The “Magnificent Seven” is a name bestowed upon a cluster of distinguished tech behemoths. Among them are Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), Meta (NASDAQ: META), and Tesla (NASDAQ: TSLA). In this elite group, Tesla stands as the smallest member with a market cap of around $700 billion. Without a doubt, these are colossus enterprises.

Each of the Magnificent Seven holds its allure for investors, but presently, Microsoft shines the brightest in my eyes. If you are considering investing $1,000 (after securing an emergency fund and clearing high-interest debts), Microsoft could be the cornerstone of your investment portfolio.

Microsoft: A Versatile Tech Maestro

Microsoft’s appeal for 2025 stems from its diversified business approach amongst the Magnificent Seven. While the fortunes of other members hinge heavily on specific products or services, Microsoft’s success is not staked on a singular offering. To elucidate, consider the pivotal products or services dictating the fate of other Magnificent Seven stocks:

- Apple: The trajectory of Apple mirrors that of the iPhone. Strong iPhone sales elevate Apple’s revenue growth, while any downturn places a significant weight on the company’s financials.

- Nvidia: Nvidia’s prosperity intertwines with the sales of its graphic processing units, now integral components in the artificial intelligence domain.

- Alphabet: The cornerstone of Alphabet rests on advertising through Google Search. Any hitches in the advertising sphere directly impact Alphabet’s bottom line.

- Amazon: E-commerce serves as Amazon’s fundamental revenue source. While Amazon Web Services generates substantial profits, e-commerce fuels the company’s diverse ventures.

- Meta: Over 98% of Meta’s revenue is attributed to advertising. Any slowdown in digital ads can impede the company’s financial progress.

- Tesla: Scaling electric vehicle production and maintaining an industry lead are critical for Tesla. Without these, the company faces steep challenges.

This is not to diminish the other businesses; my belief in most of them remains steadfast. Rather, it underscores Microsoft’s expansive business reach.

Microsoft boasts segments in enterprise software, consumer software, cloud services, gaming, social media, hardware products, without over-reliance on any singular domain. Its primary business segment, Intelligent Cloud, contributes only about 44% of its overall revenue.

Microsoft’s Rock-Solid Financial Foundation

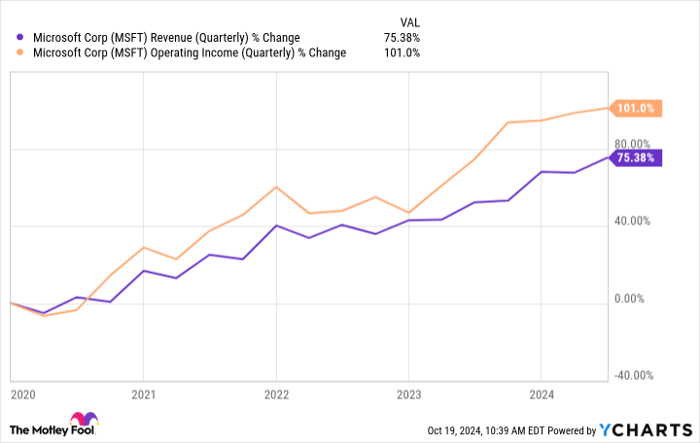

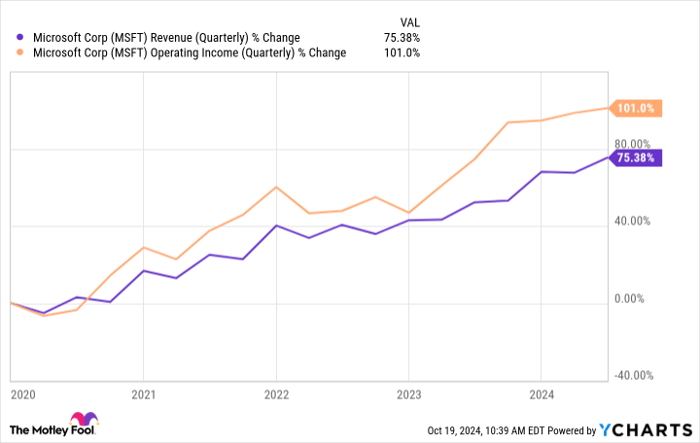

Microsoft’s financial prowess in recent years speaks volumes. In the fourth quarter of fiscal 2024 (ending June 30), its revenue and operating income surged by 15% year-over-year, reaching $64.7 billion and $27.9 billion, respectively.

MSFT Revenue (Quarterly) data by YCharts.

Over the past five years, Microsoft has doubled its operating income, a remarkable achievement for a corporation of its magnitude. This growth underscores operational efficiency and the expansion of high-margin ventures like Azure, its cloud platform.

Cloud computing remains a focal point for Microsoft’s high-growth trajectory in the immediate future. Even if growth moderates from previous years (although that seems unlikely), it will still add substantial value to Microsoft’s financial metrics.

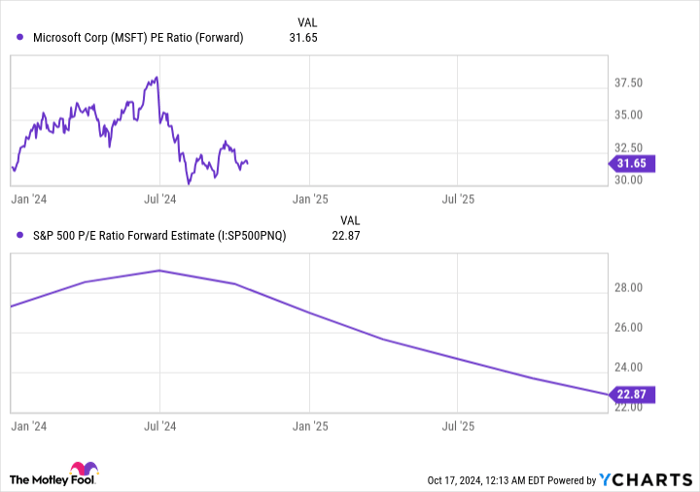

Valuable Investment Despite Premium Pricing

Granted, Microsoft commands a premium price, a prevailing trend for some time now. Its shares trade at approximately 31.6 times forward earnings, markedly higher than the S&P 500’s average of 22.8. Yet, elite companies like Microsoft seldom come at discounted levels, so this is hardly surprising.

MSFT PE Ratio (Forward) data by YCharts.

Investing in a premium stock involves the risk of capping short-term upside potential. Thankfully, Microsoft prioritizes rewarding shareholders through dividends and stock buybacks.

With a quarterly dividend of $0.83, offering a yield of around 0.8% at current prices, Microsoft has consistently raised its payouts over the years. Investors can also find solace in Microsoft’s recently announced $60 billion stock buyback scheme.

If you seek an undervalued gem or a steady income stock, Microsoft may not fit the bill. Nonetheless, for long-term investors, Microsoft presents a stable option that can be held with confidence, disregarding current valuation concerns.

Seize the Moment for a Potentially Lucrative Venture

Ever lament missing out on lucrative stock opportunities? Then this is for you.

Insider’s “Double Down” Stock Recommendations Set Investors Aflame

Uncovering the Lucrative Path

Imagine a treasure map that lays bare the path to untold riches. The siren song of potential wealth echoes down the corridors of history, resonating with power and promise.

The Illuminated Path

In the annals of investment lore, a sacred few have walked this illuminated path—the “Double Down” connoisseurs, whispering secrets of market fortune to those who dare to listen. Numbers don’t lie; they sing, each digit a symphony of success.

Unveiling the Alleged Titans

According to the heralds of prosperity, certain behemoths tower above the rest—a triumvirate of Amazon, Apple, and Netflix. The past, a tapestry woven with golden threads of opportunity, beckons as proof.

- Amazon: Enter the time machine to 2010, invest $1,000, and emerge with the Midas touch—$21,294!*

- Apple: Frequent the market streets in 2008, bet $1,000, and discover a pot of gold—$44,736!*

- Netflix: Venture into 2004’s financial wilderness, stake $1,000, and claim your treasure—$416,371!*

The past, a mere prologue to the future now unfolds before us. The stars are aligning once more, offering a glimpse into unparalleled possibilities.

Charting a Course Towards Riches

Today, the voices of providence whisper from the shadows, revealing new “Double Down” beacons—three illustrious companies overlooked by the masses. The clock ticks, the window of opportunity shrinking with each passing moment.

Don’t be left in the shadows. Embrace the future and explore these three hidden gems that could redefine your financial fate.

*Stock Advisor returns as of October 21, 2024

In a world where giants roam and fortunes are made with astute vision, the sage words resonate. Like investing maestros before us, taking the leap could transform fortunes. The cogs of history turn, and choices now will paint the portrait of the future—will you be the brushstrokes on the canvas of wealth?