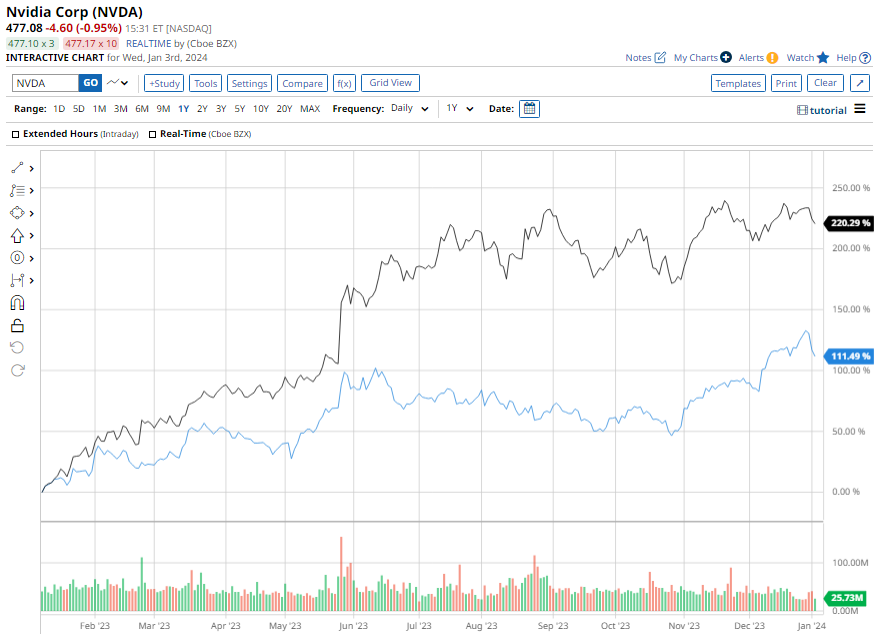

The soaring trajectory of chip stocks, particularly Nvidia (NVDA) and Advanced Micro Devices (AMD) over the past year, underscores the widespread investor optimism surrounding the artificial intelligence (AI) megatrend. Both AMD and Nvidia have carved out a niche in manufacturing specialized chips that are instrumental in fueling data centers for a variety of AI applications. In 2023, Nvidia witnessed a remarkable surge, with its stock more than tripling, while AMD’s stock also registered stellar gains of 127.6%.

However, the recent cautionary note from an analyst flags potential vulnerability for NVDA in the face of the AI hype cycle transition into the so-called “trough of disillusionment” phase. Against the backdrop of a sluggish start for tech giants in 2024, the focus shifts to discerning which semiconductor stock presents a more promising outlook for investors at present.

The Bulls Reckon on NVDA Stock

Nvidia’s strong positioning to capitalize on the forthcoming generative AI adoption in the next decade is evident from its formidable fiscal Q3 2024 performance, culminating in sales of $18.1 billion, marking a remarkable 206% surge year over year, largely propelled by its data center segment.

Amid its substantial scale, analysts anticipate a staggering 118.4% sales upsurge to $59 billion for fiscal 2024, followed by a 56.5% leap to $92.3 billion in fiscal 2025. Furthermore, the forecast for adjusted earnings per share to grow annually by 102.5% over the next five years positions NVDA stock attractively priced at 24.2 times forward earnings, given its exceptional growth projections.

Market research by Gartner indicates a projected surge in AI chip sales to $67 billion in 2024, up by 25% year over year, with Nvidia currently commanding an approximately 80% market share in this sphere, projecting revenue to reach around $54 billion in the next year, provided the demand for AI chips sustains its exponential growth trajectory.

With 30 out of 35 analysts advocating a “strong buy” for NVDA stock and an average target price of $653, signaling a 37% upside potential from current levels, the sentiment in the market remains largely bullish for Nvidia’s stock.

The Bulls Reckon on AMD Stock

The astronomical growth of AMD, culminating in a staggering 3,710% rise since January 2014, together with CEO Lisa Su’s forecast of the data center AI chip vertical escalating from $45 billion in 2023 to a monumental $400 billion in 2027, places the company on a trajectory for substantial top-line expansion in the forthcoming years.

In addition to its AI prospects, AMD stands to benefit from the growth in its legacy businesses, encompassing graphics and enterprise processors. Not without its share of challenges, AMD navigated through headwinds stemming from slowing PC sales, elevated costs, heightened interest rates, and diminished enterprise spending, compounded by geopolitical tensions affecting its operations in China.

Despite a forecasted 4% dip in sales year over year to $22.65 billion in 2023, projections point to a 16.6% revenue upswing to $26.4 billion in 2024. Moreover, the envisaged expansion of adjusted earnings per share from $2.65 in 2023 to $3.73 in 2024 underpin a forward earnings multiple of 39.5, showcasing AMD’s growth trajectory albeit at a somewhat steeper valuation relative to NVDA.

With the majority of analysts giving a vote of confidence to AMD stock, as reflected by 23 “strong buy” recommendations out of 29 analysts, and an average target price of $135.07, hinting at a marginally lower position compared to the stock’s present levels, there is a discernible sense in the market that NVDA may hold more upside potential relative to AMD in the coming year.