When markets sway like a ship in a storm, many investors seek solace in high-dividend yielding stocks. These stalwarts are often companies flush with cash, generously rewarding their shareholders with hearty dividend payouts.

Investors can now tap into the wisdom of Wall Street’s savviest analysts to glean insights into top high-yielding financial stocks. Among the ocean of analyst ratings, traders can navigate through a sea of data to discover the highest accuracy voices in the industry.

Let’s dive into the assessments by the most precise analysts for three notable high-yielding stocks in the financial sector.

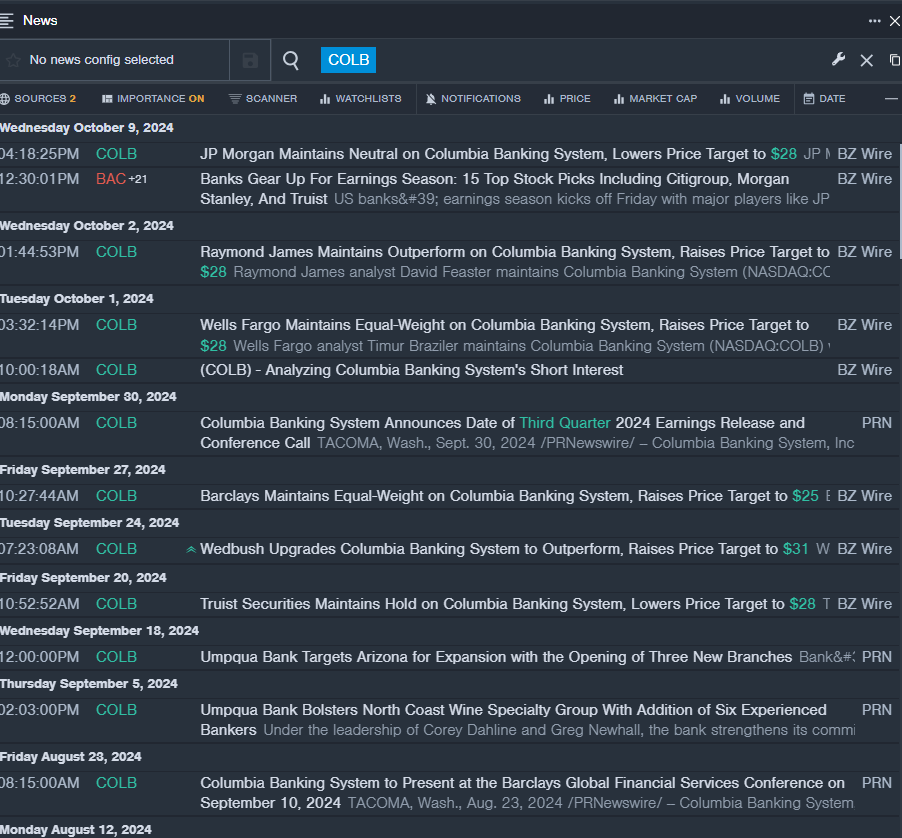

Columbia Banking System, Inc. COLB

- Dividend Yield: 5.19%

- JP Morgan analyst Steven Alexopoulos maintained a Neutral rating, adjusting the price target from $29 to $28 on October 9. This analyst boasts an accuracy rate of 71%.

- Raymond James analyst David Feaster upheld an Outperform rating and lifted the price target from $26 to $28 on October 2, with an accuracy rate of 68%.

- Recent News: Columbia Banking System is set to unveil its third-quarter financial results on Thursday, October 24, prior to the market’s opening bell.

- Benzinga Pro’s instantaneous news stream kept traders informed about the latest COLB updates.

Lincoln National Corporation LNC

- Dividend Yield: 5.35%

- Wells Fargo analyst Elyse Greenspan sustained an Equal-Weight rating and raised the price target from $28 to $29 on October 10, demonstrating a 68% accuracy rate.

- TD Cowen analyst Daniel Bergman initiated coverage on the stock with a Hold rating and a price target of $34 on October 9, boasting a 66% accuracy rate.

- Recent News: Lincoln Financial is projected to announce its third-quarter results on October 31.

- Benzinga Pro’s up-to-the-minute feed ensured traders were abreast of the latest LNC developments.

Main Street Capital Corporation MAIN

- Dividend Yield: 7.86%

- Morgan Stanley analyst Devin McDermott upgraded the stock from Underweight to Equal-Weight, setting a price target of $24 on September 16, recording an impressive 80% accuracy rate.

- Barclays analyst Theresa Chen maintained an Equal-Weight rating and raised the price target from $21 to $22 on September 13, backed by a robust 78% accuracy rate.

- Recent News: Main Street reported a preliminary estimate of third-quarter net investment income ranging from 99 cents to $1.01 per share on October 15.

- Benzinga Pro’s charting tool provided traders with insights into the evolving trends of MAIN stock.

Dive Deeper: Fuel your financial acumen with the latest market news and data curated by Benzinga APIs