Technology stocks are having a terrific 2024 thanks to strong demand for Artificial Intelligence (AI)-enabled services that are helping in the ongoing digital transformation. The rapid evolution of Generative AI (GenAI) technology is noteworthy, and it continues to attract large spending from big technology companies, including Alphabet, Meta Platforms and Microsoft MSFT.

The strong demand for data center chips that can power huge Large Language Models (LLMs) bodes well for semiconductor sales. The World Semiconductor Trade Statistics (WSTS) projects global sales to reach $611.2 billion in 2024, indicating a 16% increase over 2023, up from the previous guidance of 13.1%. For 2025, WSTS global sales are expected to grow 12.5%, ultimately reaching $687.4 billion.

These factors have helped the tech-laden Nasdaq Composite to appreciate more than 26% year to date (YTD). The momentum is expected to continue in the remainder of the year and into 2025, with stable economic growth and cooling inflation expected to boost the upswing in consumer confidence.

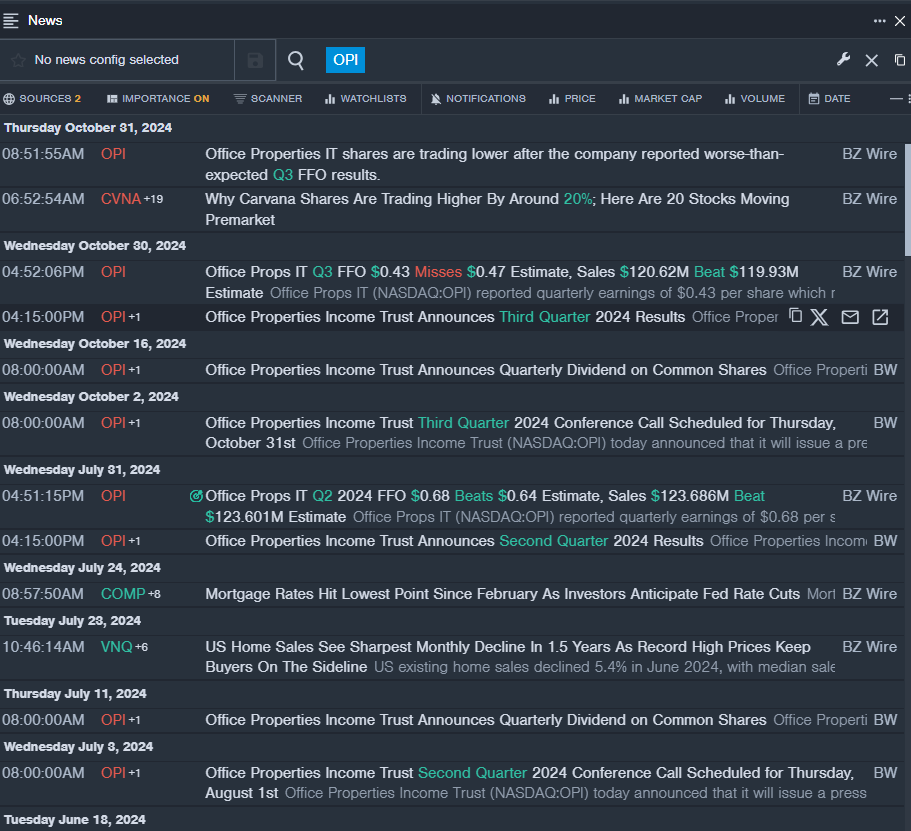

American Superconductor AMSC, Vertiv VRT, Toast TOST and Impinj PI are four technology stocks well-poised to benefit from the positive momentum. Shares of AMSC, VRT, TOST and PI have appreciated 210.7%, 176.9%, 135.5% and 115.1%, respectively, YTD. The Zacks Computer & Technology sector has returned 27.4% over the same timeframe.

YTD Performance

Image Source: Zacks Investment Research

Tech Sector’s Prospects Rides on AI

AI-related software and services are attracting huge amounts of investments. Gartner projects spending on AI software to witness a CAGR of 19.1% between 2023 and 2027, reaching $297 billion by 2027. Spending on GenAI software alone is expected to soar from 8% in 2023 to 35% by 2027.

Per CNBC, which cited data from Menlo Ventures, business spending on GenAI has jumped 500% in 2024 to reach $13.8 billion from $2.3 billion in 2023. Foundation LLMs — ChatGPT, Gemini, Claude and others — have received $6.5 billion in enterprise investment.

IDC expects spending on technology to support AI strategies globally will reach $337 billion in 2025, and more than double to $749 billion by 2028. More than 67% of anticipated AI spending in 2025 will be wanted by enterprises embedding AI capabilities into core business operations.

Deloitte expects 25% of enterprises (50% by 2027) using GenAI will deploy AI Agents, a step beyond Chatbots. AI Agents require minimal human intervention to complete tasks.

4 Tech Stocks to Ride on Tech’s Strong Prospects

Each of the four stocks — American Superconductor, Vertiv, Toast and Impinj — have a favorable combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per the Zacks proprietary methodology, stocks with this favorable combination offer good investment opportunities.

Let’s delve deep to find out why these four are attractive investments.

American Superconductor

AMSC has a Growth Score of A.

In second-quarter fiscal 2025, American Superconductor booked roughly $60 million of new orders with new Energy Power Systems, including strong contributions from industrials, renewables, utilities, semiconductors and mining. AMSC ended the fiscal quarter with a 12-month backlog of more than $200 million and a total backlog of over $300 million.

The acquisition of NWL, a private company based in New Jersey that provides power supplies to industrial and military customers, has been a major contributor as it expanded AMSC’s clientele significantly. The growing power demand for AI data centers is a key catalyst.

The Zacks Consensus Estimate for 2024 earnings is pegged at 50 cents per share, up 61.3% over the past 60 days. AMSC reported earnings of 2 cents per share in 2023.

American Superconductor Corporation Price and Consensus

American Superconductor Corporation price-consensus-chart | American Superconductor Corporation Quote

Vertiv

Vertiv, a cooling and power management infrastructure provider, predominantly serves data center providers and has been capitalizing on robust AI-driven order growth. The growing focus on thermal management by data center operators aligns well with Vertiv’s strengths, and the company is poised to meet the increasing demand with advanced, efficient solutions.

VRT has been benefiting from strong order growth and backlog. At the end of the third quarter of 2024, Vertiv hit a backlog of $7.4 billion, which increased 47% year over year and 5% sequentially. The quarterly results reflected continued order momentum. Organic orders (excluding foreign exchange) surged 19.2% year over year in the third quarter.

For 2024, Vertiv expects revenues between $7.78 billion and $7.83 billion, indicating an organic growth rate of 13-15% year over year. Non-GAAP earnings are expected between $2.66 and $2.70 per share.

The Zacks Consensus Estimate for 2024 earnings is pegged at $2.69 per share, up 4.3% over the past 60 days and indicating 51.98% year-over-year growth.

Vertiv has a Growth Score of B.

Vertiv Holdings Co. Price and Consensus

Vertiv Holdings Co. price-consensus-chart | Vertiv Holdings Co. Quote

Toast

TOST has a Growth Score of A.

Toast is expanding among small and medium businesses in the United States and plans to expand its total addressable market internationally, covering enterprise restaurants and food and beverage retail. It added 7,000 locations in the third quarter of 2024.

Location increases, international expansion and a larger share of repeat customers are driving Toast’s Annual Recurring Revenue. Higher adoption of its solutions among customers is mainly due to its suite-based packaging model that simplifies sales and encourages customers to adopt more of the platform over time, boosting Average Revenue Per User.

The Zacks Consensus Estimate for 2024 earnings is pegged at 2 cents per share compared with a loss of 10 cents over the past 60 days. TOST reported a loss of 47 cents per share in 2023.

Toast, Inc. Price and Consensus

Toast, Inc. price-consensus-chart | Toast, Inc. Quote

Impinj

Impinj is riding on growing demand for its products and services, a wider customer base and the successful deployment of large-scale RFID solutions. A significant portion of Impinj’s revenues comes from its Endpoint ICs segment, which surged 67% year over year to $81 million in the third quarter of 2024.

PI is winning clients by focusing on creating RFID solutions that are scalable, efficient and advanced. Impinj’s technology is designed to meet the needs of various industries like retail, logistics, healthcare and supply-chain management.

Impinj has been expanding into the food tagging sector, focusing on quick-service restaurants and grocery pilot programs. This new market is anticipated to be much larger than its current business segments, offering significant growth potential.

The Zacks Consensus Estimate for 2024 earnings is pegged at $2.05 per share, up 6.2% over the past 60 days. The figure indicates 192.86% growth from the figure reported in 2023.

Impinj has a Growth Score of A.

Impinj, Inc. Price and Consensus

Impinj, Inc. price-consensus-chart | Impinj, Inc. Quote

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Microsoft Corporation (MSFT) : Free Stock Analysis Report

American Superconductor Corporation (AMSC) : Free Stock Analysis Report

Impinj, Inc. (PI) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

Toast, Inc. (TOST) : Free Stock Analysis Report