Chinese e-commerce giant Alibaba’s domestic platforms, Taobao and Tmall, will start accepting payments through Tencent’s payment service, WeChat Pay, from September 12. This move aligns with recent Chinese regulations encouraging collaboration among domestic tech companies and breaking down isolated ecosystems.

The integration, which was initially tested with a limited user group, is expected to be rolled out widely within weeks.

The Benefits of the Deal for Alibaba

Previously, Alibaba’s marketplaces relied solely on Alipay, its own payment system. However, with the integration of WeChat Pay, Alibaba is set to improve the user experience by offering more payment options to customers.

This integration also offers a strategic advantage in expanding Alibaba’s reach, particularly by accessing Tencent’s extensive network of 1.37 billion users. Additionally, it strengthens Taobao and Tmall’s ability to counter growing competition from newer rivals like JD.com and Pinduoduo.

Assessing Alibaba’s Investment Potential

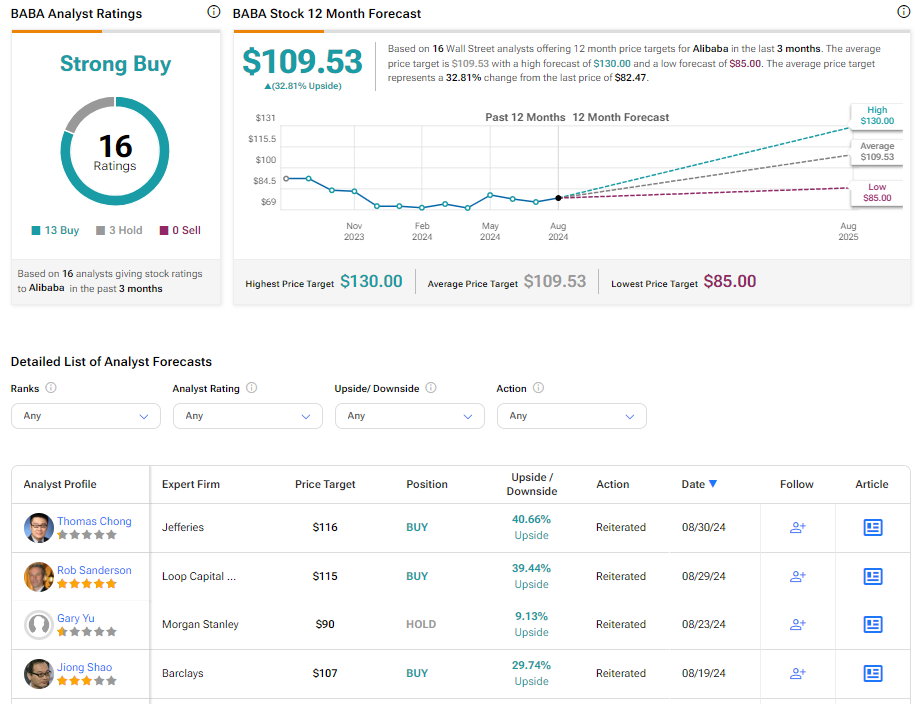

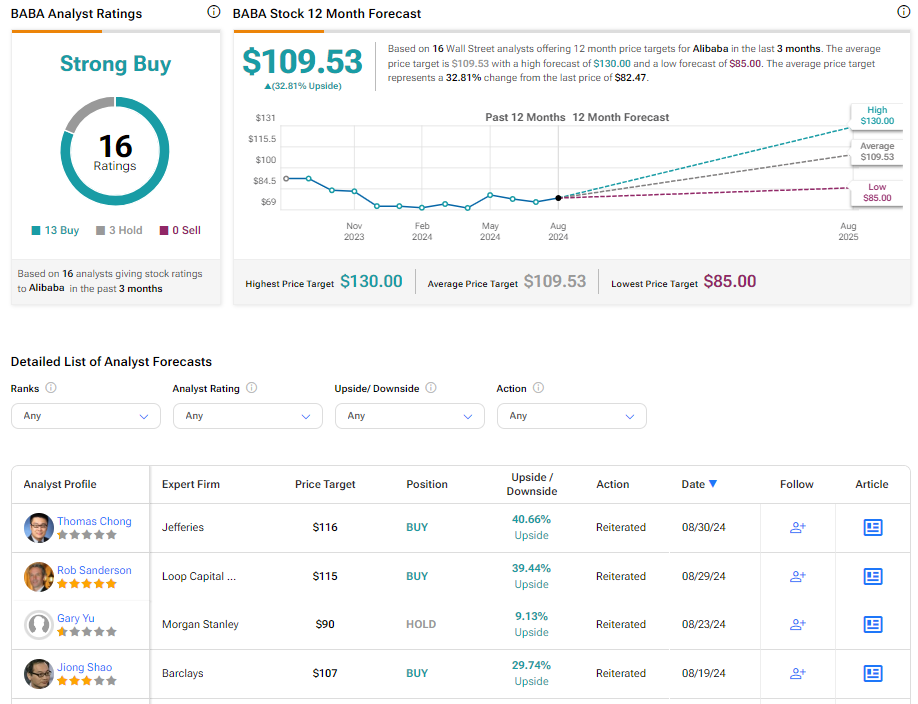

Overall, Wall Street is optimistic about the stock. Alibaba has a Strong Buy consensus rating based on 13 Buys and three Holds. The analysts’ average price target on Alibaba stock of $109.53 implies a 32.81% upside potential from current levels. Shares of the company have gained 16.9% over the past six months.

Explore more analyst ratings for Alibaba here