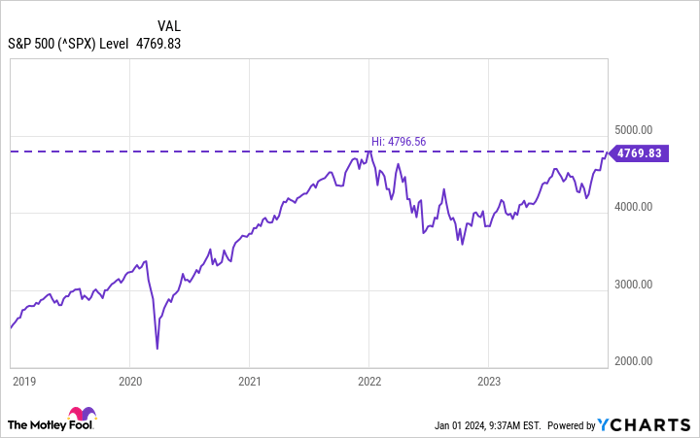

The benchmark S&P 500 index plunged into a bear market in 2022 when it fell more than 20% from its all-time high. But following a strong 2023, it recovered nearly all of that lost ground.

The index is on the cusp of setting a new record high, which would mark the official beginning of a new bull market. It only needs a gain of 0.5% to get there.

Data source: YCharts.

History suggests 2024 will likely be another positive year for the stock market, which would practically guarantee the S&P 500 enters bull territory. With that in mind, here’s why investors might want to begin the year with shares of the world’s two largest companies: Microsoft(NASDAQ: MSFT) and Apple(NASDAQ: AAPL).

Microsoft: A Tech Giant’s Fortunes

Microsoft opened its doors in 1975 as a software company, and it went public in 1986 valued at $777 million. After diversifying into hardware, gaming, cloud computing, and artificial intelligence (AI) over the last 48 years, Microsoft amassed a valuation of $2.8 trillion. It trails only Apple for the title of world’s largest company.

That significant value creation prompted Microsoft to execute nine stock splits since 1987 to ensure its shares remained accessible to small investors — who might be grateful right now, considering it soared 57% in 2023, doubling the return of the S&P 500. And 2024 could be another strong year as the company ramps up efforts to monetize its growing portfolio of AI products.

Management started 2023 with a bang when it agreed to invest $10 billion in top generative AI start-up OpenAI, which is responsible for the ChatGPT chatbot. Microsoft has since embedded that technology into its Windows operating system, Edge internet browser, Bing search engine, Microsoft 365 document suite, and Azure cloud computing platform.

Azure OpenAI Service allows businesses to access OpenAI’s latest GPT-4 models to help them build their own AI applications. The service started calendar year 2023 with just 200 customers, but within nine months, over 18,000 organizations had signed up. I anticipate that number will grow significantly this year as businesses race to embed AI into their operations to boost efficiency.

Microsoft is also running an early-access program for its ChatGPT-powered Copilot technology in Microsoft 365 applications. Now, businesses can harness the power of AI in Word, Excel, PowerPoint, Outlook, and Teams for $30 per employee, per month. The company says 40% of the Fortune 500 companies are participating in the early-access program, including giants like Visa and KPMG.

According to Statista, over 1.3 million companies use Microsoft 365, so the ability to charge them more for AI-enabled versions could be a seismic financial opportunity.

Microsoft’s fiscal 2024 will end on June 30 this year. Wall Street analysts estimate the company will deliver $243 billion in revenue, an increase of 14.8% year over year. Its earnings per share are expected to jump 14.5% to $11.24.

It places the stock at a forward price-to-earnings (P/E) ratio of 33.5, which is a slight premium to the Nasdaq-100 technology index. However, the company’s presence in AI might still warrant further gains. Leading Wall Street technology analyst Dan Ives at Wedbush recently named Microsoft as his top pick, and he thinks the stock could hit $450 in 2024 thanks to AI. That implies an upside of almost 20%.

Image source: Getty Images.

Apple: A Fruitful Journey Continues

Apple was founded in 1976, and it went public in 1980 valued at $1.8 billion. It now generates that much in revenue every 40 hours and became the first company in history to amass a $3 trillion valuation.

Like Microsoft, it has created so much value that its management executed five stock splits since 1987 to keep its shares accessible to small investors.

The catalyst behind the bulk of Apple’s market value is the iPhone, which was introduced in 2007. It has taken consumers on a journey packed with innovation, like the smartphone’s high-resolution displays, its camera technology, and its app ecosystem. But the latest iPhone 15 lineup sets the stage for what could be the next big value creator: on-device artificial intelligence.

The iPhone 15 is fitted with the Apple-designed A17 Pro processor, which is the smartphone industry’s first 3-nanometer chip. Simply put, the brain of the iPhone is now smaller, faster, and more efficient than ever.

Its neural engine, which processes AI and machine-learning workloads, delivers a twofold performance boost over its predecessor, the A16 Bionic. That allows the iPhone to manage AI

Apple’s Innovations in AI and Virtual Reality Set the Stage for a Transformative 2024

The Next Big Leap in AI

Apple, renowned for its technological prowess, is set to revolutionize the world of AI. The company’s plans to develop its own large language models and a generative AI application called Apple GPT signify a pivotal moment in the industry. Imagine a future where Apple’s AI innovations are seamlessly integrated into every aspect of your iPhone, driven by the device’s own chip hardware. From personalized messages and emails to automated image and video content creation, the potential applications are boundless.

Virtual Reality: Apple’s Vision Pro

In addition to its AI endeavors, Apple is gearing up to launch its Vision Pro, a highly anticipated virtual reality headset. Priced at $3,499, the Vision Pro is anticipated to unleash a wave of new gaming and entertainment experiences. While initial sales volume might not be substantial given its premium pricing, its release signals Apple’s foray into a new product category, the first since the debut of its watch in 2015.

Financial Insights and Outlook

Despite concerns over sluggish revenue growth, Apple stands firm in its commitment to rewarding shareholders. With Wall Street estimating a modest 3.5% year-over-year revenue increase to $396 billion in fiscal 2024, Apple continues to exert financial strength through significant stock buybacks and dividend payments. In fiscal 2023, the company repurchased $77.5 billion worth of its own stock and disbursed $15 billion in dividends, garnering substantial favor among prominent investors such as Warren Buffett.

Strategic Maneuvering in 2024

Amid its remarkable technological advancements, Apple remains on course for a potentially transformative 2024. As the company solidifies its groundwork in AI and prepares for widespread consumer interaction with the Vision Pro platform, the year is poised to be one of the most dynamic periods in Apple’s storied history.

Conclusion

The intersection of AI and virtual reality presents Apple with an opportunity to redefine consumer technology. Its strategic initiatives and financial fortitude position the company for sustained innovation and competitiveness in the ever-evolving landscape of tech. As 2024 unfolds, Apple’s narrative as a tech juggernaut is set to reach new heights, propelling the company into a future defined by groundbreaking AI applications and immersive virtual experiences.