Celebrating the bull market’s second anniversary, Wall Street saw the S&P 500 closing at record highs. Over the past two years, the S&P 500 has skyrocketed by more than 60%, marking a remarkable journey from its closing low of 3,577.03 as reported by Dow Jones Market Data.

The unrelenting pace of the bull market owes its resilience to the sturdy U.S. economy and the groundbreaking strides made in artificial intelligence (AI). With AI continuing to gain momentum, the S&P 500 is anticipated to ascend further in the remaining months of the year and into the next. The widespread integration of AI is predicted to amplify real GDP growth, bolster earnings per share (EPS), and enhance the S&P 500’s intrinsic value.

The Rising AI Phenomenon: NVIDIA & PLTR Shine Bright

The advent of the AI revolution has ushered in an era of practical applications that drive efficiency and cut operational costs. Companies that stand out in harnessing the power of AI, such as NVIDIA Corporation (NVDA) and Palantir Technologies Inc (PLTR), have reaped substantial rewards.

NVIDIA is renowned for its pivotal role in providing essential technologies for AI applications. Their graphic processing unit (GPU) is fundamental to the infrastructure that powers large language models and AI interfaces. On the other hand, Palantir’s AI software, like the Artificial Intelligence Platform (AIP), has garnered significant success in the tech landscape.

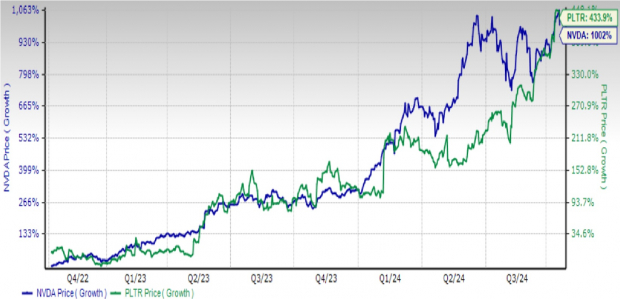

Over the last two years, NVIDIA and Palantir witnessed jaw-dropping stock surges of 1002% and 433.9%, respectively. Bolstered by the ongoing AI fervor, these tech giants are poised for further upward trajectory.

NVIDIA’s Growth Drivers in the AI Arena

The recent move by the Biden administration to restrict U.S. chip exports may pose a challenge for NVIDIA, but the soaring demand for Blackwell chips is anticipated to elevate its stock value.

CEO Jensen Huang’s affirmation of the intense demand for Blackwell chips, currently in full production, underscores their superior AI processing capabilities compared to existing alternatives. NVIDIA’s dominance in the GPU market, accounting for over 80% share, positions it favorably in a market set to soar to $1,414.39 billion by 2034, according to Precedence Research.

Moreover, NVIDIA’s efficient CUDA software platform continues to attract developers over competitors like Advanced Micro Devices, Inc (AMD). This preference is reflected in the 72.4% surge in NVIDIA’s Zacks Consensus Estimate for earnings per share compared to a year ago.

The Palantir Journey in the AI Landscape

Palantir has emerged as a key player in the AI domain, notably through its association with government contracts. The company’s software solutions have significantly contributed to enhancing governmental data aggregation processes, leading to cost savings and operational efficiency.

Recent quarters have seen a notable shift with Palantir witnessing a surge in commercial clientele following the launch of AIP. This shift translated into a 55% revenue increase to $159 million in the U.S. commercial sector alongside an 83% spike in customer count, underscoring the commercial demand for AIP. Notably, Palantir had a mere 14 U.S. commercial clients four years ago.

Even as traditional government revenues for Palantir registered a 23% uptick, sustained demand for Palantir’s AIP sets the stage for further share price escalation. With the AI market forecasted to reach $1 trillion in a decade, Palantir’s stock appears primed for substantial long-term gains.

Interest Rate Dynamics: Boosting NVDA & PLTR

The Federal Reserve’s recent decision to slash interest rates by 50 basis points marks a favorable development for NVIDIA and Palantir. Lower interest rates serve to reduce borrowing costs and amplify profit margins, consequently fostering a conducive environment for tech entities like NVIDIA and Palantir to thrive.

Furthermore, the diminished interest rates do not impede cash flows critical for the growth initiatives of both companies, setting the stage for sustained progress. Analysts have set ambitious short-term price targets for NVDA and PLTR, projecting substantial upside potential from their current closing prices.

NVIDIA currently boasts a Zacks Rank #2 (Buy), while Palantir holds a Zacks Rank #3 (Hold), signaling positive sentiment from analysts tracking these tech stalwarts.

Zacks Names #1 Semiconductor Stock

Standing at a fraction of NVIDIA’s size but brimming with untapped potential, our leading semiconductor stock recommendation heralds a vast growth opportunity. The tech arena’s insatiable appetite for artificial intelligence, machine learning, and Internet of Things aligns perfectly with this stock’s trajectory, poised to ride the semiconductor sector’s escalating value, projected to surge from $452 billion in 2021 to $803 billion by 2028.

Exploring the Tech Market Surge

Unveiling the Meteoric Rise

The tech market, akin to a phoenix rising from the ashes, has completed a triumphant two-year rally spurred by a surge in Artificial Intelligence (AI). Notable stars of this celestial show include NVIDIA and Palantir Technologies, whose stocks glitter like distant constellations.

Shining Stars of the Virtual Sky

Advanced Micro Devices, Microsoft Corporation, NVIDIA Corporation, and Alphabet Inc. are just some of the giants of this digital universe, their trajectories aligning with the trajectory of a comet through the night sky.

Embracing the Tech Galaxy

The tech world’s orbit has seen a new addition with Palantir Technologies Inc. and Meta Platforms Inc. shooting like shooting stars across the market horizon. These companies, akin to newly discovered planets, have quickly established their gravitational pull.