The rollercoaster ride of the cryptocurrency market in the first week of August left many investors reeling. Bitcoin, the flagbearer of virtual currencies, soared to an all-time pinnacle of $73,750 on March 14. Nonetheless, the recent market upheaval precipitated a downturn for cryptocurrencies, with Bitcoin plummeting below $55,000.

The year started with a bang for Bitcoin after the approval of 11 spot Bitcoin exchange-traded funds (ETFs) by the Securities and Exchange Commission in January. This decision marked a watershed moment in Bitcoin’s evolution, providing both individual and institutional investors a secure avenue to engage with the cryptocurrency, thereby adding heft to liquidity and price stability.

Despite the earlier optimism, Bitcoin’s value has been on a downward trajectory since April. One significant factor contributing to this decline was the halving event in April. The halving event reduces block rewards by half to maintain a finite supply of 21 million coins, typically stoking demand and raising prices. However, Bitcoin’s value dipped significantly, breaching the $59,000 mark.

Recent wobbles in economic metrics, notably concerning labor markets, have set the stage for potential interest rate cuts assessed via the CME FedWatch. The probability of a 25-basis point cut in September stands at 100%, with a 51.5% likelihood of a 50-basis point cut. Looking to November and December, participants foresee a further reduction, underscoring an imminent shift in monetary policy.

Despite short-term jitters, investors should adopt a macroscopic viewpoint. The Federal Reserve appears poised to phase out its high-interest rate regime, a boon for growth-oriented sectors like technology, consumer discretionary, and, intriguingly, cryptocurrency.

Therefore, proponents of the long game recommend a strategy of accumulating Bitcoin, capitalizing on market dips. Each price downturn is an entry point, paving the way for substantial gains once the Federal Reserve’s monetary grip slackens.

Exploring Potential Investment Options

From the realm of bitcoin-centric companies, we focus on five stocks carrying robust potential for the remainder of 2024.

CME Group Inc., through its CME options, empowers traders with the ability to transact cryptocurrency futures contracts at predetermined prices in the future. Offering Bitcoin, ether options, and standard/micro futures, CME holds an expected year-on-year earnings growth of 4.9%. The Zacks Consensus Estimate for its current-year earnings has risen by 0.3% over the past month, with a current Zacks Rank of #3 (Hold).

NVIDIA Corp. stands tall in the semiconductor realm, basking in the glow of a remarkable journey over 2023 and 2024. As a GPU design luminary, NVIDIA’s fortunes surge in tandem with a thriving crypto market – GPUs play a pivotal role in data centers, AI, and creating crypto assets. Anticipating an earnings growth exceeding 100% for the current year, NVIDIA carries a Zacks Rank #2 (Buy).

Interactive Brokers Group Inc. is a global e-broker providing clients with avenues to engage in cryptocurrency trading through its commodities futures desk. With an anticipated annual earnings growth rate of 18.4%, Interactive Brokers boasts a Zacks Rank #1 (Strong Buy).

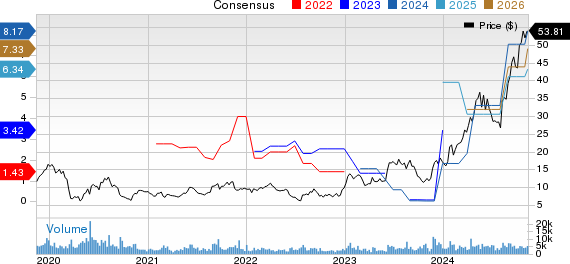

Robinhood Markets Inc. operates a finance platform in the U.S., enabling users to invest in stocks, ETFs, and cryptocurrencies. Robinhood offers Bitcoin, Ethereum, and Dogecoin trading via its platform. Exhibiting an expected earnings growth rate of over 100%, Robinhood Markets holds a Zacks Rank #2.

Block Inc., the parent company of Square and Cash App, offers users the ability to buy, sell, and transact Bitcoin. With an anticipated earnings growth rate of 98.9%, Block has seen a 9.2% surge in its Zacks Consensus Estimate for the current year earnings in the past month, and currently carries a Zacks Rank #3.

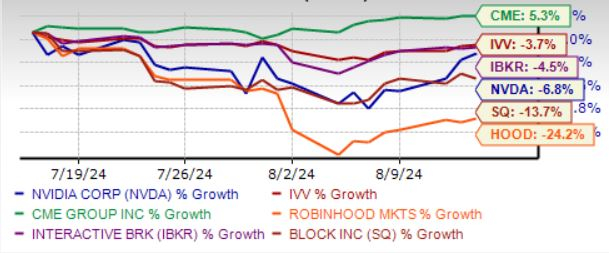

The chart below illustrates the performance of the aforementioned stocks over the past month:

Image Source: Zacks Investment Research

Discover 5 Stocks Poised for Significant Growth

Handpicked by Zacks experts as top contenders for over 100% growth in 2024, these stocks have the potential to replicate previous success stories, exhibiting gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks showcased in this report are currently off Wall Street’s radar, offering a ripe opportunity to enter the market at an advantageous juncture.

Today, See These 5 Potential Home Runs >>

CME Group Inc. (CME) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Block, Inc. (SQ) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report