We find ourselves deep in the throes of the 2024 Q1 earnings season with an impressively packed schedule of earnings releases lined up for this week. Thus far, the atmosphere has been largely positive, with results from major banks failing to stir any turbulence.

This week’s spotlight shines on American Airlines (AAL) and Southwest Airlines (LUV). So, what can investors anticipate? Drawing insights from peer company United Airlines (UAL) may illuminate the runway ahead. Let’s delve deeper.

United Airlines: Soaring Performance

United Airlines (UAL) rocketed past expectations, boasting a 71% beat on the Zacks Consensus EPS estimate and surpassing sales forecasts, showing significant improvement over the previous year. Notably, UAL’s financial soar could have been even higher if not for the $200 million dent caused by the grounding of the Boeing 737 MAX 9.

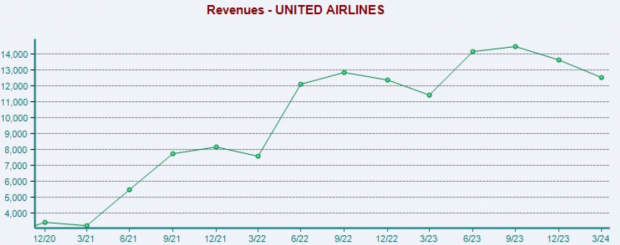

An illustrative chart depicting the company’s revenue trajectory is showcased below.

Image Source: Zacks Investment Research

The skies are looking bright with consumer interest in travel still soaring, as UAL’s capacity has climbed by 9.1% year-over-year. Additionally, the drop in fuel prices to $2.88 per gallon from $3.13 in the prior quarter has further fueled profitability. The company reaffirmed its annual forecast, expecting an adjusted EPS ranging from $9 to $11 for 2024. The market responded with enthusiasm, propelling shares higher post-announcement.

American Airlines: Navigating Turbulence

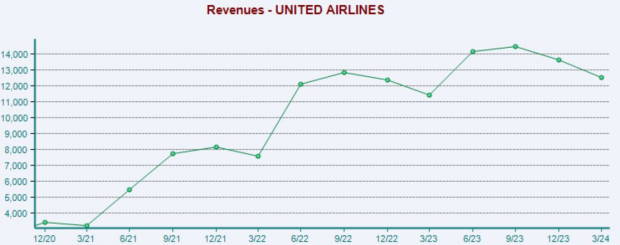

Market analysts have flipped the script on earnings estimates for American Airlines (AAL), with the current Zacks Consensus EPS estimate of -$0.28 exhibiting an uptick from the -$0.32 projected at the close of March. Revenue predictions have painted a positive outlook for the year, with an expected $12.6 billion overshadowing the $12.5 billion anticipated back in January.

Image Source: Zacks Investment Research

Remarkably, AAL has outperformed expectations significantly in recent times, surpassing the consensus EPS estimate by a massive 120% across its last four financial unveilings.

Southwest Airlines: Aiming for Clear Skies

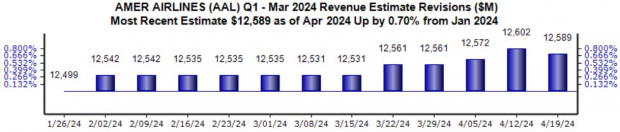

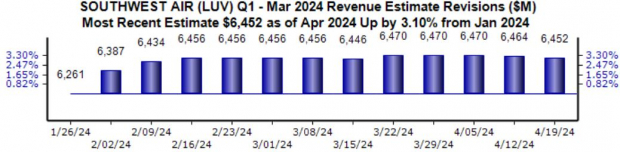

The forecast for Southwest Airlines (LUV) has been clouded with negativity, as the Zacks Consensus EPS estimate of -$0.31 has plummeted notably from the -$0.19 mark recorded in mid-March. Despite this, there is a silver lining in revenue revisions, with the expected $6.4 billion now showing a modest 3% increase.

Image Source: Zacks Investment Research

Similar to AAL, Southwest has been riding a wave of success lately, surpassing our consensus EPS estimates by an average of 52% over its most recent four releases.

Crucial Insights for Investors

As American Airlines (AAL) and Southwest Airlines (LUV) prepare to reveal their financial performance, analyzing United Airlines’ (UAL) recent triumph can offer valuable insights into consumer behaviors. UAL’s robust quarterly results, fueled by capacity growth and lower fuel costs, inspire optimism. However, it is vital to recognize that challenges faced by UAL due to the Boeing 737 MAX grounding do not directly impact LUV or AAL, as these carriers do not operate the specific aircraft.